Calculating your real-time rates from the industry's best lenders...

purefy has been featured on

Our Picks for the Best Student Loan Refinancing Companies

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

No maximum loan amount

Up to 12 months of forbearance if you experience financial hardship

Borrowers can refinance Parent PLUS loans in their own name

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

We’re here to simplify student loan refinancing.

How Purefy Works: Our Rate Comparison Process

01

Complete Form – 2 Minutes

Fill out basic details about your student loan situation.

02

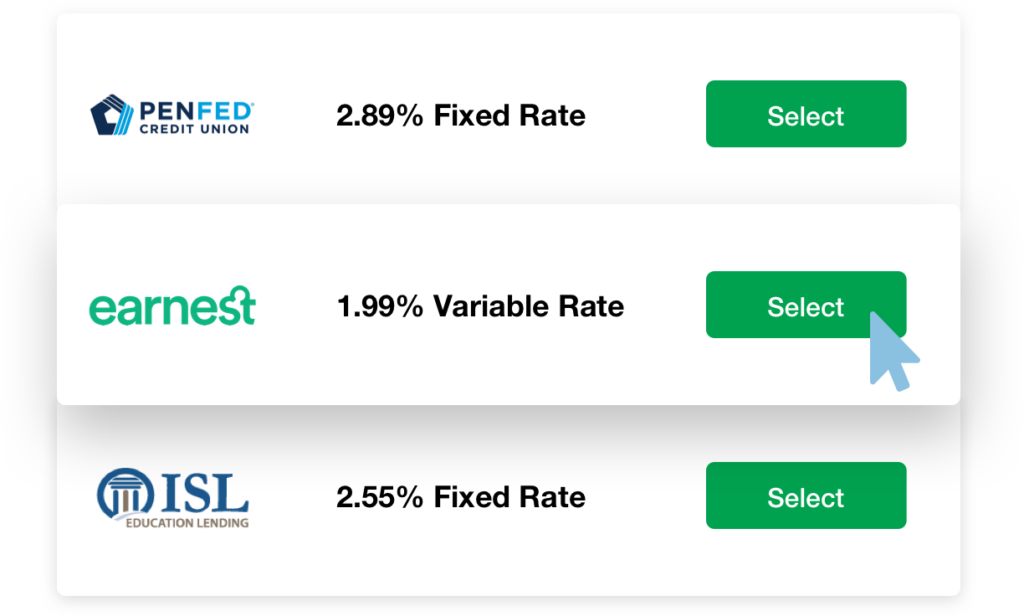

Compare Rates – 15 Seconds

See real, pre-qualified rates from a variety of nationwide lenders – tailored to your specific loan situation.

03

Submit Application – 15 Minutes

Pick your favorite combination of rate, term, and monthly payment – and head straight to our lender partner for confirmation.

Transparent. Accurate. Safe.

No Fees

Purefy is 100% free to use and will never charge you a fee.

Actual Prequalified Rates

See today’s real-time rates that you’re prequalified for — no teasers or bait-and-switch.

100% Secure

Your personal information is always protected by industry-leading SHA-256 with RSA Encryption.

How Student Loan Refinancing Saves People Money

$16,736 in Savings

An Industrial Engineer from University of Central Florida reduced her interest expense by $16,736 from $38,396 to $21,660

Interest Rate Cut in Half

A University of Cincinnati graduate saved over 3% on his interest rate from 6.24% to 2.99%

$130 Lower Monthly Payment

A Surgeon from Rosalind Franklin University of Medicine and Science lowered her monthly payment by $130 from $483 to $353

1% Lower Rate With Cosigner

A Registered Nurse from West Coast University saved 1% on his rate and over $5k in interest by refinancing with a cosigner

Student Loan Refinancing, Rate, & Comparison Basics

Student loan refinancing is a process where you take out a new loan through a private lender for the amount of your current debt. You then use the new refinanced loan — which has a different interest rate, monthly payment, and length of repayment than your old loans — to pay off your remaining college debt.

Save Money

When you refinance, you may qualify for a lower interest rate. With a lower rate, more of your payment goes toward the loan principal rather than interest, allowing you to save a significant amount of money over the life of your new loan.

Reduce Your Monthly Payment

Refinancing allows you to lengthen your repayment term, in addition to the possibility of qualifying for a lower interest rate. Either way, you could be eligible for a lower monthly payment, freeing up more money in your budget to pursue other financial goals.

Pay Off Your Debt Faster

With more of your loan payment going toward the principal rather than interest, refinancing can help you pay off your debt ahead of schedule. You’ll save money while getting out of debt much more quickly.

In addition, you can always choose to shorten your repayment term. This method increases your monthly payment, but puts you on track to pay off your debt faster — while reducing the amount of time for interest costs to accrue.

Get One Easy Payment

Did you take out more than just one student loan? Or maybe you have a mix of both federal and private student loans? Juggling multiple loans, monthly payments, and due dates can be confusing.

Refinancing can help streamline things for you by consolidating your student loans together. After refinancing, you will have just one loan to manage through one lender, and one easy monthly payment going forward.

Lose Access to Income-Driven Repayment Plans

Income-driven repayment (IDR) plans extend your repayment term and cap your monthly payments at a percentage of your discretionary income — dramatically reducing your payments. However, once you refinance your loans, you can no longer qualify for IDR plans.

If you’re in a low-paying field or your income fluctuates from year-to-year, refinancing may not be a smart option compared to keeping your federal loans with an IDR plan.

Lose Chance to Enter Loans into Deferment or Forbearance

With federal loans, you can enter into deferment or forbearance if you experience a financial hardship like an illness or job loss. Under these programs, you can postpone making payments without entering into default which gives you time to get back on your feet.

Once you refinance, you typically lose out on this federal benefit, although many private lenders do offer some degree of protection. If you work in a volatile field or have recurring health issues, it could be wise to maintain the option of placing your loans into deferment or forbearance if needed.

Lose Ability to Qualify for Federal Student Loan Forgiveness

Some federal student loans are eligible for loan forgiveness programs such as Public Service Loan Forgiveness. But after refinancing, you can no longer qualify for loan forgiveness.

If you work for a non-profit organization or government agency and plan to do so for the next ten years, it may be a smart financial decision to pursue loan forgiveness rather than student loan refinancing.

Considering refinancing your student loans? Your best chance of getting the best loan available is to first shop around. By using Purefy’s rate comparison tool, you can compare multiple interest rates from a variety of lenders in one place with one simple form.

The tool also allows you to calculate how your monthly payments and the total cost of your current loans compare to what you may qualify for through refinancing.

As you begin comparing your refinancing options, make sure to review more than just the rates. Also look at other features each lender offers such as the repayment terms, option to release your co-signer from the loan, deferment and forbearance terms, and autopay discounts.

With this holistic approach, you can ensure that you’ll apply for the best loan for your unique needs with the lowest possible interest rate — allowing you to save the most money in the long term.

If you’re thinking of refinancing student loans, use Purefy’s rate comparison tool to view rates and terms from the best lenders, all in one place with one convenient form.

Simply share a few details about yourself and your debt, and you’ll be able to shop around without needing to visit each individual lender’s website and fill out multiple cumbersome applications.

It’s an easy way to compare lenders and find the best student loan refinance option for you. You’ll be presented with real, prequalified rates from a selection of quality, vetted lenders. These rates are based on your credit score and borrower profile — no teaser rates to worry about. Plus, comparing rates with Purefy has no impact on your credit score.

This lets you make an informed decision. You can compare rates, terms, and monthly payments all in one easy, sortable chart. You can also try adding a cosigner, to see if that helps you qualify for an even lower rate.

If you like what you see and select a lender, you will be taken to their specific loan application. It takes just seconds to find your rates, and a student loan refinance loan application generally takes less than 15 minutes to complete.

If you’re looking for ways to simplify your student loan repayment strategy or pay off your debt more quickly, you may be considering student loan refinancing or consolidation.

Neither option is inherently better, so it’s important to know your needs and goals before pursuing one.

Consolidation is usually best for people who don’t have a stable income or have low income, and may need access to an income-driven repayment plan. It can also be a smart option to consider if you already have low interest rates and just want to simplify your monthly payments into one.

Refinancing student loans, on the other hand, is typically a better choice if you have high interest rates or want more flexibility with payments — and don’t need federal loan benefits. More specifically, it tends to be a smart decision if you have a strong credit history and steady income — or if you can find a co-signer with those attributes — so that you can qualify for the lowest interest rate possible.

To decide which option makes more sense for your needs, think about what your goals are with your student loans. Then consider your current financial situation and check your credit score to see what your chances are of qualifying for refinancing.

If you want to refinance student loans but aren’t eligible on your own or with a co-signer, work on boosting your credit and income to improve your chances of qualifying.

Student loan refinancing is an effective way to manage your debt, helping you save money, reduce your payment, and streamline your loans. However, refinancing has some significant drawbacks you should consider before applying for a loan.

Refinancing is a smart choice for those with good credit, a stable income, and who don’t plan on using federal loan benefits. By doing your homework, you can ensure you make the right decision for you.

Your credit score is a numeric value, ranging from 300 to 850, which is determined by your credit history. Your score is calculated using various factors, such as payment history, length of credit history, amounts owed, types of credit, and applications for new credit. Yes, simply applying for a new loan will slightly lower your credit score. You can earn those points back, though.

Refinancing companies require a good credit score (generally in the 650-700 range) to qualify and an excellent credit score to get the best rates. If you are unsure what your credit score is, you can see if you qualify to refinance student loans using our free Compare Rates tool — with no impact on your credit score.

If you’re specifically looking to refinance student loans in order to reduce your interest rate, there are many factors that lenders will consider when deciding which rate to offer you.

Private student lenders use a risk-based pricing model to decide which interest rate and other terms to give you. This means that if you’re considered a risky borrower, you’ll be offered a higher interest rate versus someone who’s viewed as a lower risk.

Some of the factors that lenders use to determine your interest rate include:

- Your credit score

- Information on your credit report

- Your income and employment status

- How much total debt you have

In other words, just having a high credit score may not be enough. For example, if your credit history is limited or you have a high debt-to-income ratio (a large percentage of your monthly gross income goes toward debt payments), it could lead to a higher interest rate than you expected.

.