Calculating your real-time rates from the industry's best lenders...

Featured In

Purefy’s experts have decades of experience in student loans and have identified the best companies for student loan refinancing. In addition to competitive interest rates, we’ve evaluated them on the following attributes: reputation/trust, security, transparency, fees (or lack thereof), flexible repayment terms, and forbearance options.

Benefits of Refinancing Your Parent PLUS Loans

Did you know that you can refinance Parent PLUS loans? For parents who took out loans to help their children go to college, this can be an easy way for qualified borrowers to reduce their interest rate and pay off their loans sooner.

Whether you want to pay off your loans quickly, free up more room in your monthly budget, or even transfer your Parent PLUS loans to a child, student loan refinancing can help you accomplish your financial goals — and simplify your finances.

Reduce Parent PLUS Loan Rates

ultimately saving you money on interest costs over the life of your new refinanced loan.

Pay Off Your Loans Faster

with a lower interest rate — and flexible repayment terms.

Merge Your Student Loans into One

Lower Your Monthly Payment

We’re here to simplify student loan refinancing.

How Purefy Works: Our Rate Comparison Process

01

Complete Form – 2 Minutes

Fill out basic details about your student loan situation.

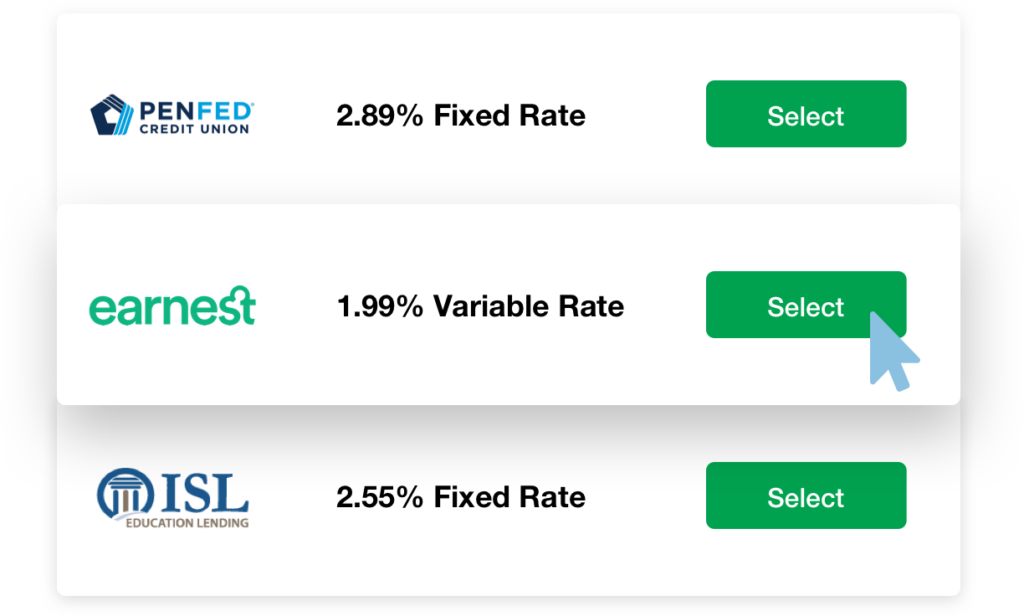

02

Compare Rates – 15 Seconds

See real, pre-qualified rates from a variety of nationwide lenders – tailored to your specific loan situation.

03

Submit Application – 15 Minutes

Pick your favorite combination of rate, term, and monthly payment – and head straight to our lender partner for confirmation.

Parent PLUS Loan Refinance:

Interest Rates, Lenders, and Terms

Fixed Rate

Variable Rate

Purefy Rating

Why We Selected It

- Best customer rating in the student loan industry, with almost 2,000 TrustPilot reviews and a 4.9 star average

- Dedicated Student Loan Advisors help you through the refinance process

- Borrowers can refinance Parent PLUS loans in their own name

Maximum Loan Amount

Degree Requirement

Minimum Credit Score

Forbearance

Repayment Terms

Cosigner Release

Customer Feedback

Purefy Rating

Fixed Rate

Variable Rate

Why We Selected It

- Best customer rating in the student loan industry, with almost 2,000 TrustPilot reviews and a 4.9 star average

- Dedicated Student Loan Advisors help you through the refinance process

- Borrowers can refinance Parent PLUS loans in their own name

Maximum Loan Amount

Degree Requirement

Minimum Credit Score

Forbearance

Repayment Terms

Cosigner Release

Customer Feedback

Fixed Rate

Variable Rate

Purefy Rating

Why We Selected It

- SoFi members get access to free career coaching and financial advice

- 98% of surveyed customers would recommend SoFi to a friend

- Borrowers can refinance Parent PLUS loans in their own name

Maximum Loan Amount

No Max

Degree Requirement

Minimum Credit Score

Forbearance

Repayment Terms

Cosigner Release

Customer Feedback

Purefy Rating

Fixed Rate

Variable Rate

Why We Selected It

- SoFi members get access to free career coaching and financial advice

- 98% of surveyed customers would recommend SoFi to a friend

- Borrowers can refinance Parent PLUS loans in their own name

Maximum Loan Amount

Degree Requirement

Minimum Credit Score

Forbearance

Repayment Terms

Cosigner Release

Customer Feedback

Fixed Rate

Variable Rate

Purefy Rating

Why We Selected It

- Option to "Skip" up to one payment per year

- Rate match guarantee if you find a lower rate elsewhere

- Lightning-fast loan processing

Maximum Loan Amount

Degree Requirement

Minimum Credit Score

Forbearance

Repayment Terms

Cosigner Release

Customer Feedback

Purefy Rating

Fixed Rate

Variable Rate

Why We Selected It

- Option to "Skip" up to one payment per year

- Rate match guarantee if you find a lower rate elsewhere

- Lightning-fast loan processing

Maximum Loan Amount

Degree Requirement

Minimum Credit Score

Forbearance

Repayment Terms

Cosigner Release

Customer Feedback

Parent PLUS Loan Refinance Basics

First, what is student loan refinancing? Refinancing allows you to take out a loan from a private lender that covers the cost of your current debt. The new loan is completely different from your old ones — with a new repayment term, interest rate, and monthly payment. And, if you had multiple student loans before, refinancing gives you just one loan and one monthly payment going forward.

Refinancing your Parent PLUS loans and lowering your current interest rate can be a very big deal for your finances — especially considering Parent PLUS Loans typically have the highest interest rate of any federal student loan. Your student loan balance can quickly balloon with such a high rate, making refinancing Parent PLUS Loans a smart financial decision for many families.

To get started with refinancing, use Purefy’s rate comparison tool. You’ll quickly and easily compare your actual student loan options from a tightly vetted list of refinance companies — all with one simple form.

Our lenders have sterling reputations and offer loans with no origination fees or prepayment penalties. The rate comparison tool will show your rate and monthly payment options with absolute transparency, allowing you to make an informed decision that meets your financial needs.

Some of our lenders also allow parents to transfer their Parent PLUS and private student loans into their child’s name — which can be a great way to help your children take charge of their education and start building up a credit history.

Top Reasons to Refinance Parent PLUS Loans

Save Money

All Parent PLUS loans get the same high fixed interest rate regardless of your credit score. This rate is set every year by the federal government. For example, the rate for the 2018-2019 school year was 7.60%.

If you choose to refinance with a new provider and have good credit, you may find that you qualify for a substantially lower interest rate on multiple student loan options — saving you a large sum of money in the process of paying off your new loan.

Get One Simple Payment

Refinancing also serves as a Parent PLUS loan consolidation. If you have multiple loans (federal or private) they are all combined into one easy-to-manage loan, with just one monthly payment to your new provider.

Reduce Your Monthly Payment

Struggling to afford your current monthly payment? Refinancing can help with that, too.

When you refinance, you get a chance to choose a new loan repayment term and can opt for a longer term that reduces your payment each month. This flexibility lets you dial in your monthly payment exactly how you want it, so you can be more comfortable with the rest of your financial responsibilities.

For example, if you had $30,000 in student loans at 7.08% interest and a 10-year repayment term, your minimum monthly payment would be $350.

If you refinance your loans, keep your same interest rate, but extend your repayment term to 15 years, your payment would drop to only $271 per month. Refinancing would free up an extra $79 in your monthly budget.

Extending your repayment term can cause you to pay more in interest over time, but it may be worth it to get some extra breathing room each month to help with other necessary expenses.

Parent PLUS Loan Consolidation vs Refinancing Parent PLUS Loans

While refinancing can be a powerful tool for managing your Parent PLUS loans, there are some drawbacks to consider.

When you refinance Parent PLUS loans, you lose federal student loan benefits such as:

- Deferment or Forbearance

- Income-Driven Repayment Plans

- Public Service Loan Forgiveness Program

If these federal benefits are important to you, an alternative option to refinancing is consolidating Parent PLUS loans with the federal government through a Direct Consolidation Loan.

This program consolidates all your federal loans, and the new rate is based on the weighted average of your current loans. So, although you’ll only have one loan and monthly payment to manage, there’s little chance you will save money on interest costs compared to the savings possible through refinancing.

It’s also worth noting that federal Parent PLUS loan consolidation does not let you combine your federal loans with your private student loans. For that, you would need to refinance.

What to Expect When You Apply

If you decide to refinance Parent PLUS Loans, use Purefy’s rate comparison tool first to view offers from multiple lenders, with just one simple form, and find your best rate.

To be eligible for Parent PLUS Loan refinancing, you’ll need to meet the following criteria:

- Have a strong credit history

- Have at least one outstanding education loan

- Have steady income

Qualified borrowers may be offered significantly better rates and terms than they currently have on their Parent PLUS Loans, based on their creditworthiness including credit score, income, debt-to-income ratio, and other factors. If you have bad credit, you may be able to qualify by adding a creditworthy cosigner to your application.

Once you have decided on your lender of choice for your Parent PLUS loan refinance, you will be taken to that lender’s application, which can generally be completed in less than 15 minutes.

You’ve gone through enough loan application processes to know what to expect, but one tip is to have your current loan statements handy when applying — the lender will want to know the details.

If you are preapproved, you will need to submit documents to verify the information on your application, including:

- ID

- Paystub

- Loan statements and other possible documentation, depending on the lender’s guidelines

All in all, the process is usually a bit more rigorous than something like an auto loan. To offer such low rates on unsecured loans (loans with no collateral), the lender’s underwriters must do their due diligence.

How to Pay Off Parent PLUS Loans Quickly

A Lower Rate

Have good credit? By refinancing your Parent PLUS loans — which have a high standardized interest rate — you can qualify for a much lower rate to save a lot of money on interest costs.

This can help you pay off your debt faster, too. If you’re saving money through a lower interest rate, you can put the extra cash toward additional prepayments, to pay off your loan more quickly — while maintaining the safety net of the same 10-year repayment term in case other expenses take priority.

For example:

Let’s say you had $30,000 in Parent PLUS Loans at 7.08% interest and a 10-year repayment term. Over the course of your repayment, you’d pay a total of $41,948.

However, if you refinanced your loans and qualified for a 10-year loan at 5% interest, you’d repay just $38,184.

By just refinancing your debt, you’d save over $3,700 in extra funds that can be used to increase your monthly payments and get rid of your debt sooner.

A Shorter Term

An alternative option is to simply refinance your Parent PLUS loans to a shorter total repayment term, coupled with your reduced interest rate. Shorter repayment terms also typically come with even lower rates, as an added bonus.

This method will set you up for faster repayment success. You’ll have a higher must-pay monthly payment, but also a much smaller total debt thanks to your lower rate — allowing you to ultimately pay less while putting you on course to shed your debt in less than 10 years.

.

Original Loan at

7.08% Interest

Refinance Loan

at 5% Interest

Loan Amount

$30,000

$30,000

Repayment Term

10 years

10 years

Monthly Payment

$350

$318

Total Interest Paid

$11,948

$8,184

Total Repaid

$41,948

$38,184

Refinancing Parent PLUS loans to child

An excellent benefit of refinancing Parent PLUS loans is the ability to refinance them from your name to your child’s.

If you took out Parent PLUS Loans to help your child pay for school, those loans are entirely in your name which can be a serious burden. That means you’re solely responsible for repaying them, and with high interest rates, the loans can be expensive and difficult to repay. Plus, having them on your credit report can affect your ability to qualify for other forms of loans, such as a mortgage.

If your child is doing well in their career and is earning enough money to take over the loans, you may be able to transfer the loans into their name through student loan refinancing.

By using this strategy, your child will then be responsible for the loan, and you would no longer be obligated to repay the debt — allowing you to focus on your other financial goals.

If your child has bad credit and doesn’t qualify on their own, you may also consider cosigning on a refinance loan with them. Some lenders, like PenFed Credit Union, offer both parent plus transfer capabilities as well as a cosigner release program, which could remove you from the loan after a certain period of time, after your child’s credit has improved.

How to choose the best Parent PLUS loan refinance option

Ready to easily find your top refinancing option?

Using our rate comparison tool , you can quickly tell which lenders are offering the best rate that is tailored to your financial profile — no teaser rates or “bait and switch” with Purefy.

You can use our sortable chart to see your best rates, and by entering your current loan details, you can compare monthly payments at the various term lengths on offer — whether you’re looking for a shorter or longer repayment term.

If you’re currently dealing with Parent PLUS Loans and a high interest rate, student loan refinancing can be a useful strategy to help you save money, reduce your monthly payment, or even to transfer them to your child.

We also have a team of personal loan advisors who are available to help you through the process. If you have any questions, you can contact us by phone at 202.599.4700 or by email at [email protected].

.

Parent Loan Refinance FAQs

Refinancing allows you to take out a loan from a private lender that covers the cost of your current debt. The new loan is completely different from your old ones — with a new repayment term, interest rate, and monthly payment. And, if you had multiple student loans before, refinancing gives you just one loan and one monthly payment going forward.

Parents with student loan debt can refinance federal Parent PLUS Loans, private student loans from a bank or other financial institution, or a combination of the two.

Yes, you can refinance Parent PLUS Loans, and/or private student loans that you may have taken out for your child. Refinancing can be an easy way for qualified parents, who took out loans to help their children go to college, to reduce their interest rate and pay off their loans sooner.

Whether you want to pay off your loans quickly, free up more room in your monthly budget, or even transfer your Parent PLUS loans to a child, student loan refinancing can help you accomplish your financial goals — and simplify your finances.

Refinancing your Parent PLUS loans and lowering your current interest rate can be a very big deal for your finances — especially when considering Parent PLUS Loans typically have the highest interest rate of any federal student loan. Your student loan balance can quickly balloon with such a high rate, making refinancing Parent PLUS Loans a smart financial decision for many families.

If you have good credit and steady income, you may be an excellent candidate for parent student loan refinancing to save money and free yourself from student debt more easily.

Parent PLUS Loans typically have the highest interest rate of any federal student loan option. This rate is set by the federal government and is standardized across all parent loans regardless of your credit history, credit score, annual income, or debt-to-income ratio.

Because of their high interest rates, it’s crucial to think about refinancing to save significantly on interest costs and manage your loan debt much more easily. If you have good credit, it’s very possible to qualify for a substantially lower interest rate through refinancing — which can save you heaps of cash throughout the life of your loan.

You shouldn’t be stuck with high interest loans if you don’t need to be. Taking advantage of a refinance can significantly reduce your current rate, allowing you to save money on interest costs or pay off your loans much sooner.

By refinancing their student loans, parents can:

- Qualify for a lower interest rate to save thousands on interest costs over the life of the new refinanced loan.

- Pay off parent student loans faster with shorter repayment term options.

- Get a lower monthly parent loan payment to have small and more manageable bills.

- Merge all parent loans into one to have just one easy monthly payment to plan for.

- With some lenders, parents can transfer their loans into their child’s name to free themselves from all further debt responsibility.

To be eligible for Parent PLUS Loan refinancing, you’ll need to meet the following criteria:

- Have a strong credit history

- Have at least one outstanding education loan

- Have steady income

Qualified borrowers may be offered significantly better rates and terms than they currently have on their Parent PLUS Loans, based on their creditworthiness including credit score, income, debt-to-income ratio, and other factors. If you have bad credit, you may be able to qualify by adding a creditworthy cosigner to your application.

All Parent PLUS loans get the same high, fixed interest rate regardless of your credit score. This rate is set every year by the federal government. For example, the rate for the 2018-2019 school year was 7.60%.

If you choose to refinance with a new provider and have good credit, you may find that you qualify for a substantially lower interest rate on multiple student loan options — saving you a large sum of money in the process of paying off your new loan.

When refinancing your parent student loans, you can also choose a quicker repayment term than the Standard Repayment Plan of 10 years.

By choosing a shorter term, you can pay off your loans sooner and get rid of them for good — while maximizing your savings on costly interest.

Use Purefy’s Compare Rates tool to see student loan refinance offers from multiple top lenders — all in one place with one fast form. Quickly compare your interest rate and monthly payment options, as well as your lifetime interest savings, with no impact on your credit score and zero fees.

Refinancing through a private lender means that you’ll lose federal student loan benefits including deferment, forbearance, income-driven repayment, and Public Service Loan forgiveness.

If keeping one or more of these benefits is important to you, consolidating your Parent PLUS Loans through a federal Direct Consolidation Loan could be an effective alternative that still combines all your parent loans into one simple monthly payment.

However, refinancing is generally the only way to save money by getting a lower interest rate through your private lender of choice. Federal Consolidation, on the other hand, gives you a new rate that is the weighted average of all your current loans, rounded up to the nearest 1/8 or a percent.

Borrowers should be aware that by refinancing Parent PLUS Loans from the U.S. Department of Education, they may lose certain benefits offered by federal student loan programs such as deferments, forbearance, income-based repayment plans, and Public Service Loan Forgiveness.

No, there are zero fees with a student loan refinance through Purefy. Our lenders never charge origination fees, application fees, or prepayment penalties, and we don’t think you should face any additional charges for trying to save money.

There are both benefits and drawbacks to refinancing, so it’s important to consider your options before you refinance.

For example, if you work in public service and plan to take advantage of the federal Public Service Loan Forgiveness program, refinancing your parent plus loans would make you ineligible for this forgiveness. You would also no longer be eligible for other federal benefits and repayment plans, such as the graduated repayment plan.

However, if you don’t plan on utilizing these federal benefits, you may be able to secure a lower interest rate and more favorable repayment terms through refinancing. Lowering your interest rate can save thousands of dollars throughout the life of the loan and shortening your repayment term can allow you to become debt-free sooner.

Read our blog on the Pros and Cons of Refinancing Parent PLUS Loans to explore more benefits and drawbacks.