The 4 Best Parent Student Loan Refinance Companies of 2023

Apply today and lock in your savings.

Check rates from our favorite Parent PLUS refinance companies with no impact to credit and zero fees.

Purefy’s experts have decades of experience in student loans and have identified the best companies for student loan refinancing. In addition to competitive interest rates, we’ve evaluated them on the following attributes: reputation/trust, security, transparency, fees (or lack thereof), flexible repayment terms, and forbearance options.

Our Picks for the Best Parent PLUS Loan Refinance Companies

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

No maximum loan amount

Up to 12 months of forbearance if you experience financial hardship

Borrowers can refinance Parent PLUS loans in their own name

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

Parent PLUS Loan Refinance - How It Works in 5 Easy Steps

01

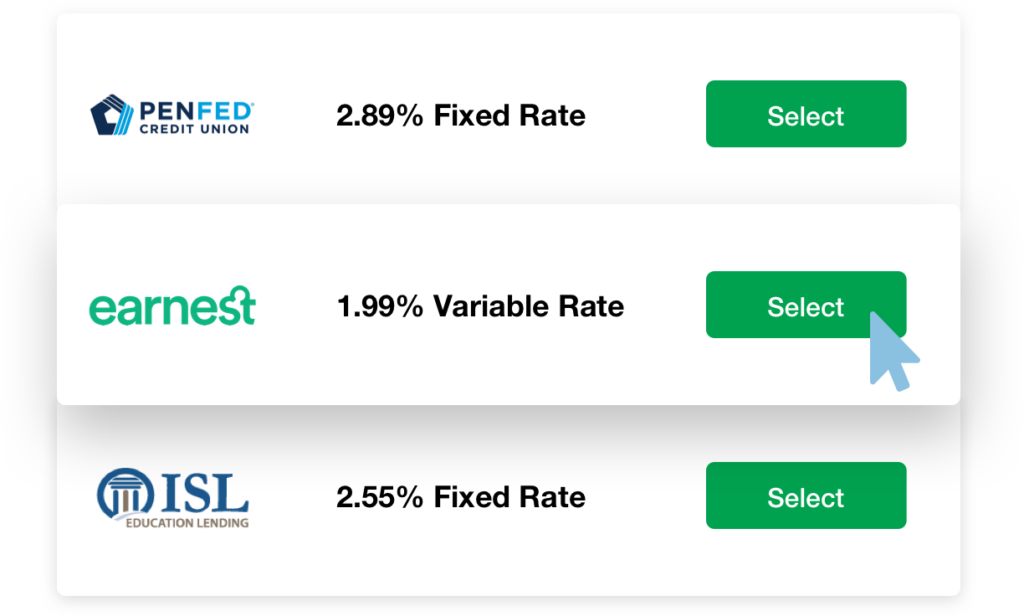

Compare Rates

Student loan refinancing is all about saving money, and that starts with getting a lower interest rate. Check out our favorite lenders above or get a customized rate comparison in seconds with our free Compare Rates tool. See your real, pre-qualified rates from the lenders you qualify for, all in one easy-to-sort chart.

02

Learn If Refinancing Is Right for You

Refinancing can be a great way to save money, but it’s not for everyone. For instance, if you refinance federal student loans, you’ll lose access to certain federal benefits like loan forgiveness programs. Need help? Visit our blog for tips from our team of expert personal finance writers, who go over all of refinancing’s benefits, drawbacks, whys, and hows.

03

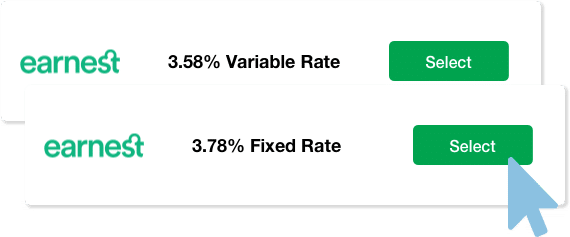

Decide on Your Rate and Term

When you refinance, you often have a choice between fixed and variable rates. Fixed rates stay the same, while variable rates – and your monthly payment – can change on a monthly basis as the market fluctuates. You also get to choose your new repayment term, usually between 5 years (most lifetime savings) and 20 years (low monthly payment).

04

Apply Online and Submit Documents

Once you’ve decided on a lender, you can complete their online loan application. This process usually takes about 15 minutes. After you submit your application, you may be asked to upload documents like a paystub and loan statement for your existing loans. The documents needed can vary from lender to lender, and are used to verify the details on your loan application.

05

E-Sign and Enjoy Your Savings

Once your loan is approved by the lender, you can sign your documents electronically – no paper necessary with any of our top lenders! From there, your new lender will pay off your old student loans and set up the new refinance loan in your name. All that’s left is for you to enjoy your savings – whether it be a little extra room in your monthly budget, or getting out of debt faster.

Student Loan Refinance FAQs

Refinancing allows you to take out a loan from a private lender that covers the cost of your current debt. The new loan is completely different from your old ones — with a new repayment term, interest rate, and monthly payment. And, if you had multiple student loans before, refinancing gives you just one loan and one monthly payment going forward.

Parents with student loan debt can refinance federal Parent PLUS Loans, private student loans from a bank or other financial institution, or a combination of the two.

Yes, you can refinance Parent PLUS Loans, and/or private student loans that you may have taken out for your child. Refinancing can be an easy way for qualified parents, who took out loans to help their children go to college, to reduce their interest rate and pay off their loans sooner.

Whether you want to pay off your loans quickly, free up more room in your monthly budget, or even transfer your Parent PLUS loans to a child, student loan refinancing can help you accomplish your financial goals — and simplify your finances.

Parent PLUS Loans typically have the highest interest rate of any federal student loan option. This rate is set by the federal government and is standardized across all parent loans regardless of your credit history, credit score, annual income, or debt-to-income ratio.

Because of their high interest rates, it’s crucial to think about refinancing to save significantly on interest costs and manage your loan debt much more easily. If you have good credit, it’s very possible to qualify for a substantially lower interest rate through refinancing — which can save you heaps of cash throughout the life of your loan.

You shouldn’t be stuck with high interest loans if you don’t need to be. Taking advantage of a refinance can significantly reduce your current rate, allowing you to save money on interest costs or pay off your loans much sooner.

By refinancing their student loans, parents can:

- Qualify for a lower interest rate to save thousands on interest costs over the life of the new refinanced loan.

- Pay off parent student loans faster with shorter repayment term options.

- Get a lower monthly parent loan payment to have small and more manageable bills.

- Merge all parent loans into one to have just one easy monthly payment to plan for.

- With some lenders, parents can transfer their loans into their child’s name to free themselves from all further debt responsibility.

Refinancing your Parent PLUS loans and lowering your current interest rate can be a very big deal for your finances — especially when considering Parent PLUS Loans typically have the highest interest rate of any federal student loan. Your student loan balance can quickly balloon with such a high rate, making refinancing Parent PLUS Loans a smart financial decision for many families.

If you have good credit and steady income, you may be an excellent candidate for parent student loan refinancing to save money and free yourself from student debt more easily.

To be eligible for Parent PLUS Loan refinancing, you’ll need to meet the following criteria:

- Have a strong credit history

- Have at least one outstanding education loan

- Have steady income

Qualified borrowers may be offered significantly better rates and terms than they currently have on their Parent PLUS Loans, based on their creditworthiness including credit score, income, debt-to-income ratio, and other factors. If you have bad credit, you may be able to qualify by adding a creditworthy cosigner to your application.

All Parent PLUS loans get the same high, fixed interest rate regardless of your credit score. This rate is set every year by the federal government. For example, the rate for the 2018-2019 school year was 7.60%.

If you choose to refinance with a new provider and have good credit, you may find that you qualify for a substantially lower interest rate on multiple student loan options — saving you a large sum of money in the process of paying off your new loan.

When refinancing your parent student loans, you can also choose a quicker repayment term than the Standard Repayment Plan of 10 years.

By choosing a shorter term, you can pay off your loans sooner and get rid of them for good — while maximizing your savings on costly interest.

Use Purefy’s Compare Rates tool to see student loan refinance offers from multiple top lenders — all in one place with one fast form. Quickly compare your interest rate and monthly payment options, as well as your lifetime interest savings, with no impact on your credit score and zero fees.

Refinancing through a private lender means that you’ll lose federal student loan benefits including deferment, forbearance, income-driven repayment, and Public Service Loan forgiveness.

If keeping one or more of these benefits is important to you, consolidating your Parent PLUS Loans through a federal Direct Consolidation Loan could be an effective alternative that still combines all your parent loans into one simple monthly payment.

However, refinancing is generally the only way to save money by getting a lower interest rate through your private lender of choice. Federal Consolidation, on the other hand, gives you a new rate that is the weighted average of all your current loans, rounded up to the nearest 1/8 or a percent.

Borrowers should be aware that by refinancing Parent PLUS Loans from the U.S. Department of Education, they may lose certain benefits offered by federal student loan programs such as deferments, forbearance, income-based repayment plans, and Public Service Loan Forgiveness.

No, there are zero fees with a student loan refinance through Purefy. Our lenders never charge origination fees, application fees, or prepayment penalties, and we don’t think you should face any additional charges for trying to save money.