A personal loan is one of many ways to acquire money to finance personal expenses. It’s a common form of credit you can use to pay for medical expenses, house renovations, unforeseen expenses, and so much more.

Thanks to digital advancements, applying for a personal loan is easy. However, you may still have questions about how personal loans work, and understanding the process is imperative if you are considering a personal loan.

Read on to learn more about personal loans, how to get a personal loan, and the complete application process from beginning to end.

What Is a Personal Loan?

Personal loans are installment loans that allow you to borrow a lump sum of money from a financial institution. These institutions can be banks, online lending companies, or credit unions. Once you are approved and the personal loan is funded, you’ll make your first payment anywhere between 30-45 days after your funds disburse.

Personal loans typically have fixed interest rates and a set repayment term between one and seven years, although longer terms are possible. Personal loans range anywhere between $1,000 and $100,000, but loan amounts will vary depending on the lender.

Although large personal loans are possible, the amount you can qualify for will depend on your creditworthiness. Qualifying for a personal loan also entails having a steady income and employment history and a low debt-to-income ratio. The stronger your credit score, the more likely you’ll be to qualify for a low rate on a personal loan.

Personal loans are available in both secured and unsecured forms. The former requires collateral to back the loan, such as your car or home. The latter doesn’t need any collateral for your application to be processed and approved. While a secured loan can offer a lower interest rate, the lender can also seize the collateral if you are unable to make payments.

Common Uses of a Personal Loan

Before taking out a personal loan, consider your financial situation and your ability to make payments. You’ll be required to repay a fixed amount each month, and failure to make payments can result in serious consequences.

Personal loans can be used for many reasons, and most people apply for a personal loan to fund big projects. Some other uses for personal loans include:

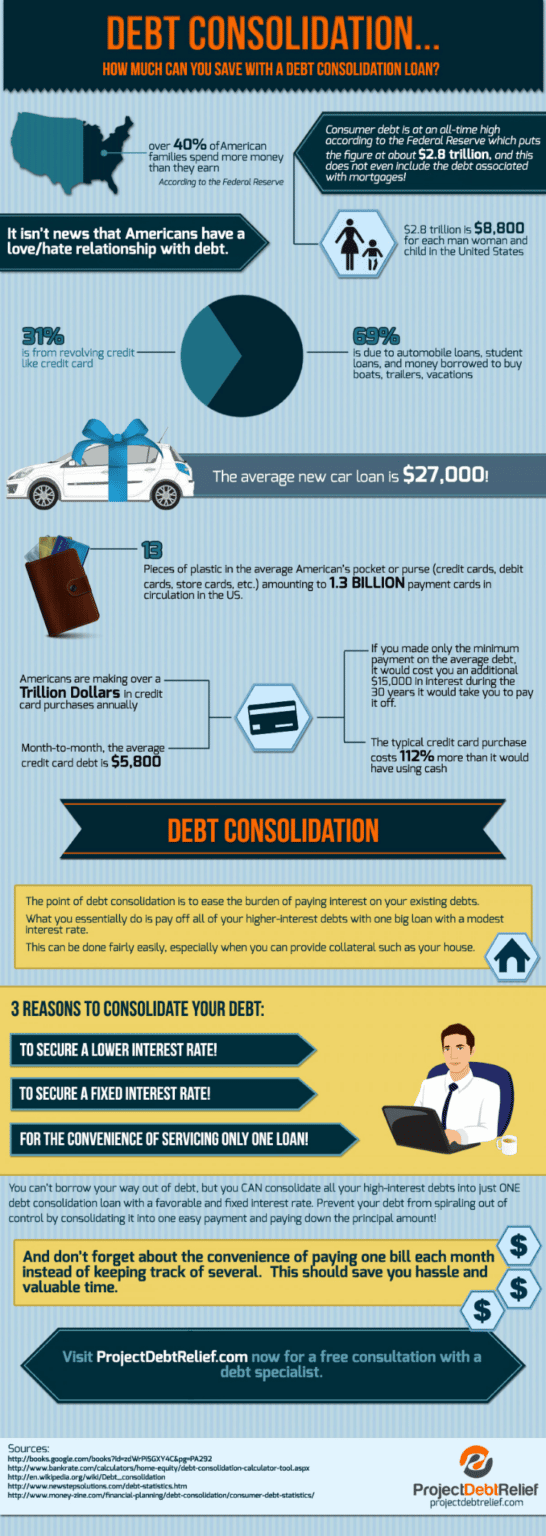

- Debt consolidation: Credit card debt often comes with high interest rates, and it’s easy to get underwater if you’re only making minimum payments. A debt consolidation loan allows you to pay off multiple credit cards and consolidate that debt into one personal loan with a cheaper interest rate. As a result, you can save money on interest and get out of debt faster.

- Home improvement: Another common use for personal loans is home improvement. With a personal loan, you can finance home repairs such as painting, roofing, HVAC replacement, and more. These projects can be costly, and you may not have enough money saved to cover an unexpected repair. A personal loan can be a great option when you need to pay for home repairs upfront.

- Pay for moving expenses: Moving to another location can be very expensive, whether it’s across town or to a different state. If you need to relocate suddenly for a job, you may not have the savings to cover your move, and a personal loan can be a great option to get the funds you need.

- Emergency expenses: Despite our best efforts to be prepared, life can be unpredictable, and you may find yourself in a position to need money for an emergency. Perhaps you need to pay for medical expenses, such as surgeries not covered by insurance, a loved one’s funeral, or another catastrophe, but you don’t have enough money in your savings. A personal loan can give you the necessary funds in a pinch and can be a cheaper alternative to using a credit card.

- Financing for vehicles: While auto loans are typically a lower-cost option to finance a car purchased from a dealer, a personal loan can come in handy to purchase a secondhand car. If you are shopping for a used vehicle through Craigslist or another marketplace, you could score a great deal, but you’ll need the funds to cover your purchase. A personal loan can bridge the gap between your savings and the sale price, or even cover the entire cost of the purchase.

Expenses come at you hard.

The Difference Between an Unsecured Loan vs. a Secured Loan

Secured loans require collateral, such as your car or home, to back the loan. Secured loans are appealing to lenders because having the collateral makes funding the loan less risky from a lender’s perspective. As an added bonus, secured loans usually come with lower interest rates than unsecured loans.

Here are a few types of secured loans:

- Mortgage loans

- Vehicle loans

- Pawnshop loans

- Secured credit cards

Unsecured personal loans, on the other hand, do not demand collateral. However, failing to pay even once can result in damage to your credit score, and if you default on the loan, you could lose your collateral. As a result, you must be more cautious and pay your monthly bills on time. Unsecured loans typically have higher interest rates than secured loans to account for the lender’s risk in providing funds.

Fixed vs. Variable Rates on Personal Loans

Fixed rate personal loans mean that the interest rate (and monthly payment) will remain the same throughout the life of your loan. Having a set payment allows you to budget and plan for the future, but if market rates ever become lower your loan would not adjust.

In the meantime, variable rate personal loans will adjust with market rates, so your payment could change each month if the market fluctuates. This could be good if interest rates are dropping, but an increasing payment could strain your finances and make it difficult to budget. Variable rates are less common than fixed rates when it comes to personal loans, but it’s important to carefully consider your options and make sure you are prepared to handle a payment that could increase if you choose a variable rate.

Interest Rates and Repayment Terms

Personal loans typically come with shorter repayment terms than a mortgage or a student loan. The options may vary from one lender to another, but term lengths between one and seven years are common with personal loans. Although longer loan terms will result in lower monthly payments, you’ll end up spending more on interest throughout the life of the loan.

Personal loan interest rates may also differ from one lender to another. The rate you receive will depend on several factors, such as your credit score, debt-to-income ratio, and financial stability, with the lowest rates going to the most creditworthy borrowers. While personal loan interest rates may seem high compared to other types of credit, they are still generally lower than credit card APRs.

Common Requirements When Applying for a Personal Loan

Eligibility criteria for personal loans can differ from lender to lender, but here are a few of the more common requirements to obtain a personal loan:

- Credit history

- Verifiable income

- Reliable repayment history

- A low debt-to-income ratio (generally, below 35%)

- Proof of identity

Personal Loan Application Process

Applying for a personal loan is easier and faster than many other forms of loans. You can apply at a bank, credit union, or online lender. You can also use a pre-qualification tool like Purefy’s rate comparison tool to shop multiple lenders, which only takes a few minutes.

To obtain a rate quote, you’ll need to provide some basic information, like your date of birth and SSN, the loan amount and purpose, and your income. After submitting the form, you’ll undergo a soft credit pull (which does not hurt your credit score) and receive real, pre-qualified rates from top lenders. If the offers are favorable, you can continue to the application itself, which can also be submitted online.

Depending on the lender you choose, you may need to provide a few supporting documents, like paystubs or a photo ID. Once your loan application is approved, many lenders can provide funds as soon as one business day, although some lenders may take up to seven business days.

A Personal Loan Might Be an Excellent Way to Fund Your Expenses

If you’re considering applying for a personal loan, be sure to shop around and compare rates with multiple lenders before choosing a loan. Some lenders may have origination fees for personal loans, so you’ll also need to consider those fees in the total loan cost. Purefy’s rate comparison tool provides a breakdown of these costs, so you won’t be surprised by any hidden fees.