If you helped your child pay for college with Parent PLUS Loans, you’re probably looking for solutions to get rid of them for good.

With such high interest rates, lingering Parent PLUS Loan debt can severely limit your ability to achieve life’s big financial goals — from serious ones like taking care of your mortgage or planning for retirement to fun ones like going on a trip or making home improvements.

But how do you pay off your Parent PLUS Loans — more easily and quickly — to finally free yourself up financially?

Did you know? Parent PLUS Loans often have the highest rate of any federal loan.

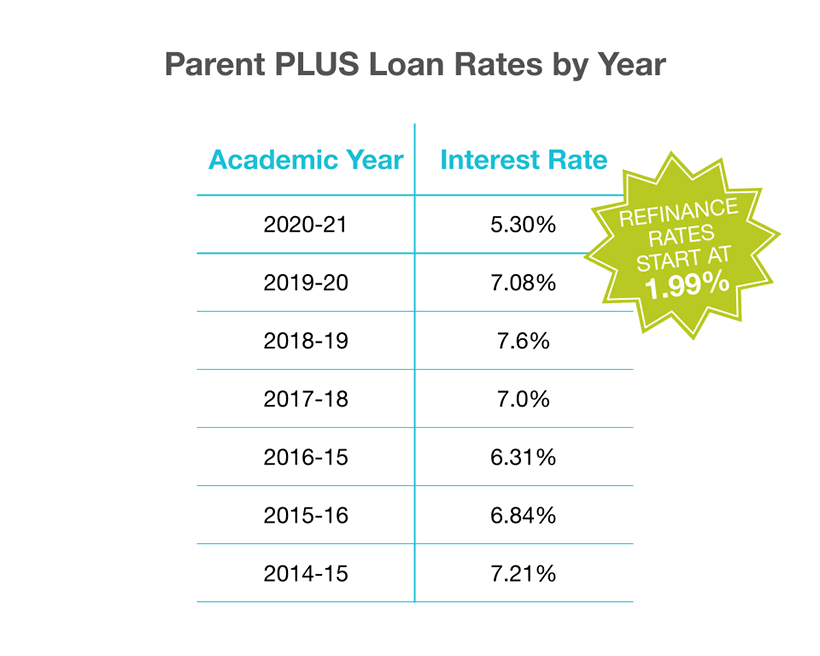

Over the past 5 years, Parent PLUS Loans have had an average rate of 6.7% — but refinance rates currently start at a historic low 1.88%.

Takes 2 minutes • No impact on credit

The answer could be as simple as refinancing.

First, what is a Parent PLUS Loan refinance?

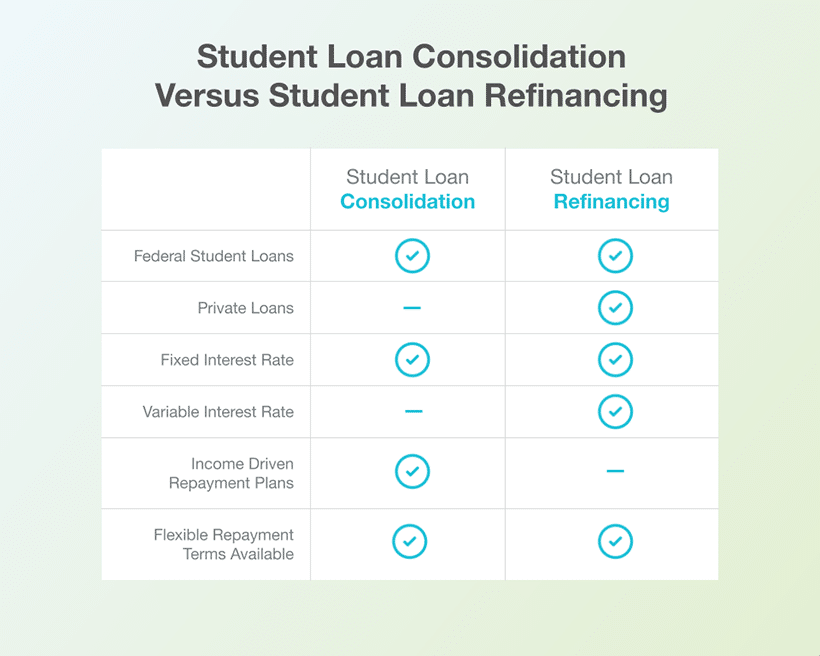

Refinancing means that you take out a new loan from the private lender of your choosing — after qualifying, of course — who then pays off the total balance of your current parent loan(s). Student loan refinancing consolidates all your Parent PLUS Loan debt into one loan with a new:

- Interest rate

- Monthly payment

- Repayment term

- Loan servicer

The importance of paying off Parent PLUS Loans efficiently

Parent PLUS Loans historically have the highest interest of any federal student loan. That’s because each year, the federal government sets the same fixed interest rate for all Parent PLUS Loans — regardless of your credit score.

This high interest makes them essential to pay off efficiently, either by finding a way to lower your interest rate, setting a shorter repayment term, or increasing the amount you pay each month.

Benefits of refinancing Parent PLUS Loans

The federal government’s fixed interest rate on Parent PLUS Loans means there’s initially no opportunity to qualify for a lower rate, even with excellent credit history.

That’s where refinancing comes in.

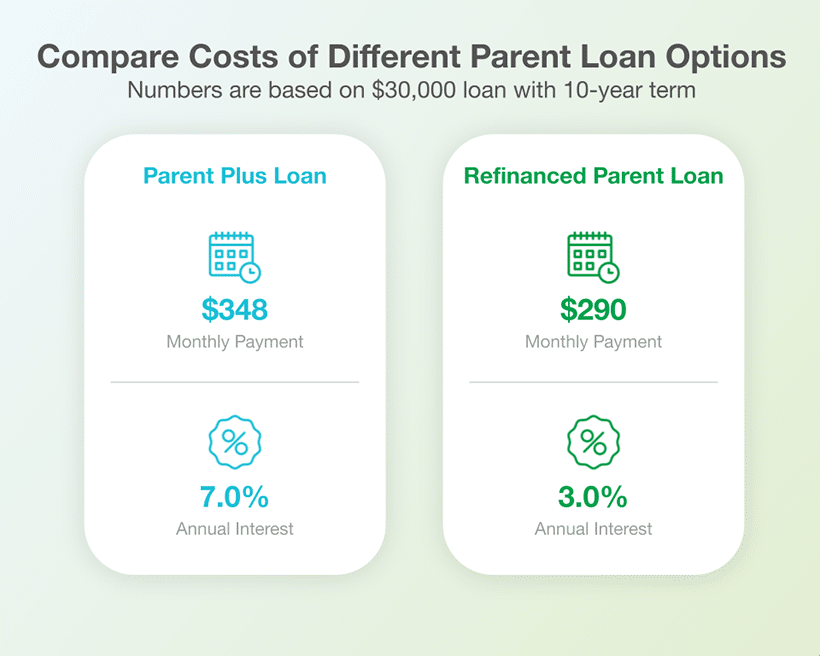

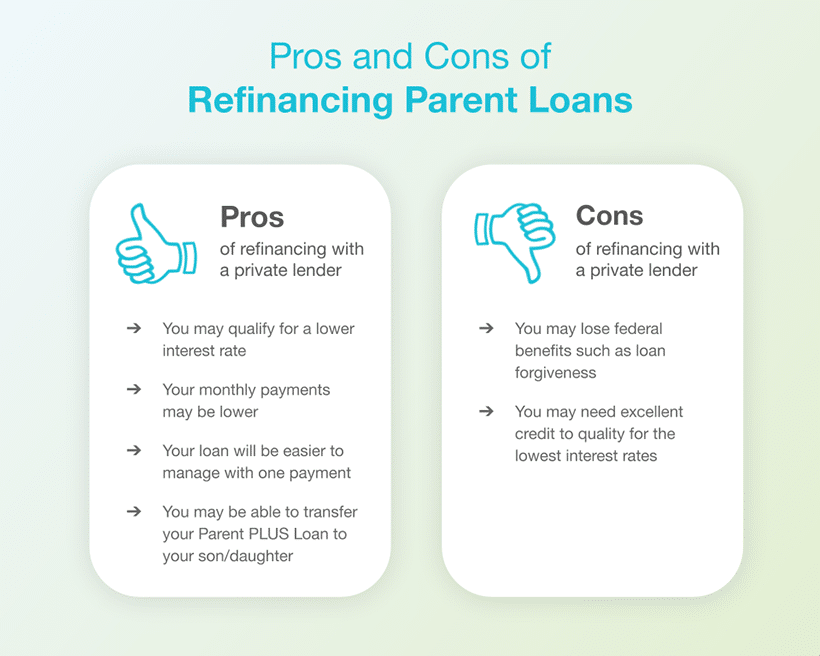

If you choose to refinance and you have good credit, you may be able to get a substantially lower interest rate than what you have now. This can be a big deal for your finances and a smart decision for your family — allowing you to save a large amount of money in the process of paying off your new refinanced loan.

Outside of saving money over the life of your loan, refinancing can have other major benefits as well including:

- Paying off your loans faster by shortening your repayment term — with a lower interest rate and likely a higher monthly payment.

- Getting a smaller, more management monthly payment by lengthening your repayment term — also with a lower interest rate.

- Merging all your loans into one new loan — giving you just one monthly payment to worry about with one lender.

- Transferring your loan payments into your child’s name — allowing them to take over the debt incurred on their behalf.

The 2 Best Companies to Refinance Student Loans

Our Top-Rated Picks for 2024 Offer Low Rates and No Fees

When refinancing can work for you

To be able to refinance your Parent PLUS Loans, you’ll need:

- A strong credit history

- At least one outstanding education loan

- A steady income

If you meet these criteria, refinancing can be a great tool for repaying your loans with much lower interest costs. Qualified applicants can be offered significantly better rates and terms based on overall creditworthiness including credit score, income, debt-to-income ratio, and other factors.

Refinancing Parent PLUS Loans is one of the easiest ways to save money!

If you’re looking to save on high-interest Parent PLUS Loans, refinancing can be the fastest and simplest strategy to secure a lower rate.

Takes 2 minutes • No impact on credit

If your credit is not so great, do you have someone — a family member or close friend — who would be willing to cosign the loan with you?

By adding a cosigner with good credit, you may still be able to qualify for excellent refinancing options.

Is your child willing to take over your Parent PLUS Loan debt, now that they are more established in their careers?

Refinancing is a simple way to transfer your loan into your child’s name — allowing them to take control of your debt and monthly payments.

When refinancing may not be the right choice

For some, refinancing can be a powerful solution to pay back Parent PLUS Loans. But it’s not for everyone and there are drawbacks to think about.

Refinancing through a private lender means that you’ll lose federal student loan benefits like:

- Deferment or Forbearance

- Income-Driven Repayment Plans

- Public Service Loan Forgiveness

If hanging on to one or more of these benefits outweighs the lower interest rate you’re offered, it may be worth forgoing a refinance.

Parent PLUS Loan repayment alternatives

Parent PLUS Loan debt can create immense strain on your monthly budget — but refinancing may not be the right option for your needs. If that’s the case, there still may be ways to repay your loans more easily.

Parent PLUS Loan Consolidation

Consolidating your loans with the federal government through a Direct Consolidation Loan allows you to maintain your federal benefits. Plus, the program consolidates all your federal loans into one — with a rate based on the weighted average of your current loans combined.

Because of this, you’re unlikely to save much on interest costs, but your monthly payment will be easier to keep track of.

Income-Contingent Repayment (ICR)

Parent PLUS Loans aren’t eligible for an ICR plan on their own; they need to be consolidated first with a Direct Consolidation Loan.

By entering an ICR plan, your loan payments are capped at 20% of your total discretionary income or what you’d pay with a fixed repayment period of 12 years — whichever is less. With ICR, you’re also eligible for Parent PLUS Loan forgiveness after 25 years of payments. Once your 25 years is complete, the remaining balance on your loans is discharged, and the amount that is forgiven may be subject to taxation.

ICR is a longer-term approach to repayment, but it can be helpful for those really struggling to make their current monthly payments.

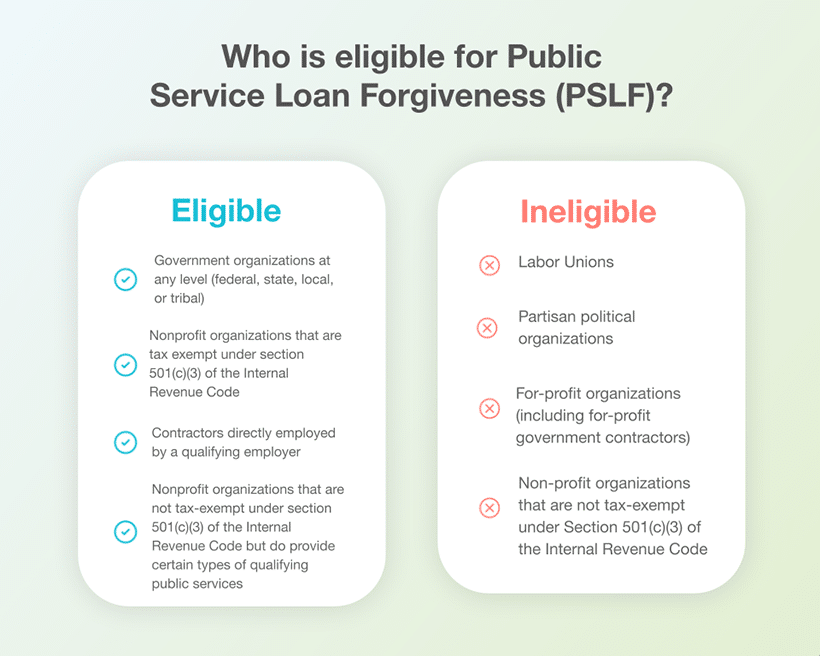

Public Service Loan Forgiveness (PSLF)

Do you work for a non-profit, government agency, or other public service organization?

After making 10 years of qualifying payments while working for an eligible employer, PSLF discharges your remaining loan balance. However, like ICR, Parent PLUS Loans are not eligible for PSLF until they are consolidated. You must get a Direct Consolidation Loan first, and then enroll in PSLF.

Even though it’s a lot of steps, it can be worth it for those with careers in public service to have their debt forgiven after only 10 years. Unlike ICR, loan forgiveness under PSLF is not subject to taxation.

Find your best Parent PLUS Loan refinance rate

Think refinancing could be the perfect repayment solution for you? Ready to quickly find your best refinancing option?

After completing one simple form, you can instantly compare your available refinancing options from a variety of top lenders — with no credit check needed.

It’s convenient. It’s fast. It’s easy.

And with an at-a-glance look at multiple interest rates and repayment terms, you’ll know which is the best for you without having to check a bunch of different websites.

Use Purefy’s Compare Rates tool to find your lowest Parent PLUS Loan refinancing rate — and start saving money now.