Save on Sallie Mae, Discover, and Wells Fargo Student Loans

Student loan refinance rates are now at historic lows. Lock in your rate today and save big.

Why Refinance My Student Loans?

Save Money on Interest

Lock in a lower rate and enjoy big lifetime interest savings for years to come.

Shorten Your Term

Pay off student loans faster with a shorter term and save even more on total lifetime interest.

Reduce Your Payments

Choose a longer term to decrease your monthly payments and keep more cash in your pocket.

Simplify Your Bills

Multiple student loan payments and due dates? Combine them into one easy bill.

How Student Loan Refinancing Saves People Money

$16,736 in Savings

An Industrial Engineer from University of Central Florida reduced her interest expense by $16,736 from $38,396 to $21,660

Cut Interest Rate in Half

A University of Cincinnati graduate saved over 3% on his interest rate from 6.24% to 2.99%

$130 Lower Monthly Payment

A Surgeon from Rosalind Franklin University of Medicine and Science lowered her monthly payment by $130 from $483 to $353

1% Lower Rate With Cosigner

A Registered Nurse from West Coast University saved 1% on his rate and over $5k in interest by refinancing with a cosigner

Purefy’s Comparison of Top Student Loan Refinance Companies

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

No maximum loan amount

Up to 12 months of forbearance if you experience financial hardship

Borrowers can refinance Parent PLUS loans in their own name

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

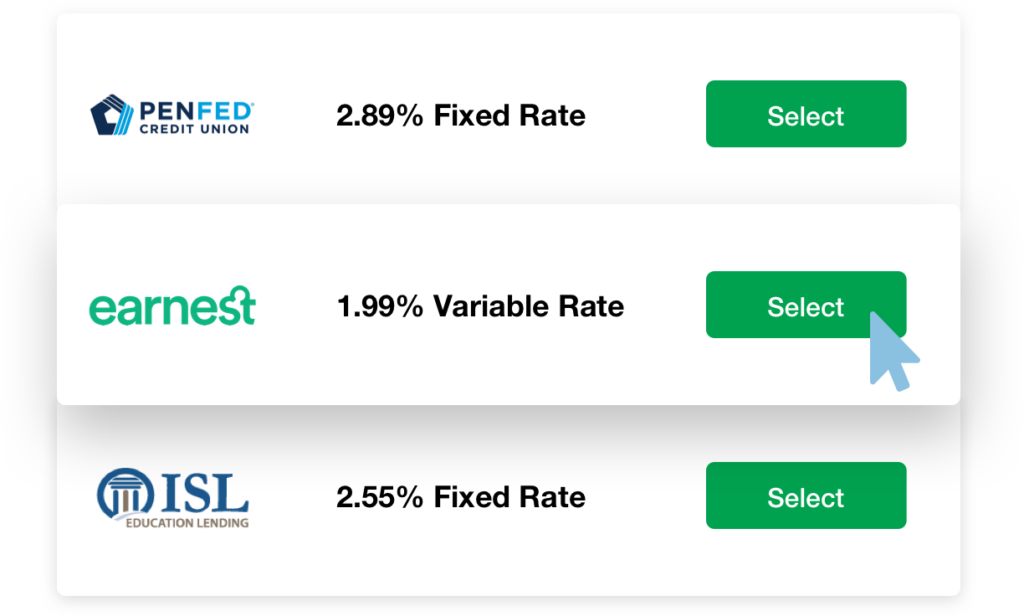

Explore Purefy’s Marketplace of Top-Rated Refinance Companies

We know your time is valuable.

Purefy speeds up the research process by bringing the best refinance lenders and rates together – all in one place – so you can review options, choose your new rate, and start saving quickly.

Real Rates

See pre-qualified rates from a range of vetted lenders – all at once with one easy-to-use tool.

Zero Fees

Compare your rates with no fees, hidden costs, or strings attached

No Impact to Credit

Checking rates has zero effect on your credit score and your information is 100% secure.

We're here to simplify student loan refinancing.

How Purefy Works: Our Rate Comparison Process

01

Complete Form - 2 Minutes

Fill out basic details about your student loan situation.

02

Compare Rates - 15 Seconds

See real, pre-qualified rates from a variety of nationwide lenders – tailored to your specific loan situation.

03

Submit Application - 15 Minutes

Pick your favorite combination of rate, term, and monthly payment – and head straight to our lender partner for confirmation.

Purefy Helps You Pay Less on Student Loans

213,000+ People

Have Compared Refinance Rates

$1.7 Billion+

in Refinanced Student Loans

5 Star

Rating on NerdWallet

25,000+

Monthly Blog Readers

Uncover More on Student Loan Refinancing

Looking for additional info on student loan refinancing? Check out all the whys, whens, and how-tos from Purefy’s team of experts.

purefy has been featured on