If you’ve ever applied for a mortgage or a student loan, you’re probably aware that loan approval can take time.

But personal loans are an entirely different ball game. If you apply for a personal loan online, you could reach full approval and get the funds within 24 hours through some lenders. If you need funds quickly for an emergency situation — for example, to pay rent, emergency healthcare, or unexpected car maintenance costs — a personal loan may be your best option.

If you want to better understand the personal loan application process, read on for the answers you need.

The Difference Between Online Lenders, Banks, and Credit Unions

The approval process for a personal loan ultimately depends on the lender you choose and the complexity of your income. For example, if your application is simple and your income is straightforward, you’re likely to have a faster approval time. But if you have any mitigating factors, such as self-employment/1099 earnings or a high debt-to-income (DTI) ratio, the lender may request more documents and take longer to approve your application.

You can apply for a personal loan with an online lender, a bank, or a credit union. Most of these organizations have similar application processes. However, the time it takes to approve a personal loan will vary between each type of lender.

Approval Time vs. Funding Time

Online Lender

- Approval time: Up to three business days

- Funding: Up to five business days

Bank

- Approval time: Up to seven business days

- Funding: Up to seven business days

Credit Union

- Approval time: Up to seven business days

- Funding: Up to seven business days

While online lenders have the fastest approval time, funding may still take up to five business days after you apply for a loan online. However, there are some online lenders with same-day approval and funding.

On the other hand, banks are a good option if you’re not in immediate need of funds. Even more so if you have a connection to one of them and they know your reputation as a borrower. If you have an account with them, they may consider speeding up the process for approval and funding.

Finally, credit unions are more specific and cater to the people in the community. If you’re a member of the local credit union and don’t need the funds immediately, a credit union may be a good option.

Personal Loan Requirements and Application Process

Before applying for a personal loan with an online lender, bank, or credit union, there are a few steps you can take to prepare. Gathering your information beforehand will ensure that the application process goes as quickly as possible.

The basic requirements for a personal loan are as follows:

- Name

- Social Security number

- Address

- Phone number

- Proof of identity (such as a driver’s license or passport)

- Proof of income (such as a pay stub or W-2 form)

Before you can apply for a personal loan, it may also help to know what lenders are looking for. Aside from the basic information listed above, lenders typically need to see:

- Credit score & history (varies based on lender, but typically fair-to-good credit is required)

- Collateral (if applying for a secured loan)

- Debt-to-income ratio (usually less than 36%)

Since each lender has its own criteria, prequalification can help avoid multiple applications and allow you to see your rates before a hard credit pull. Use a tool like Purefy’s rate comparison to shop multiple lenders at once and receive offers within minutes. Checking rates will not affect your credit, and you can complete the application process online.

Complete the Personal Loan Application

After checking your rates and selecting an offer, you’ll need to complete the official loan application and consent to a hard credit pull. You’ll typically receive your pre-approval or denial within minutes of the credit pull.

Required documents will sometimes vary on the size of the loan, but ultimately it will be the lender’s call. You can expect to provide at least a photo ID and income verification, but you may need to provide additional items (such as multiple supporting income documents if your income is complex).

Loan Underwriting

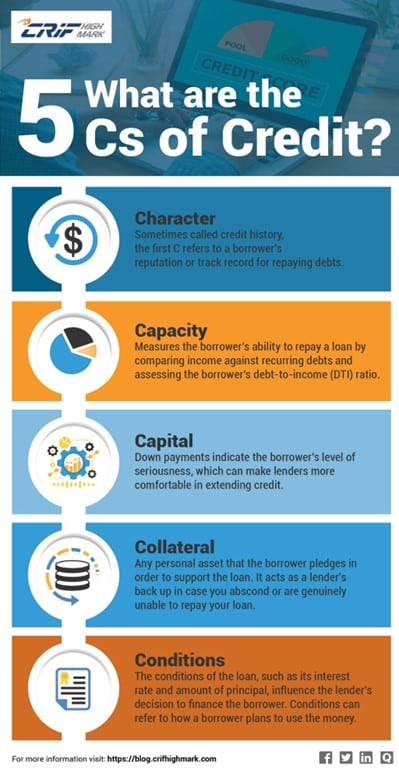

During the underwriting process, the analyst assigned to work on your application will evaluate the loan using the Five C’s of Credit: character, capital, collateral, capacity, and conditions. Some items considered during the evaluation are your credit scores, repayment history, and cash reserves available. During the underwriting phase, your supporting documents will also be evaluated.

Loan Approval or Denial

After the underwriting process, your personal loan will either be approved or denied. If your loan is approved, the lender will communicate the final terms and conditions of the loan.

If your application gets denied, the lender will let you know the reason for denial. You can use that feedback to improve your chances when you apply for another loan in the future. Approval may be as simple as adding an eligible cosigner to your application, so be sure to communicate with your lender to determine if you have a path forward.

Closing

Once your personal loan application is approved, you will be able to review the loan documents and eSign the paperwork. After signing, the lender will disburse funds to your account, typically through a wire transfer or ACH payment. And that’s it – you’ve completed the personal loan application!

Post-Closing

When the loan transaction is done, you will receive a letter or email stating where to make payments. Your first loan payment will typically be 30-45 days after your funds disburse. You’ll also receive a copy of your loan documents, so be sure to keep track of them for your records.

Outsmart Rising Credit Card Interest Rates With a Personal Loan

Credit card APRs often exceed 20%. Get your finances on the right track today with a quick & easy personal loan from our marketplace of top-rated lenders

How to Get Personal Loans Fast

Now that you’re familiar with how to apply for a loan, here are some tips on how you can make the process quicker:

Research and Compare Lenders

One of the best ways to find a loan that fits your needs is by researching and comparing different lenders. Not all lenders have the same requirements, terms, and interest rates. Some lenders may charge fees (like an origination fee), so it’s important to factor these fees into the total cost of the loan.

Using Purefy’s rate comparison tool, you’ll be able to compare all details of the loan, including any fees each lender may charge. Comparing lenders is the best way to find who has the fastest approval and funding process, and of course, which lender can offer you the best rates.

Review Your Credit Report Before Applying

Ahead of the application process, you should review your credit report and credit score for errors and inaccuracies. If you do notice any errors, you’ll need to dispute them with each credit bureau to get them removed from your credit report. This can improve your credit score and help you qualify for a lower rate when it comes time to apply for a personal loan.

Gather Required Documents

Another tip that can save you time is researching what documents you need to submit to the lenders. Locating those documents and having everything ready to submit ahead of time will speed up the underwriting process.

Be Sure to Enter Everything Correctly

Aside from submitting the required documents, you must also ensure that everything you put in the application form is accurate. This includes your personal information and employment details, so complete the application carefully and to the lender’s specifications.

For example, you may receive bonus income each year, or have separate child support or alimony payments on top of your regular income. Be sure that you have documents to support and verify any income you enter on the application, because the lender will need to verify the full stated amount.

If any information needs to be corrected or you aren’t able to provide verification, this can delay processing or even result in a denial of your loan application.

Why Should You Avoid Payday Loans?

Payday loans offer same-day processes and funding, which is why many people are tempted to apply for these types of loans. However, they have a huge disadvantage, with an APR of 600% or more. Payday loans are often predatory and are designed so borrowers have difficulty repaying the loan. As a result, borrowers need to get another loan to repay the original loan and pay another round of fees, which sinks them deeper into debt.

In addition, most payday lenders want to access your bank account, and they can be ruthless when collecting debt. To save you from financial catastrophe, personal loans are a far better option.

Final Takeaway

Applying for a personal loan online may be the fastest option for those looking to acquire funds quickly. You can use Purefy’s rate comparison tool to shop for a personal loan and start an application.