Student loan debt can feel like a burden which holds you back from attaining life goals. In fact, with the majority of student loan debt—over $1 trillion—being held by those aged 18 to 29, it’s no surprise that millennials are putting off major life goals like owning a home or buying a new car.

Student loan refinancing has emerged as a powerful tool to manage this debt. If you’re curious about how to refinance student loans, in this guide we’ll show you the best way to find the right loan for your needs—it also happens to be the easy way, too.

First, decide if a student loan refinance is right for you

If you have taken care of your credit and have steady income, you may be able to qualify for the best student loan refinance rates—and Purefy will help you find them with our easy-to-use rate comparison tool.

If you have private student loans and you can get a lower rate through refinancing, it’s usually a no-brainer. Student loan refinance companies typically offer similar benefits to what you get with private student loans, so the decision usually comes down to the savings.

You should still check your new lender’s benefits before you proceed. For instance, if you plan on going back to school for a graduate degree, you will want to make sure your student loan refinance company offers deferment.

Federal student loans, on the other hand, can be a trickier decision, because they come with certain benefits and protections that private student loans typically do not have—benefits you would give up by refinancing with a private lender.

For example, if you are hesitant to give up access to federal forbearance and income-based repayment programs, you might want to hold off on refinancing. That said, for many people with federal student loans, refinancing still makes a lot of sense.

If you have both federal and private loans, you may have wondered how to consolidate student loans—all of them—into one loan with one payment. Refinancing is the only way to do this. There is a federal Direct Consolidation Loan program, but that can’t be used on private loans. It also doesn’t get you a completely new rate based on your credit profile, like student loan refinancing does. In fact, federal consolidation will take the weighted average of the interest rates on your federal loans, and round up to the nearest one-eighth percent for the new interest rate on your consolidation loan.

Find the right student loan refinance companies and compare rates

If you want to get the best deal on your student loan refinance, you must compare rates from multiple lenders. We explored this topic in-depth in this post. Long story short, you can’t use the rate ranges that lenders list on their websites (or on comparison sites) to guess who is going to offer you the best rate. You need to get actual rate quotes that are based on your personal situation and credit profile.

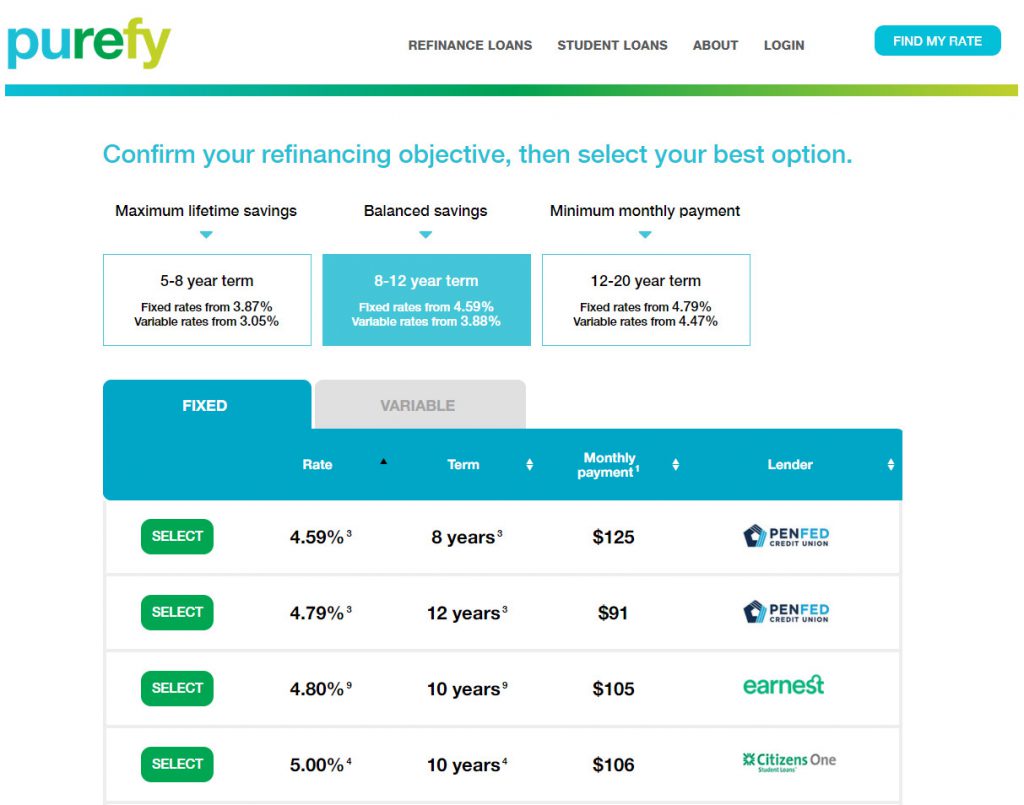

Purefy has developed a rate comparison tool to help you easily compare offers from some of the most well-regarded lenders out there, without having to fill out several cumbersome applications. All you need to get started is to enter a few details about yourself. Comparing rates has no impact on your credit score. Once you submit the form, you will be taken to a results page that looks like this:

The first thing you’ll want to do is to select one of the objectives at the top, to narrow down your options. By default, “balanced savings” will be selected, which shows you options with 8-12 year repayment terms. You can generally save more in interest by choosing a shorter term, or get the lowest monthly payment by choosing a longer term.

The student loan refinance calculator will show you the lowest rates first—you can sort the columns any way you like by clicking on the headers. For instance, if your goal is to reduce the strain on your monthly budget, you could click on —monthly payment” in the blue bar to isolate the lowest amounts.

You will also notice that the student loan refinance rates you see at first are all fixed rates. To view the variable rates, click the —variable” tab at the top of the chart. While fixed rates will stay the same for the life of the loan, variable rates will fluctuate over time with market rates. Variable rates usually start a little bit lower than fixed rates, but they are riskier, especially if you select a longer term. Most borrowers who choose variable rates do so with the intention of paying off the loan as soon as possible.

Lastly, if you are interested in adding a cosigner to see if you may qualify for a better rate, you can do so at the bottom of the page.

What to expect after you apply

If you like what you see and select one of the lenders, you will be taken straight to their website to apply. Generally, most student loan refinance companies will ask you for the following information:

- Contact information

- Social Security number

- Employment/income information

- Degree information

- Current loan servicers, account numbers, and balances

Most applications can be completed in less than 15 minutes. If you add a cosigner, there is also a portion that they will need to complete before your student loan refinance application can be processed. Once everything is submitted, the student loan refinance company will run a hard credit check, and you will generally receive your preapproval decision very quickly.

If you are preapproved, the lender will request documentation to verify the information listed on your application. This part of the process will feel a little more like getting a mortgage than a car loan—remember, your student loan refinance is an unsecured loan (no collateral), so the lender needs to do a little extra due diligence. The documents they request might include:

- Government-issued ID

- Paystub or other income verification

- Graduation verification

- Loan statements for your current loans

Final Approval and Loan Payoff

Once the lender reviews and approves all your documents, you will then need to select your loan terms and review your loan documents. This part of the process is usually handled through your lender’s website or online portal, where you can sign your loan agreement electronically.

After everything is finalized, your new lender will send a disbursement check or electronic funds transfer to your old servicer, to pay off your old loans. This process can take a little bit of time—keep in mind that once your old servicer receives the funds, it may take a few days for them to process it.

If you have any payments due with your old lender during this whole process, we recommend you keep making them so that you do not risk having a delinquency reported to the credit bureaus. Any overpayments to your old servicer will be refunded back to you at the end of the process.

Summing up

Purefy has developed tools to make it easy for you to compare multiple offers to find the best student loan refinance rates. Our tools are totally transparent, and they are always free to use. And if you need any help figuring out how to refinance student loans, you can always reach out to our award-winning customer service team by phone at 202-524-1115, by text at 202-688-5572, by email at [email protected], or by web chat.