Refinancing your student loans can have a significant impact on your debt payoff strategy — including giving you more flexibility and the chance to save money on interest.

But refinancing student loans with bad credit can be challenging.

Here’s why you should still consider it, and what you can do to improve your chances of getting approved for a student loan refinance.

Why you should consider student loan refinancing

Student loan refinancing is the process of combining one or more federal or private student loans into one new loan with a private lender. While refinancing isn’t for everyone, there are some major benefits you may be able to take advantage of if you qualify:

- Savings: Depending on the interest rates on your current loans, refinancing could allow you to get a loan with a lower rate, which would save you money as you pay down your debt and could also lower your monthly payment.

- Flexibility: Private lenders can typically offer repayment terms ranging from five to 20 years, giving you some control over how fast you pay off your debt. A shorter repayment term would increase your monthly payments, but it would also save you money on interest and help you become debt-free faster. On the flip side, a longer repayment term would cost you more in interest, but it could help you reduce your monthly payment to a more manageable level. The important thing is that you get to choose.

- Simplicity: Replacing multiple student loans with just one new loan can simplify your repayment plan. Instead of keeping track of several monthly payments, you just have to make one.

Keep in mind, though, that if you’re refinancing federal student loans, you will lose certain benefits that the U.S. Department of Education provides to borrowers including student loan forgiveness programs, income-driven repayment plans, generous forbearance and deferment options, and more.

The 2 Best Companies to Refinance Student Loans

Our Top-Rated Picks for 2024 Offer Low Rates and No Fees

Why refinancing student loans with bad credit is hard

The federal student loan program is set up so that borrowers don’t need to undergo a credit check to get approved for a loan. This arrangement works well for college students, who typically haven’t yet had the chance to establish a credit history.

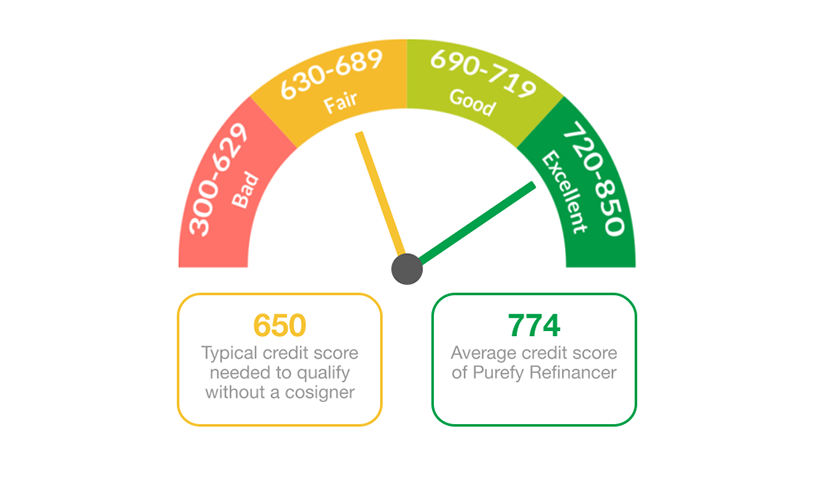

If you’re hoping to refinance, though, you can expect a credit check from a private lender. And, unfortunately, many private lenders require good or excellent credit plus a solid income to qualify. Even then, you may not be eligible for a lender’s lowest interest rate.

As a result, it’s incredibly difficult to get approved for student loan refinancing on your own if you have bad credit. That said, it’s not impossible if you have the right approach.

How to refinance student loans with bad credit

If your credit isn’t in great shape, but you still want to try to refinance, your best option is refinancing student loans with a cosigner. This cosigner acts as a co-applicant to effectively guarantee payment to the lender if you can’t keep up with your monthly payments.

If you have a loved one with great credit and income who is willing to cosign, it can improve your chances of getting approved for the loan and offered the lowest rates to help you save significant money.

Also, some lenders offer cosigner release, which allows you to remove your cosigner after you’ve made a certain number of payments and meet the lender’s credit requirements on your own. So if you have bad credit but are in the process of improving your credit score, you may be able to apply for cosigner release down the road.

Free eBook: How to Conquer Student Loans

Free eBook: How to Conquer Student Loans

Spousal student loan consolidation is another option to consider. PenFed Credit Union, for instance, allows spouses to refinance their student loans together into one account between the two of them. This process can be beneficial if one spouse has no income or hasn’t had a chance to establish a good credit history.

Keep in mind, though, that cosigners are equally responsible for making payments on the new loan. So if you default, they will be legally required to make payments on your behalf. Also, the loan will show up on their credit report. That means missed payments can hurt both your and their credit history — and depending on how much you’re borrowing, it can impact their ability to get credit on their own.

Also, if you do spousal student loan consolidation, your separate debts will become combined debt. This could cause problems if you get divorced down the road. So make sure to consider both the pros and cons of these options before you move forward.

Comparing student loan refinance rates and lenders

Now that you know how to refinance student loans with bad credit, the next step is to determine if it’s the right fit for you. If you have a cosigner or your spouse is willing to refinance loans together, take some time to shop around and compare rates and other loan terms from several lenders.

To speed up that process, use Purefy’s Compare Rates tool, which can give you rate quotes from several lenders in one place with no impact on your credit.

With this information, you can easily compare offers from several lenders, then compare those offers with what you’re currently paying. If you find a lender that offers a lower interest rate than what you’re paying now, refinancing could save you money.

In addition to the rates, also consider other features. For example, if you’re working toward Public Service Loan Forgiveness or student loan repayment assistance through a government agency, you may need to hold onto your federal loans to qualify. Also, refinancing can potentially lower your monthly payment, but most private lenders don’t offer income-driven repayment plans, which can come in handy if you experience financial hardship.

As you consider all these factors, the most important thing is to ensure you’re making the right decision financially, both in the short term and in the long term. Also, make sure to communicate with your cosigner or spouse to ensure you’re on the same page, and you don’t run into potential problems down the line.

As you carefully consider your options, you’ll be in a better position to make the right decision for your financial needs.