You may be asking yourself, “should I go to grad school?” Maybe you’re unsure what to do with your life, want to make more money, or want to change careers. Whatever the reason, going back to school is a big decision.

At Purefy, we believe that education is essential and want to help you make the best decision for your future. Here we’ll go through the advantages and disadvantages of returning to grad school and discuss payment options so you can make an educated decision about your career.

What is Grad School?

According to Top Universities, a graduate school is an institution that provides postgraduate education, such as masters and doctorate programs. A doctoral degree can take up to seven years to finish. A master’s degree, on the other hand, takes an average of two years to complete.

There are many reasons you may want to return to school. Some people do it to change their career, while others go back for personal development, or because they’re unsure about what they want to do with their lives.

In grad school, you will specialize in a particular field of study and have the opportunity to conduct research and write papers on your chosen topic. Grad school can be beneficial if you are looking to change careers or if you want to advance in your current job.

It is important to note that grad school is not for everyone and is a significant investment of time and money. Before deciding to return to school, ask yourself if it’s the right choice.

Advantages and Disadvantages of Grad School

You’ve been out of college for a few years and finally feel settled in your career. However, you can’t help but wonder “should I go to grad school?” and whether or not returning to graduate school would be the best option for you. After all, you’ve heard more and more about how difficult it is to get ahead without an advanced degree.

But before you decide to return to graduate school, you should consider a few things. Here are some advantages and disadvantages of going to grad school:

Advantages:

- You will have the opportunity to specialize in your field of interest, and you will be able to research your chosen topic.

- Returning to grad school can help you advance your career or change careers altogether.

- Grad school can give you the skills and knowledge you need to succeed in your chosen field.

Disadvantages:

- Grad school is a significant investment of time and money, and it’s not for everyone.

- You may not be able to find a job after graduation, or you may not be able to find a job in your field of interest.

- Returning to grad school can be a lot of work and balancing your other commitments may not be easy.

Free 13-page eBook: How to Pay For College

Download instantly with just one click

Free eBook: How to Pay for College

Download instantly with

just one click

Figuring Out if you Need (or Want) a Graduate Degree

Start by researching your field of interest and reach out to professionals in that area to get their thoughts on whether or not an advanced degree is necessary. It would help if you also considered whether you are ready to commit financially and timewise. Lastly, consider your long-term goals and what you hope to achieve by returning to school.

There are many things to think about before returning to graduate school. It’s an investment of time and money, so you want to be sure it’s the right choice.

Can you Work Full Time and Attend Grad School?

The next step is to find out if your employer would be willing to allow you to take on more coursework while continuing to work. Some employers are eager to cover the cost of tuition and fees, while others will offer a tuition reimbursement program. Speaking with your employer about their policies is essential before making any decisions.

Other options are available if your employer cannot help you cover the tuition. You can take out loans, apply for scholarships, or look into grants to help you pay for school. You may also talk to other professionals in your field about whether an advanced degree is necessary.

There is no easy answer when deciding if returning to grad school is suitable for you — it’s a big decision that should not be taken lightly.

The Cost of Tuition and Other Expenses

One of the most significant considerations when deciding whether or not to go back to grad school is the cost. The cost of tuition has been rising in recent years, and it is essential to determine if you can afford the cost of tuition, books, and other associated expenses.

First, decide if you are willing to take on more debt. If you take out loans, you’ll need to be able to make the monthly payments after graduation. You may want to speak with a financial advisor and ask, “is grad school worth it?” to see if returning to school is a good financial decision for you.

US News states that the cost of a two-year, full-time graduate program can be more than $100,000. Doctoral or professional programs might be even more expensive. It is essential to consider if you can afford the cost of returning to school before deciding.

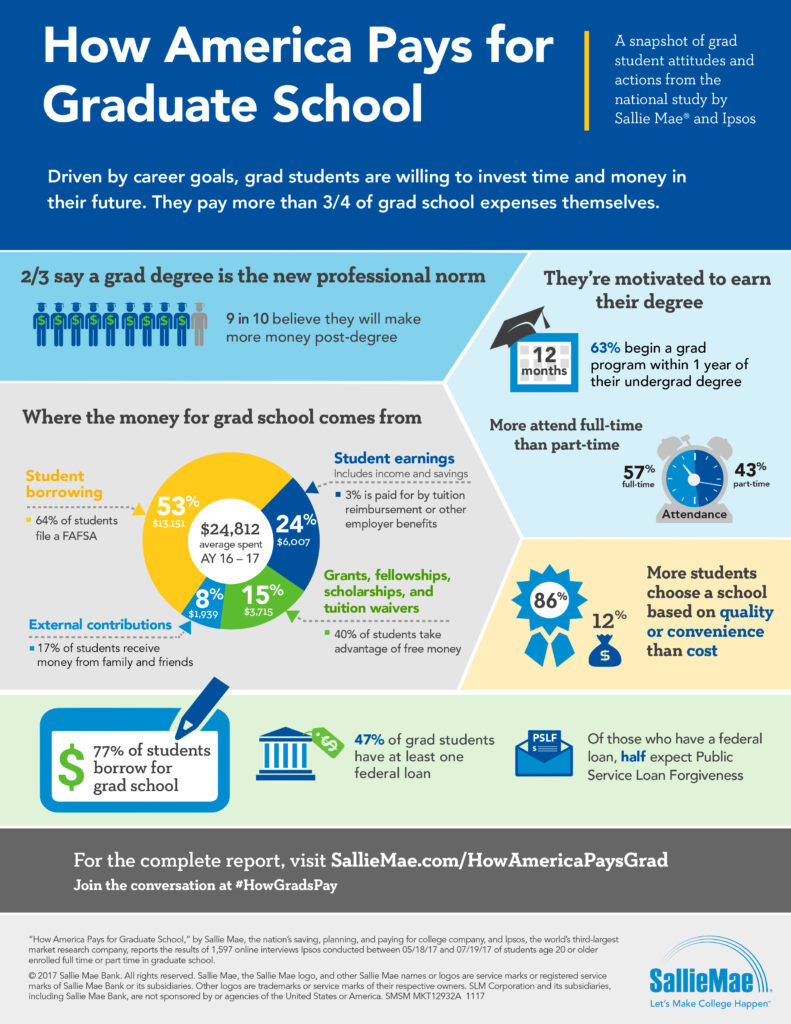

How to Pay for Grad School

When it comes to paying for grad school, you have options. You can get scholarships, grants, or student loans. You should also think about how much money you will need to live on while you are in school and if you can work while going to school.

Scholarships

One way to finance your education is by finding scholarships that can help with the cost of tuition. There are many different types of scholarships available, including need-based, merit-based, and degree-specific options.

Grants

Another way to finance your education is by finding grants that can help with the cost of tuition. Grants typically do not have to be repaid; they may be available from the federal government, state government, or private organizations.

Working While in School

Another option is to work while you are in school. This can help you cover the cost of tuition and other associated expenses. You should consider how much time you will need to devote to your studies and if working while in school is a realistic option.

Cost of Living

When planning for grad school, you should also consider the cost of living. This includes the cost of rent, food, and other necessary expenses. You should create a budget to see if you can afford the cost of living while studying.

Loans

You may also consider taking out loans to finance your education. There are various student loan options available for grad students, and a general rule of thumb is to exhaust all federal student loans before seeking out private student loans.

If you do need to take out private student loans to bridge any funding gaps, you can always refinance those loans at a later time. We’ve created an uncomplicated student loan refinancing calculator that can give you an estimate of your potential savings, and you can use our rate comparison tool to find the best rates and terms for your situation.

The 4 Best Companies for Private Student Loans

Our Top-Rated Picks for 2023 Offer Low Rates and No Fees

Option to skip a payment once a year

In-school deferment available if you return for another degree

Optional $25 payment plan during school to reduce interest after graduation

1% Cash Back Graduation Reward program

Fixed Rate

Variable Rate

Fixed Rate

Variable Rate

Graduate Degrees Aren’t the Only Option

There are other ways to gain the necessary skills and knowledge to change careers or make more money without returning to school. These options may be less expensive and time-consuming than going back to grad school. Consider these alternatives to grad school:

- Professional Certificates or Training – There are many professional certificates and training programs available to level up your knowledge and skills in your chosen field. You may even be able to get your employer to cover the costs of a certificate program.

- Online Courses – You could also consider taking online courses to gain the necessary skills and knowledge. These courses can be taken at your own pace and may be less expensive than going back to grad school. If you aren’t concerned about credentials, you can even use free courses like MIT’s OpenCourseWare.

- Boot Camps – Another option is to attend a boot camp. These camps typically last a few weeks or months and provide intensive training in a particular subject. Boot camps may be more expensive than other options but can be good if you want to gain specific skills quickly or switch careers.

The best way to decide if going back to grad school is right for you is by researching and considering your options. Talk to professionals in your field, figure out the cost of tuition and living expenses, and create a budget. Once you have done all this, you will be better positioned to make the right decision.

Get the Facts Before you Make your Next Big Decision

Going back to grad school is a big decision that should not be taken lightly. There are many things to consider before deciding, such as the cost of tuition, how you will pay for school, and if you can work while in school.

If you are considering returning to grad school and need student loans, you can use our rate comparison tool to shop multiple lenders without any impact to your credit.

Need a Private Student Loan? Check Out the Top Lenders of 2023.

Compare interest rates and perks to find the best lender for you.