Are you struggling to decide where to get a personal loan? Do you need money to pay off credit cards, fund your next big project, or pay medical bills? With so many lenders to choose from, figuring out which one is best for you may be overwhelming. To help, we’ve created a guide to go through the factors you should consider when deciding where to get a personal loan.

Characteristics of a Good Personal Loan

When looking for a personal loan, there are many things to consider. You want to ensure that you get the best deal possible and that the loan meets your needs. Typically, personal loans are unsecured loans, which means you don’t need to provide collateral to qualify or be approved. Here are some characteristics of a good loan you should consider:

Interest Rates

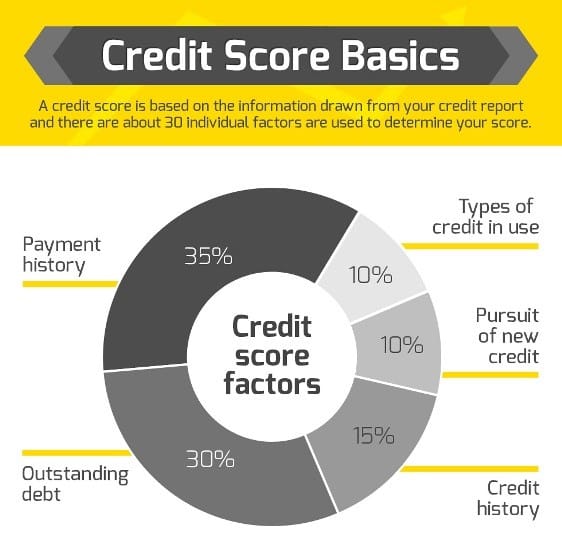

Personal loan interest rates determine what you’ll be paying on top of the principal balance. In other words, it’s the cost the lender will charge you to borrow money. Your credit score and credit history are the biggest factors used to determine your interest rate, but lenders also look at other things like your debt-to-income ratio. In general, the higher the credit score, the lower the interest rate you’ll receive.

Fees

Some lenders will ask for an origination fee, which will be deducted from the loan amount when you take out the loan. If a lender is offering you a great rate, the origination fee could be worth it – just make sure you take out a large enough loan so that once the fee is deducted, you have all the money you need left in the loan balance.

Loan Amount

The loan amount is the amount you borrow from the lender. Lenders offer loan amounts in some cases up to $100,000, however you’ll need to meet certain criteria to get these loans and likely will need excellent credit and a good debt-to-income ratio.

Repayment Period

The repayment period is the number of years or months you will be paying for the loan. There are lenders with long-term repayment options, such as five years or more. In general, the longer your repayment term, the lower your monthly payment will be. However, longer repayment terms usually mean that you will pay more in interest over the life of the loan.

Pre-qualification

Most lenders today offer a pre-qualification option, which tells you if you will qualify and what rate you will receive using a soft credit check that doesn’t affect your credit score. You can also use Purefy’s rate comparison tool to check multiple lenders all at the same time, to speed up the comparison shopping process.

Approval & Funding Time

The approval and funding time will depend on the lenders. Most lenders fund loans in anywhere from 1 day to a week. If you need funds fast, opt for lenders that offer same-day approval and fast funding.

Get Money for Home Improvements in as Little as One Day

Pros & Cons of Online Lenders, Banks, and Credit Unions

Personal loans are offered primarily by online lenders, banks, and credit unions. Here are the pros and cons of each to help you better understand them.

Online Lenders

One of the most popular options for personal loans is online lenders, which don’t have physical locations that you must visit to apply. Most online lenders have simple online applications and offer quick approval decisions.

- Pros: One advantage of online lenders is that they generally offer fast funding. Many can send the money to your bank account on the same day or within 1-2 business days if you get approved.

- Cons: If you do want to visit an in-person location to discuss the loan or remediate any issues, they do not have one to visit. However, they do generally offer customer service over the telephone, by email, or even web chat.

Banks

Getting a loan from a bank can also be an appealing option, especially if you already are a customer.

- Pros: Many banks, especially larger national ones, offer similar benefits to online lenders – fast funding, easy online applications, and online customer service. They also have the advantage of in-person customer service, if that is your preference.

- Cons: Smaller local banks and even some larger banks may not have their personal loan application process online, or you may need to visit a bank branch to provide documentation to complete your loan.

Credit Unions

Credit unions are similar to banks, except they are typically non-profit organizations that work for the benefit of their members. In order to take out a loan at a credit union, you may need to become a member first (or become one during the application process.

- Pros: Largely shares similar advantages to banks. Additionally, when you take out a loan you will become a member of the credit union, giving you access to their banking services and other loan products.

- Cons: If you don’t wish to become a member, you can’t get a loan.

How Credit Scores Can Limit Personal Loan Options

Lenders, especially banks and credit unions, will check your credit score to see if you’re qualified to borrow from them. It’s the main way they will gauge your creditworthiness and ability to pay back your loan. Therefore, the higher the score, the more chances of getting approved with a low-interest rate.

Most lenders prefer applicants with a credit score of 650+. Lower than that, you may need to seek out a lender that specializes in loans for bad credit. Be warned, however, that these lenders typically offer higher interest rates.

Common Loan Requirements

Below is a list of the common requirements that lenders will evaluate when deciding whether to give you a loan. Some lenders may ask you for documentation to verify this information (such as a paystub), while others do so automatically.

- Credit score

- Debt-to-income ratio

- Loan application

- Proof of income

- Proof of identity

- Proof of address

- Loan purpose

- Monthly expenses

Compare the Best Personal Loan Lenders Before You Borrow

Before applying for a loan, compare their rates to see which works best for you. Not all loan offers are one-size-fits-all, and the company offering you the best deal might not be the one you expect.

At Purefy, we provide a free rate comparison tool that allows you to compare rates from multiple lenders with one fast form. It takes about 2 minutes and has no impact on your credit score.