Outsmart Your Student Loans With Earnest

Earnest is a highly rated student loan refinance company with a top-notch reputation. See if they’re the right solution to save money on your college debt.

Why Purefy Recommends Earnest Student Loan Refinancing

Super Low Rates

Save big on lifetime interest with historically low rates from 1.74% variable or 2.44% fixed.

Flexible Terms

Repay student debt on your schedule. Choose a term between 5 and 20 years.

Fast Application

See your lowest qualifying rate and apply for a loan with a smooth and speedy process.

How Much Can You Save With Earnest?

Ready to drop your student loan interest rate?

Head to Earnest to check your rate and see your savings in minutes.

Purefy's Comparison of Earnest to Other Industry Leaders

Earnest is a smart choice for student loan refinancing – but they’re not the only option. See how they compare to other trusted lenders in the student loan market.

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

No maximum loan amount

Up to 12 months of forbearance if you experience financial hardship

Borrowers can refinance Parent PLUS loans in their own name

Fixed Rate

Term

Minimum Credit Score

Variable Rate

Eligible Loans

Federal & Private

Purefy Rating

Fixed Rate

Term (years)

Minimum Credit Score

Variable Rate

Eligible Loans

Purefy Rating

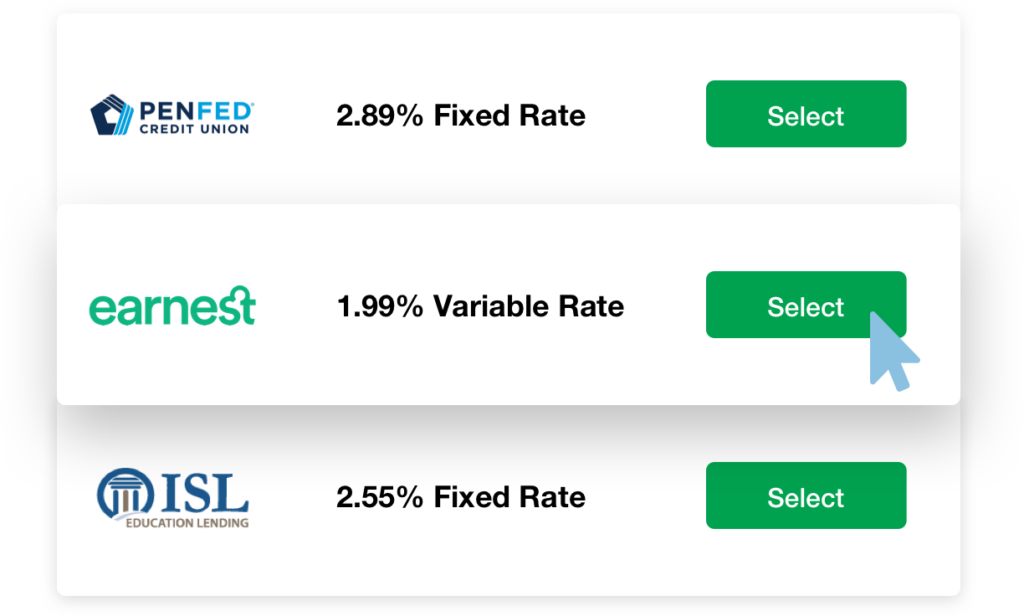

Explore Purefy’s Marketplace of Top-Rated Refinance Companies

We know your time is valuable.

Purefy speeds up the research process by bringing the best refinance lenders and rates together – all in one place – so you can review options, choose your new rate, and start saving quickly.

Real Rates

See pre-qualified rates from a range of vetted lenders – all at once with one easy-to-use tool.

Zero Fees

Compare your rates with no fees, hidden costs, or strings attached

No Impact to Credit

Checking rates has zero effect on your credit score and your information is 100% secure.

purefy has been featured on

It’s fast, simple, and transparent.

How Purefy Works: Our Rate Comparison Process

01

Complete Form – 2 Minutes

Fill out basic details about your student loan situation.

02

Compare Rates – 15 Seconds

See real, pre-qualified rates from a variety of nationwide lenders – tailored to your specific loan situation.

03

Submit Application – 15 Minutes

Pick your favorite combination of rate, term, and monthly payment – and head straight to our lender partner for confirmation.

How Student Loan Refinancing Saves People Money

$16,736 in Savings

An Industrial Engineer from University of Central Florida reduced her interest expense by $16,736 from $38,396 to $21,660

3% Lower Interest Rate

A University of Cincinnati graduate saved over 3% on his interest rate from 6.24% to 2.99%

$130 Lower Monthly Payment

A Surgeon from Rosalind Franklin University of Medicine and Science lowered her monthly payment by $130 from $483 to $353

1% Lower Rate With Cosigner

A Registered Nurse from West Coast University saved 1% on his rate and over $5k in interest by refinancing with a cosigner