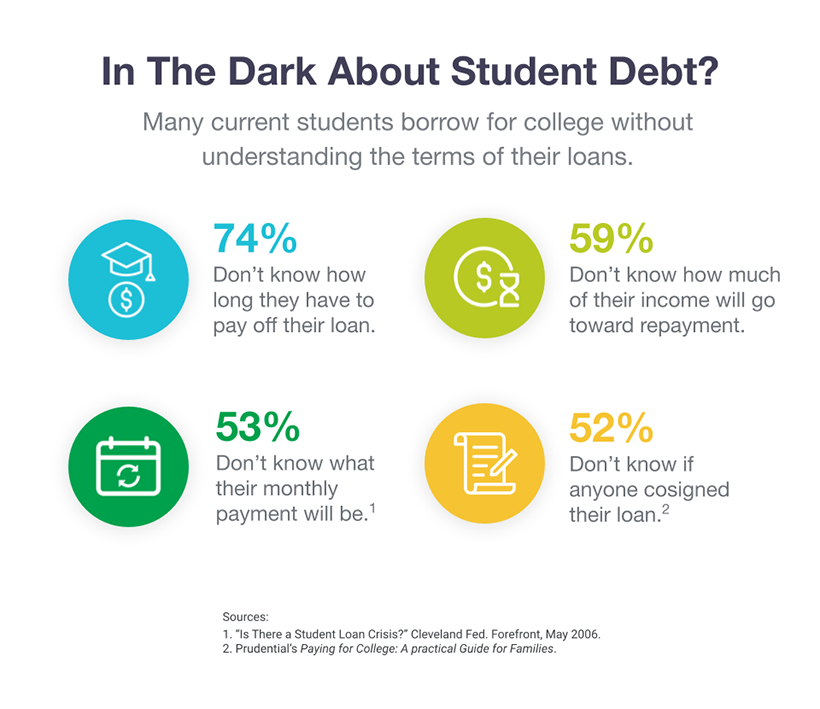

“I’ll never be able to repay these loans. I can’t afford my rent, let alone loan payments. I would have so much more freedom if I didn’t have student loans.” If any of these thoughts sound familiar to you, you’re not alone. Among the class of 2017, 65% of college students left school with student loans. And you, like many, may be wondering about the pros and cons of refinancing student loans and if you should refinance federal student loans.

If you’re focused on paying off your debt as soon as possible or want to save money, you’ve likely considered student loan refinancing. But should you refinance federal student loans?

You can refinance some or all of your federal student loans, and you can even refinance federal and private student loans together if you have both. Here’s what you should know before submitting your refinance loan application, including the essential pros and cons of refinancing federal student loans.

What is student loan refinancing?

Student loan refinancing is a process where you work with a private lender to take out a loan for the amount of your current debt; you use the new loan to pay off your old ones. The refinance loan has different repayment terms than your old ones, including interest rate, monthly payment, and length of repayment. Although the terms are often used interchangeably, refinancing is different from federal student loan consolidation in a number of ways.

Free eBook: How to Conquer Student Loans

Free eBook: How to Conquer Student Loans

Can you refinance federal student loans?

If you took out federal student loans to finance your education, you likely have multiple different loans and monthly payments to worry about — potentially with different loan servicers. Plus, your loans currently are stuck at whichever federal loan interest rate was in effect at the time you applied.

With a variety of federal loans to deal with — all with different due dates, bill amounts, and interest rates — it can be hard to keep track of everything and maintain on-time payments. You also may be in a much better financial situation now that you’ve graduated and entered the workforce. With a good career, credit history and income, you may have the opportunity to take advantage of a lower rate and save money while paying back your debt.

If you’re finding it difficult to manage a large quantity of loans, or you think your financial situation could score you a lower rate, refinancing federal student loans could be an excellent solution.

Talk to a student loan refinancing expert

At Purefy, our experts are ready to guide you through your best options to save.

Talk now 800-491-9310

Kelli

Shannon

Evan

Cassie

By pursuing a refinance for your federal loans, you can combine all your loans into one — saving you the headache of managing multiple payment amounts and dates. And, refinancing also provides the opportunity to get a better rate for those who qualify — allowing you to save big on interest costs over the course of paying back your loan.

Getting approved for a student loan refinance — and getting the lowest rates — usually depends on credit history and income. If you don’t have a strong credit score or steady income, you can always choose to apply with a creditworthy cosigner to have higher odds of approval.

The 2 Best Companies to Refinance Student Loans

Our Top-Rated Picks for 2024 Offer Low Rates and No Fees

What if you have both federal and private student loans?

With student loan refinancing, you decide which and how many student loans you want to include in the refinance. You can choose to only refinance federal loans, only private loans, or a combination of both — based on your own financial situation and student loan pay off goals.

Depending on the types of loans you have, it’s important to understand the pros and cons of refinancing student loans. The benefits and drawbacks of refinancing federal loans is quite different than refinancing private student loans pros and cons. So if you have both types of loans, make sure you have a good grasp of both scenarios before moving forward.

Benefits of refinancing student loans

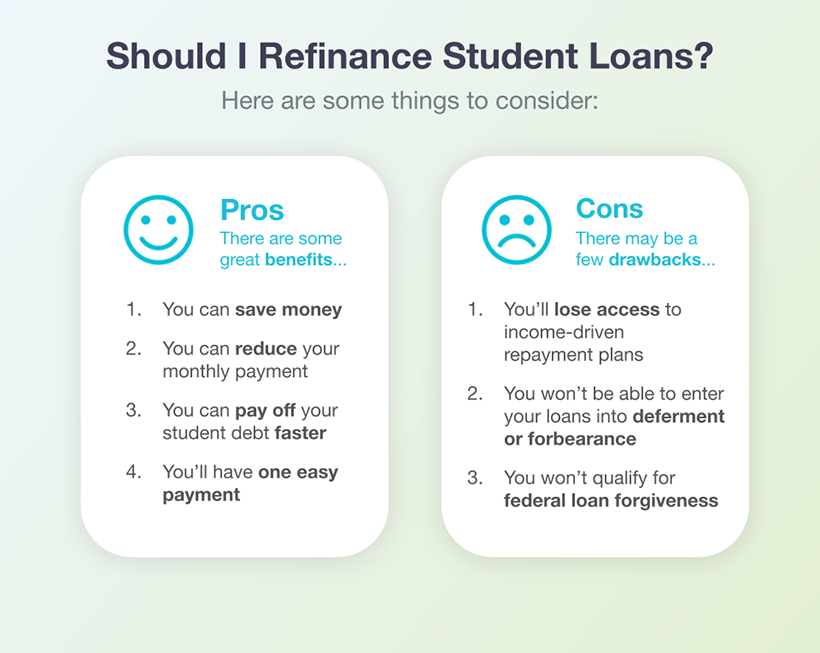

Refinancing your student loans is a quick and easy process, but there are certain student loan refinance pros and cons to be aware of. Refinancing offers several benefits that can greatly improve your student loan situation and debt management, but it’s important to understand both the positives and negatives before applying.

See how these refinancing benefits — as well as the pros and cons of refinancing federal student loans — match up with your personal student loan pay off goals.

1. You can save money

When you refinance, you can qualify for a lower interest rate. With a lower rate, more of your payment goes toward the loan principal rather than interest, allowing you to save a significant amount of money.

For example, let’s say you had $35,000 in student loans at 6.6% interest — the interest rate on Direct Unsubsidized Loans for graduate students for the 2018-2019 school year — and a ten-year repayment term. Over the course of ten years, you’d repay a total of $47,904.

But if you refinanced those loans and were approved for a ten-year loan at 5% interest, you’d repay just $44,548. Refinancing would help you save over $3,300. You would also lower your monthly payment by $28—if you use that money to make an extra prepayment on your loan each month, you’ll pay off your loans even sooner.

Find out how much you can save with Purefy’s rate comparison tool, which lets you see your rates and savings with multiple lenders, so you get the best deal.

2. You can reduce your monthly payment

When you refinance, you can extend your repayment term or qualify for a lower interest rate. Either way, you could be eligible for a lower monthly payment, freeing up more money in your monthly budget.

For example, if you had $20,000 in student loans at 6% interest and a ten-year repayment term, your monthly payment would be $222 per month. If you refinanced and qualified for a loan with a 5% interest rate and a 15-year term, your payment would drop to just $158 a month. Refinancing would free up an additional $64 a month from your budget, allowing you to pursue other financial goals.

3. You can pay off your student debt faster

With more of your payment going toward the principal rather than interest, refinancing can help you pay off your debt ahead of schedule.

For example, pretend you had $30,000 in student loans at 6.6% interest, and a $342 monthly payment. It would take you 120 months to pay off your loans. But if you qualified for a lower interest rate of 5%, but kept making a monthly payment of $342, you would cut down your repayment term by almost a year. You’d save money and get out of debt much faster.

4. You’ll have one easy payment

Chances are that you took out more than just one student loan. You may even have a mix of federal and private student loans. If that’s the case, juggling multiple loans, monthly payments, and due dates can be confusing. Refinancing can help streamline things for you.

When you refinance, you consolidate your student loans together. Going forward, you’ll have just one loan to manage and one easy monthly payment.

5. You can use it to transfer your student loan

Some student loan refinance lenders allow you to transfer federal Parent PLUS student loan debt to a student. This process involves the consent of both parties, but if everyone agrees, it can be a good way for a parent to completely ditch that debt immediately and avoid letting federal student loan debt get in the way of their other important financial goals.

Once the Parent PLUS loans are out of the parent’s name, they’ll no longer be obligated to repay them. This can take a serious load off a parent’s monthly expenses as well as their credit history — freeing them up financially to pursue other life goals like a new mortgage or saving for retirement.

The flip side is that these loans will need to be put into the student’s name, which gives them the burden of the debt instead and full responsibility to make on-time payments.

If the student has the means to successfully handle the Parent PLUS payments, this strategy can be an excellent way for them to take charge of their education and start building up a credit history.

Disadvantages of refinancing student loans

Student loan refinancing can be extremely beneficial, but it’s not for everyone. There are risks involved, especially if you have federal student loans. Here are the primary cons of refinancing student loans.

1. You’ll lose access to income-driven repayment plans

Under an income-driven repayment (IDR) plan, the loan servicer extends your repayment term and caps your payments at a percentage of your discretionary income, dramatically reducing your payments. However, you no longer qualify for IDR plans once you refinance your loans.

If you’re in a low-paying field, or your income fluctuates from year-to-year, refinancing may not be a smart option for you. It may be a better idea to keep your federal loans as is so you can qualify for an IDR plan.

2. You won’t be able to enter your loans into deferment or forbearance

With federal loans, you can enter into deferment or forbearance if you experience a financial hardship, such as an illness or job loss. Under these programs, you can postpone making payments without entering into default, giving you time to get back on your feet.

Once you refinance, you lose out on this federal benefit. Some refinancing lenders do offer forbearance options, but their versions tend to be stricter and shorter in duration.

If you work in a volatile field, or have recurring health issues, it may be wise to postpone refinancing so you have the option of placing your loans into deferment or forbearance.

3. Not everyone qualifies for refinancing

Most refinancing lenders have strict criteria for approval, so not everyone will have the option to refinance their student loans. You’ll need to meet specific thresholds for credit score, income, and debt-to-income ratio. You may even need to verify if the school you attended is eligible, since some lenders have school requirements for their student loan refinancing programs.

Even if you do qualify, you may not be eligible for a lower rate or better repayment terms, so weigh your options and decide if refinancing federal student loans is worth it.

4. You won’t qualify for federal loan forgiveness

Some federal student loans are eligible for loan forgiveness programs, such as Public Service Loan Forgiveness. But once you refinance, you no longer qualify for loan forgiveness. And no private lender offers forgiveness options.

If you work for a non-profit organization or government agency and plan to do so for the next ten years, it may be financially wise to pursue loan forgiveness rather than student loan refinancing.

5. You’ll lose access to pandemic-related federal loan benefits

Since refinancing will pay off the existing loans and create a new loan with a private servicer, you would lose access to pandemic-related benefits from the CARES act, including 0% interest and forbearance through Aug. 31, 2022. Your loans would enter repayment after refinancing, so you may wish to wait until payments resume before refinancing federal student loans.

When should you refinance government student loans?

Unfortunately, not everyone can refinance their student loans due to a variety of factors including credit score, credit history, and annual income.

And just because you have the ability to refinance, that doesn’t mean you’ll get better rates and terms than you already have.

So when should you refinance your student loans? Beyond just getting approved, here are some other key indicators that show that you might be ready to refinance your student loans.

1. Your interest rates are high

Getting a lower interest rate and saving money on student loans is typically one of the top reasons people choose to refinance.

Private student loan refinance companies can often offer lower interest rates than what you’re currently paying on federal loans. In fact, current student loan refinance interest rates are at record lows.

Student loan refinance lenders use your credit score, income, and other financial information to determine which rates you qualify for. And if everything looks great, you could be eligible for a lower interest rate which can mean big savings.

A lower rate saves you money on total interest accrued over the life of your loan. Plus, paying lower interest on each of your bills means that it can also lower your monthly payment.

2. You can’t get loan forgiveness

If you’re a federal student loan borrower, refinancing your debt with a private lender means you’ll no longer qualify for student loan forgiveness, some federal student loan repayment assistance programs, and income-driven repayment plans.

The federal government offers two forgiveness programs, one for teachers and another for people who work for government agencies — from federal to local — or eligible not-for-profit organizations. If you think you qualify for one of those, it may not be a good time to refinance.

The same goes for if you’re eligible for a repayment assistance program, such as ones offered through the military, the Health Resources and Services Administration and other government agencies. Even some states offer these, but you typically can’t get help with private loans.

However, if you don’t anticipate needing any of these, you won’t miss out on much. But if you’re working toward forgiveness or you want an income-driven repayment plan just in case you need it, consider staying where you are.

3. Your finances are stable

The higher your credit score, the better your chances of qualifying for favorable terms. If you’ve had the chance to start building credit while you were in college or even before that, you may not need to wait long to get to where you need to be.

But if you’re just starting to build credit now, it can take some time to establish enough of a positive history to get approved.

If you have federal student loans, refinancing them will cause you to lose your access to income-driven repayment plans. This means that if you lose your job, you won’t be able to get a reduced monthly payment with a private lender.

And while many offer deferment and forbearance, they’re generally short-term solutions. If you have job security, it means you’ll have fewer concerns about not being able to make your payments.

4. You want to transfer your Parent PLUS Loan

It’s not uncommon for parents to take out loans on behalf of their children in school. But once they graduate, you may be able to transfer the debt to your child through some lenders. Just make sure they’re on board, and their credit and income are in a good enough place to get approved. You may even need to cosign, which doesn’t remove the debt from your credit report, but it’s a step in the right direction.

5. You wish to repay the loan faster

The standard repayment term for federal student loans is 10 years, and the U.S. Department of Education offers repayment terms as long as 30 years. But even being stuck with student loans for a decade is a long time. Here’s why you should consider making a plan to pay off that debt sooner rather than later.

- You’ll have the capacity to pursue other life goals: The average monthly student loan payment of $393 can significantly limit your opportunities to improve your financial health and overall well-being. If you can eliminate your student loans faster, you’ll be able to use that monthly cash flow to work toward goals that are more important to you.

- You can lower your debt-to-income ratio: Your debt-to-income ratio, DTI for short, is an important factor that lenders consider when approving you for credit. It’s especially important to mortgage lenders, so if you’re hoping to buy a house in the future, getting rid of your student loans can reduce your DTI and help you get approved for a bigger mortgage loan.

- You’ll experience less stress: Student loan borrowers can experience various psychological effects, including lack of sleep, headaches, muscle tension, and more. The sooner you can eliminate your student loan debt, the sooner you can experience peace of mind.

Among the options for how to pay off student loans early, refinancing your debt can be one of the most effective.

Private student loan refinance lenders typically offer repayment terms as short as 5 years, which means that you could reduce your repayment term significantly.

By dropping your repayment term, you can get rid of your debt much more quickly while paying significantly less in total interest. Plus, you can have the added bonus of a lower rate, saving you on interest costs payment to payment as well.

Just make sure to run the numbers to determine your new monthly payment and verify that it’ll be affordable. The last thing you need is to end up with a higher monthly obligation that you can’t meet.

Can you refinance private student loans to federal loans?

No, you cannot refinance private student loans into federal loans.

Student loan refinancing is only offered by private lenders such as banks, credit unions, and other financial institutions. Federal student loans, on the other hand, are held by the federal government and U.S. Department of Education. The U.S. Department of Education does not offer a federal student loan refinancing program.

When you refinance student loans, you are getting a new loan with a different rate and new terms from a private lender.

This means that if you had federal student loans, they would become private loans through the lender of your choice. If you already had private student loans, they would remain private loans after refinancing – but just with a new lender.

Weigh the pros and cons of refinancing federal student loans before applying

Student loan refinancing is an effective way to manage your debt — helping you save money, reduce your payment, and streamline your loans. However, there are some significant pros and cons to refinancing student loans that you should consider before applying for a loan.

Did you know? Comparing your prequalified refinance rate options only takes 2 minutes

If you’re interested in saving money, use our rate comparison engine to quickly see real-time offers from industry-leading lenders.

Takes 2 minutes • No impact on credit

Overall, refinancing is a smart choice for those with good credit, a stable income, and who don’t plan on using federal loan benefits.

By doing your homework on refinancing student loans pros and cons, you can ensure you make the right decision for your needs. The best place to start is by comparing your rates with Purefy to see what you can save.

Simply submit some basic information about yourself in Purefy’s Compare Rates tool, and see the refinance options you qualify for in seconds — all in one place with no impact to your credit. Just remember to factor in all the pros and cons of refinancing student loans before choosing to apply for your favorite loan.