Student loan refinance rates are shockingly low right now.

The lowest advertised interest rates from some lenders are below two percent in early 2022, an eye-popping figure that is making many student loan borrowers wonder if they should refinance before rates rise.

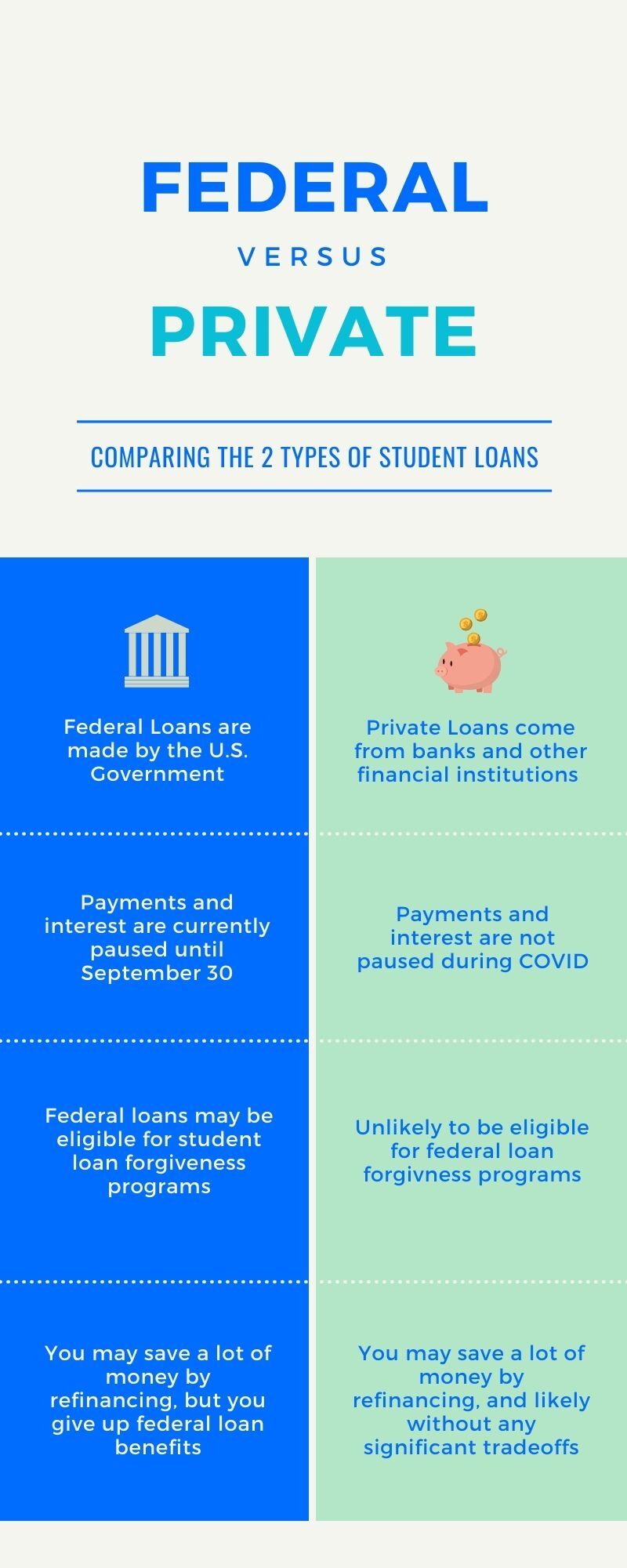

Federal student loan interest rates are currently on pause until August 31. But this pause doesn’t apply to “private” loans – student loans from companies like Sallie Mae, Wells Fargo, and Discover. It also doesn’t apply to people who’ve refinanced already with companies like SoFi, Commonbond, and Laurel Road.

If you have a private loan, now might be the perfect time to refinance. And if you’ve refinanced already, you might want to consider refinancing again. In this article, we’ll discuss why.

First, what is student loan refinancing?

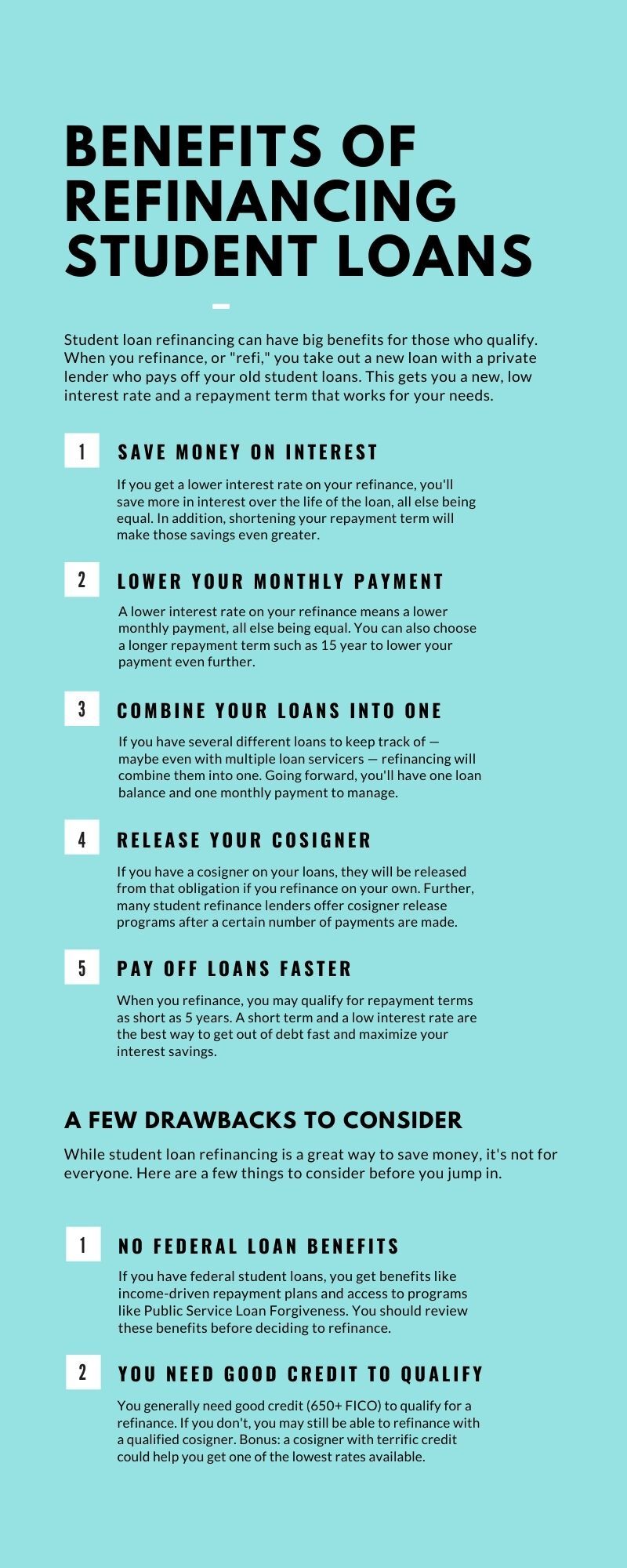

When you refinance student loans, you take a new student loan out with a private lender in the amount of your current student debt. This lender — usually a bank, online lender, or credit union — then pays off your old loans.

You don’t have to refinance all of your loans if you don’t want to — some people refinance only a portion of their loans (usually those with the highest interest rates).

Did you know? Comparing your prequalified refinance rate options only takes 2 minutes.

If you’re interested in saving money, use our rate comparison engine to quickly see real-time rate offers from industry-leading lenders.

Takes 2 minutes • No impact on credit

The result is that your old student loans are combined into one, and you get a new, low interest rate and get to choose a new repayment term (usually between 5 and 20 years).

Put simply, a lower interest rate will save you money — we’ll go over some examples of different strategies you can use in this article.

Why have student loan refinance rates dropped?

Student loan refinance rates are very low right now. The short answer to why is that market rates — which are set by the Federal Reserve, or “Fed”— dropped substantially in 2020, and have held at that level into 2021. In 2022, the Fed enacted the first of what are suspected to be several interest rate hikes during the year.

Have you ever thought about where the money comes from, when a financial institution offers you a loan? It might come from things like savings accounts and CDs, or even from another financial institution that is lending them the money.

This money comes with a cost to the financial institution, in the form of the interest that they pay to whoever they got the money from. This is called the “cost of funds” and is one of a few factors that determines your interest rate.

This ties in closely with the market rates set by the Federal Reserve.

To make a long story short, when the Fed lowers rates, banks and other financial institutions can get money more cheaply — which is good news for prospective borrowers, who get lower rates due to the lower cost of funds.

The bad news? Super low rates don’t last forever. While they could stay at this level for some period of time, many experts predict that interest rates will rise as the economy “heats up.”

Student loan refinance rates are currently at all-time lows - but that won't last for long.

Similar to mortgage refinance rates, student loan refinance rates are now at dramatic lows. Don’t wait to see if you qualify for a major drop in interest.

Takes 2 minutes • No impact on credit

So in short, if you could benefit from refinancing, now might be the time to see if you qualify.

Why are low student loan refinance rates a big deal?

Student loan rates can vary wildly depending on what type of loan you have and your personal situation when the loan was taken out.

The bottom line is that refinancing to a lower interest rate after you graduate could save you a serious chunk of money, or even ease up your monthly budget.

And the lower the rate, the greater the savings.

The 2 Best Companies to Refinance Student Loans

Our Top-Rated Picks for 2024 Offer Low Rates and No Fees

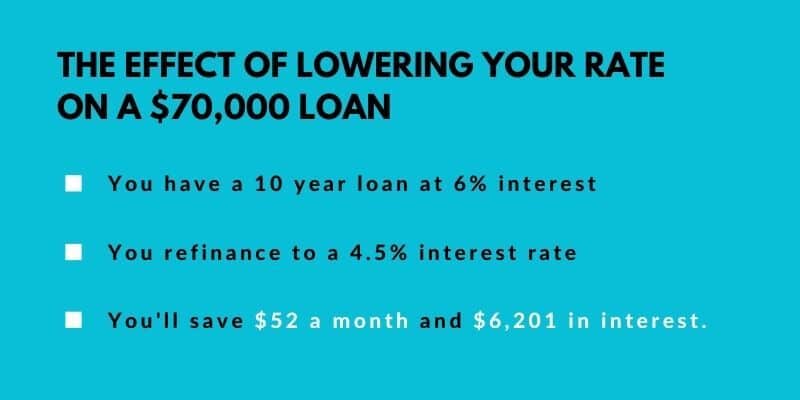

For example, say you had $70,000 in student loans with a weighted average interest rate of 6%. Here are a few examples of how student loan refinancing can be used to accomplish different goals.

Goal: Refinance to a lower rate for balanced savings

| Original Student Loan | Refinanced Student Loan | |

| Interest Rate | 6.0% | 4.5% |

| Repayment Term | 10 years | 10 years |

| Monthly Payment | $777 | $725 |

| Total Interest | $23,257 | $17,056 |

This example perfectly demonstrates the power of lowering your interest rate by refinancing student loans. Simply by refinancing and keeping the same repayment term, you’ll save $52 a month and save $6,201 in interest charges over the life of the loan.

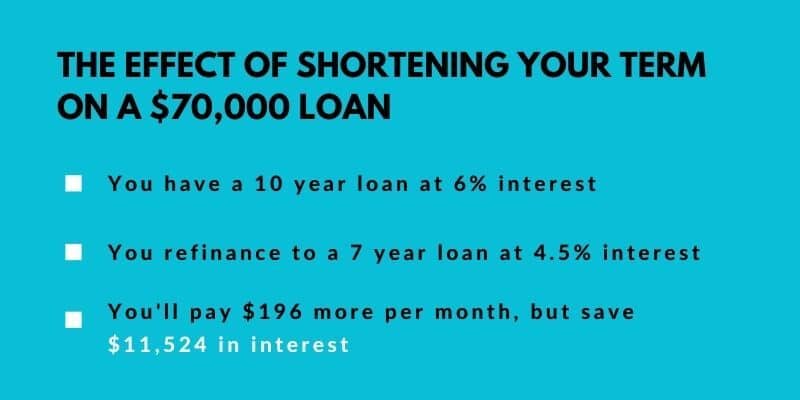

Goal: Refinance to a shorter term to pay off your student loans fast

| Original Student Loan | Refinanced Student Loan | |

| Interest Rate | 6.0% | 4.5% |

| Repayment Term | 10 years | 7 years |

| Monthly Payment | $777 | $973 |

| Total Interest | $23,257 | $11,733 |

No one likes being in debt, and in this example, we can see how refinancing to a shorter term will help pay off your loans three years ahead of schedule and save a whopping $11,524 in interest charges.

It does come at a cost: you will need to pay an extra $196 a month. But think about all you could do without those three extra years of student loan payments – you could accelerate your retirement savings, travel more, or even help offset the cost of having kids.

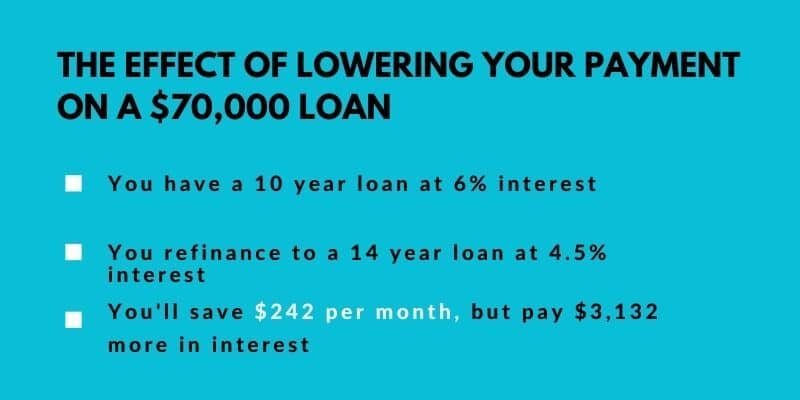

Goal: Refinance to a longer term to lower your monthly payment

| Original Student Loan | Refinanced Student Loan | |

| Interest Rate | 6.0% | 4.5% |

| Repayment Term | 10 years | 15 years |

| Monthly Payment | $777 | $536 |

| Total Interest | $23,257 | $26,389 |

Expenses coming at you hard? Refinancing to a longer term can help ease up your monthly budget. If you refinanced to a 15-year term in this example, you would save $242 a month that you could put toward other priorities.

It does come at a cost though; you’ll pay $3,132 more over time in total.

That said, if your income increases over time and you can afford a larger monthly payment, you are free to make additional prepayments and pay off the student loan ahead of schedule as your budget allows.

So refinance rates are low. How do I find the best deal and lock in my rate?

Lenders determine your student loan refinance rate by weighing several different factors, which might include your credit history, your income, your debt load, and even the type of degree of degree you have.

In general, you will need excellent credit and meet other criteria to qualify for the eye-popping rates that lenders publicly advertise.

That said, if you don’t have perfect credit, that doesn’t mean you still can’t get a great, low rate.

The only way to be sure that you are getting the best deal on your student loan refinance is to compare rates from multiple lenders.

Purefy made this process easy with our rate comparison tool.

Instead of filling out cumbersome loan applications from several different lenders, you can fill out one simple form to compare rates from the best refinance lenders in the industry — with no credit check required.

And if you have any questions during the process, you can reach out to our award-winning team of Student Loan Advisors, or even schedule a free student loan refinance consultation.