Looking for honest, transparent Earnest reviews? In this Earnest student loan refinance review, we will look at features, benefits, trade-offs, drawbacks, and eligibility qualifications to help you decide if Earnest is the right lender for you.

Whether you are interested in a student loan refinance or getting a private student loan to attend college, Earnest student loans is a high-tech lender with a streamlined application process, its own proprietary loan servicing platform (including a mobile app), not to mention competitive rates and unique perks that can help student loan borrowers save money.

Earnest has offered student loan refinancing since 2015, and as of 2019 it now offers private student loans as well. Their student loan refinance program boasts flexible repayment terms — you can choose your own monthly payment and loan term length, which is a feature unique to Earnest. They also have no origination, application, or late fees for their loans.

You can assess this Earnest student loan refinance review, check your interest rates from Earnest, and compare them with other lenders in just a few minutes using Purefy’s rate comparison tool — with no credit check required.

The 2 Best Companies to Refinance Student Loans

Our Top-Rated Picks for 2024 Offer Low Rates and No Fees

Earnest is one of the most well-known online lenders for both new student loans and refinancing, with good reason. Keep reading this Earnest student loan refinance review to find out why.

Jump to the Earnest Student Loan Refinance Review

Jump to the Earnest Student Loans Review

About Earnest Student Loan Refinancing

Refinancing your student loans can potentially save you money with a lower interest rate, monthly payment, or both. With Earnest student loans, you can also achieve more flexibility with your student loan repayment plan.

Here’s what you need to know about Earnest student loan refinance reviews and Earnest student loan refinance options to determine whether it’s the right lender for you.

Earnest Student Loan Refinance Review

Earnest offers both fixed- and variable-rate student loan refinance loans. Loan amounts range from $5,000 to $500,000, making it possible for a wide range of student loan borrowers to apply. Repayment terms range from five to 20 years, and once your application is approved, you’ll get a broad range of monthly payment options.

This setup gives you total control over what you pay each month. The payment amount you choose will determine your interest rate and the length of your repayment term. Earnest reviews include an A+ rating with the Better Business Bureau.

Earnest is also one of the few lenders available that allows people with incomplete bachelor’s or associate’s degrees refinance student loans. As long as someone with no degree or an associate’s degree meets other refinance eligibility requirements, they can enjoy the same great refinance benefits and savings on their student debt.

Earnest Refinance Interest Rates and Fees

Interest rates can vary based on your credit and financial profiles, but you can see what rates you will receive using Purefy’s rate comparison tool. There is a 0.25% interest rate discount if you set up automatic payments on your account.

Note, however, that variable-rate loans aren’t available in Alaska, Illinois, Minnesota, New Hampshire, Ohio, Tennessee, and Texas.

Also, keep in mind that while variable rates start lower, they can increase over time, potentially costing you more money, especially if you have a long repayment term.

Earnest student loan charges no origination or application fees, no prepayment penalty, and no late fees. There is, however, an $8 fee if your payment is returned due to insufficient funds.

Deferment and Forbearance

If you head back to school or are active duty in the military, you can defer payment on your student loans while you’re enrolled or serving.

You may also qualify for forbearance if you’re experiencing financial hardship due to an involuntary decrease in income, involuntary loss of employment, or a significant decrease in your non-discretionary spending.

Just keep in mind that interest will continue to accrue during your deferment or forbearance period.

Refinancing Customer Service

Earnest Student Loan Refinance offers top-notch customer service with reliable, trustworthy support.

Earnest student loan refinance reviews across well-known online publications puts their stellar customer-first reputation on full display.

Earnest boasts a 5-star rating for student loan refinance on NerdWallet – a personal finance and student loan site which offers expert guidance on everything money. And that’s not to mention the fact that Earnest took home a 2021 NerdWallet Best-Of Award for Best Student Loan Refinancing Overall.

Earnest also holds a 5-star rating on Trustpilot with over 3,000 real customer reviews. On top of that, on their website, Earnest declares they have refinanced over $11.6 billion in student loans and helped over 130,000 clients refinance their loans.

Needless to say, Earnest student loan refinance reviews prove that Earnest is an industry-leading student loan refinance company that offers high quality customer service throughout the process.

How to Qualify and Refinance Student Loans With Earnest

In addition to providing more flexibility, Earnest also differentiates itself with its approach to creditworthiness. While the lender does check your credit report and score, it also considers other factors when determining whether to approve your application and what rate to offer.

Some of those factors include:

- Savings patterns

- Employment history

- Growth potential

- 401(k) and investments

As you can see, Earnest takes a broader view of how you manage your money. So if your credit score may not be the best, but you’re generally responsible with your money and show promise in your career, you may still qualify for a low interest rate.

That said, there are some credit-related eligibility requirements you’ll need to meet to get approved. For example, you need to have a credit score of at least 680, and you can’t have a bankruptcy or recent collection accounts on your credit report.

Other requirements include:

- You must be employed, have a written job offer for a position that starts within six months, or consistent income from another source.

- Your student loans must be in good standing.

- You must be current on mortgage or rent payments.

- You must be a U.S. Citizen or permanent resident.

- Your student loans must either be in repayment status, or your degree must be completed at the end of the current semester.

You also need to live in one of the 48 states where Earnest loans are available. The lender doesn’t operate in Kentucky or Nevada. *Please note, Earnest is not able to offer variable rate loans in AK, IL, MN, NH, OH, TN, and TX.

Cosigners aren’t allowed on an Earnest student loan refinance, so you’ll need to be able to qualify on your own. If you can’t, you may need to choose a lender that does allow co-signers.

If you have student loan debt but an incomplete bachelor’s or an associate’s degree, then Earnest is an excellent refinancing option. Earnest allows those with no degree or an associate’s to refinance their student debt, as long as they meet all other refinancing criteria such as the requirements listed above.

How to Apply for Earnest Student Loan Refinancing

If you’re interested in Earnest student loans after reading this Earnest student loan refinance review, first compare their rates with other lenders using our rate comparison tool. If you select Earnest, the application process is relatively simple. You’ll start by creating an account with the lender. Then you’ll provide some information about your school, loan balance, income, assets, and housing situation.

Finally, you’ll share your address and Social Security number. Once you submit, Earnest will run a soft credit check, which won’t affect your credit score and provide some possible rate options with you. If you agree to move forward with the application, the lender will run a hard credit check and give you some more specific offers based on your eligibility. You’ll then have the opportunity to customize your loan based on your desired monthly payment.

As you do so, keep in mind that the lower the monthly payment you choose, the longer your repayment period and the more interest you’ll pay over the life of the loan. While it’s important to pick an affordable payment amount, try to avoid drawing out the life of the loan unnecessarily.

Is Earnest Student Loan Refinancing Right for You?

Earnest stands out as a student loan refinance lender that offers more control to its borrowers. Instead of getting just a few offers to choose from, you can choose your terms based on what’s affordable to you.

Because Earnest looks at more than just your credit score, it is possible to get a better interest rate based on your career trajectory and financial management. However, you’ll have a tough time getting approved if your credit score doesn’t meet the lender’s minimum requirement.

If you’re in that boat and need a co-signer — or you can get approved on your own but want a co-signer to improve your chances of getting a lower rate — it may be better to apply with another lender.

Earnest also may be the right fit for your student loan refinance if you have an incomplete bachelor’s degree or an associate’s degree. Earnest is one of only a handful of lenders who will refinance a borrower’s debt with no degree or an associate’s. As long as you meet all other refinance criteria, you can refinance through Earnest and save money on your student debt.

Before you apply for an Earnest student loan refinance, it’s important to shop around and compare terms to make sure you get the best rates available. If you’re interested in checking your rates with Earnest and other lenders at the same time, you can do so using Purefy’s rate comparison tool.

About Earnest Private Student Loans

If you’ve maxed out your access to federal student loans, private student loans can potentially help you bridge the gap between the financing you have and the cost of your education. Whether you’re a college student or a parent hoping to help your child pay for school, this Earnest student loans review can help.

Here’s what you need to know about Earnest college loans and how to determine what’s best for you.

Earnest Student Loans Review

Looking for a comprehensive Earnest student loans review? This is everything you’ll need to know before choosing Earnest as your lender of choice.

Earnest is an online lender that offers private student loans, student loan refinancing and personal loans. Earnest student loan options include:

- Undergraduate loans

- Graduate loans

- Medical school loans

- Law school loans

- MBA loans

Deferment and Repayment Solutions

You can borrow as little as $1,000 and up to the total cost of attendance for your school — although, some states may have a different minimum loan amount. Repayment options can vary depending on whether you’re applying on your own or with a co-signer:

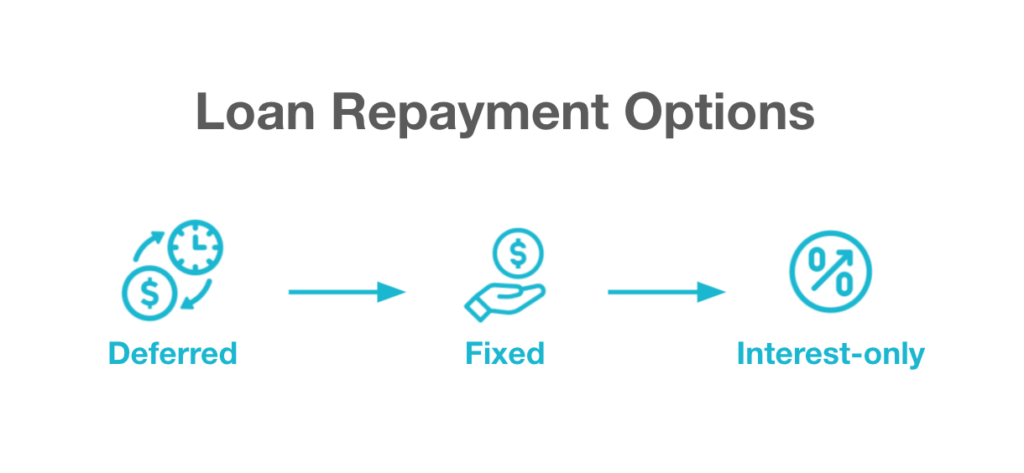

- Deferred: You won’t start making payments until nine months after you graduate or fall below half-time enrollment, at which point you’ll make full payments for the duration of the repayment term. This option is available for all borrowers.

- Fixed: You’ll pay just $25 per month while you’re in school and during the nine-month grace period after you graduate or fall below half-time enrollment. Once that period is over, you’ll start making full monthly payments. This option is also available to all borrowers and can reduce how much interest is capitalized when your repayment term begins.

- Interest-only: If you have a co-signer, you can opt to pay interest only while you’re in school and during the grace period, after which you’ll make full monthly payments. This option can eliminate any interest capitalization.

- Full payment: Borrowers with co-signers can opt to make full payments while in school and following graduation with no deferment or grace period.

After you’re approved for a loan, you’ll get the chance to choose your preferred repayment term, which is not an option for federal and some other private student loans. You may also have the option to skip a payment once a year, though note that doing so will result in a slightly higher monthly payment to ensure that you still finish paying the debt on time.

Earnest Interest Rates and Fees

Earnest student loan rates come with both variable and fixed interest rate options. Your rate will depend on your creditworthiness, income, whether you’re applying with a co-signer and other factors. You can check your rate and compare it with other lenders using Purefy’s rate comparison tool.

Variable rates aren’t available in certain states, so check before you apply. Also, keep in mind that while variable interest rates start out lower, they can increase over time and cost you more in the long run.

Whatever APR you qualify for, you can get a 0.25% rate discount when you sign up for automatic payments from your checking account. As for fees, Earnest stands out by not charging any at all — that means no origination or disbursement fee, no prepayment penalty and no late fees.

Student Loan Customer Service

Earnest Student Loans is widely known for excellent customer service and reviews – just ask NerdWallet and Trustpilot.

Earnest student loans reviews recognize that Earnest offers low fixed and variable rates, a fast and simple online application, and a user-friendly customer experience. In addition, Earnest’s private student loan features include:

- An option to skip one payment every 12 months

- No late fees

- A nine-month grace period which is longer than most other lenders offer

Earnest Student Loans Eligibility Criteria

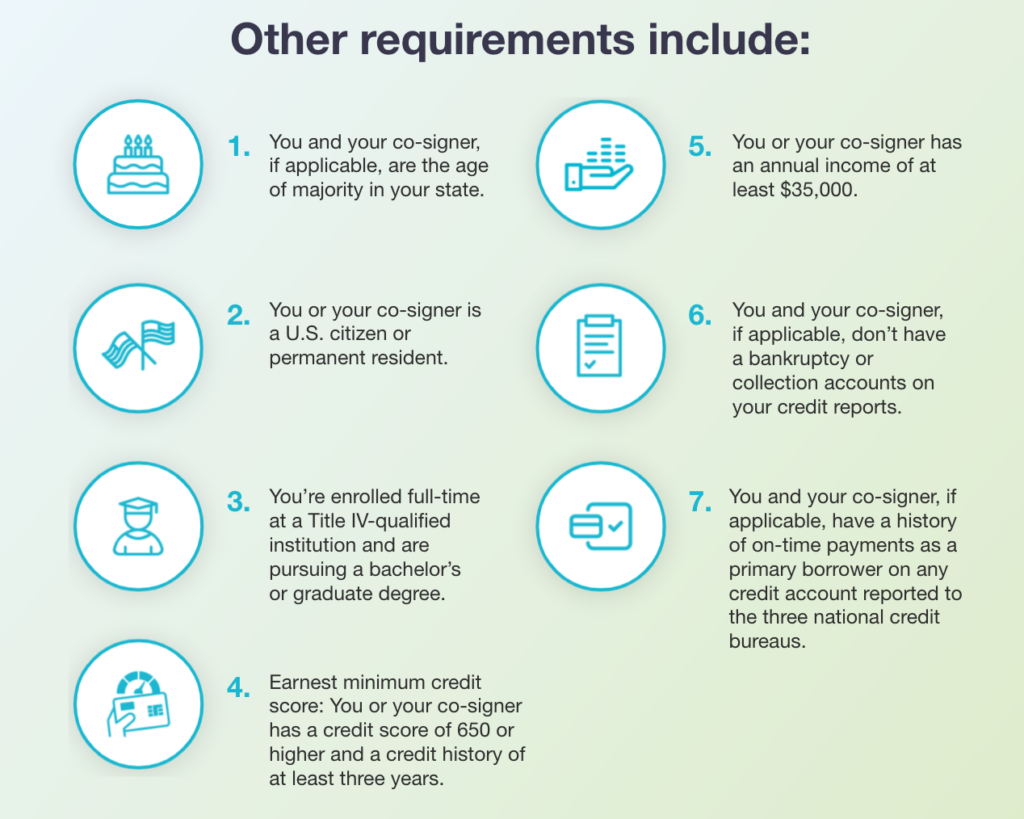

To qualify for Earnest student loans, you’ll need to undergo a credit check, and meet other standard eligibility requirements.

For starters, you need to live in one of the 39 states where Earnest operates or the District of Columbia. Residents of Alaska, Connecticut, Delaware, Hawaii, Illinois, Kentucky, New Hampshire, Nevada, Ohio, Texas and Virginia are not eligible.

Other factors Earnest will consider include your saving habits, other debts and late, overdraft and insufficient funds fees charged by your creditors and bank.

How to Apply for Earnest Student Loans

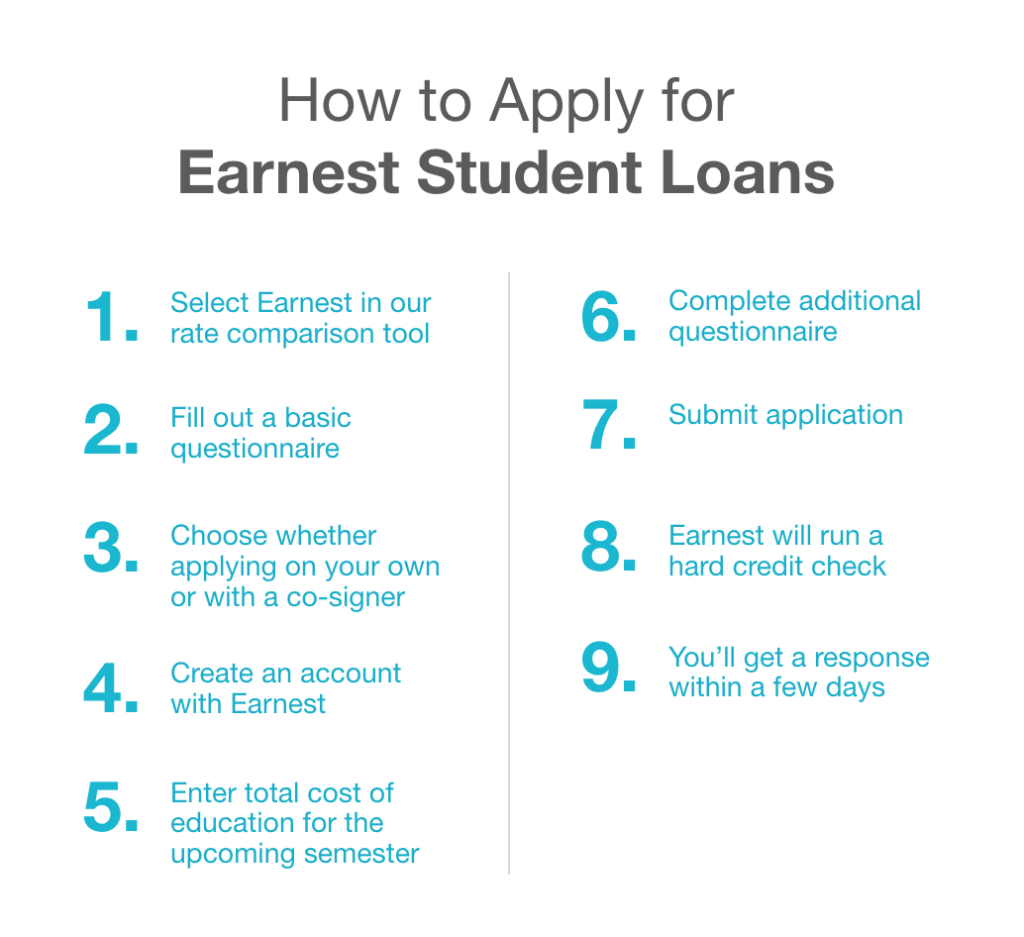

If you’re planning to apply for an Earnest student loan, the process is relatively quick and painless. If you select Earnest in our rate comparison tool after comparing them with other lenders, you’ll be taken to their site to apply. You’ll start by sharing some basic information about yourself, as well as your school, graduation plans and credit situation.

Next, you’ll get to choose whether you want to apply for a loan on your own or with a co-signer. Earnest will show you the different APR ranges based on which option you go with. Once you choose, you’ll be asked to create an account with Earnest.

After that’s done, you’ll provide the total cost of your education for the upcoming semester (Earnest will provide its own estimate for you based on your school) and how much funding you already have, giving you the total amount you need to borrow.

Finally, you’ll provide your phone number, major, current and estimated future income, total assets and Social Security number. Then you’ll submit the application and Earnest will run a hard credit check and you’ll get a response within a few days.

Are Earnest Private Student Loans Right for You?

While Earnest has only been offering in-school student loans since April 2019, the offering is impressive.

Not only do you get a grace period that’s three months longer than the norm, but you’ll also get the chance to skip a payment once a year and get multiple repayment options that can help you save on interest while you’re in school.

The lender also has competitive interest rates and flexible repayment terms that you can choose based on your preferences.

No lender is perfect, though. If you don’t qualify for Earnest student loans based on the lender’s eligibility requirements, avoid the unnecessary hard credit pull by searching for another lender that has different criteria.

Also, be sure to compare rates and other terms from various lenders before pulling the trigger on an application. Rather than going through the prequalification process with multiple lenders, use Purefy’s rate comparison tool to compare several lenders at once.

Finally, if you still qualify for federal student loans, look there first. Most private lenders don’t offer the same benefits as the U.S. Department of Education, including income-driven repayment terms and access to loan forgiveness programs. You may also be able to get a lower interest rate, especially if you’re an undergraduate student.

As with any loan decision, do your homework to make sure the one you choose is the best fit for you.

Auto Pay Discount Disclosure:

You can take advantage of the Auto Pay interest rate reduction by setting up and maintaining active and automatic ACH withdrawal of your loan payment. The interest rate reduction for Auto Pay will be available only while your loan is enrolled in Auto Pay. Interest rate incentives for utilizing Auto Pay may not be combined with certain private student loan repayment programs that also offer an interest rate reduction. For multi-party loans, only one party may enroll in Auto Pay.

Earnest loans are originated by Earnest Operations LLC, 303 2nd St., Suite 401N, San Francisco, CA 94107, NMLS #1204917, CA Finance Lender License #6054788. List of licensed states at https://www.earnest.com/licenses. Earnest student loans are serviced by Earnest Operations LLC (NMLS #1204917) with support from Navient Solutions, LLC (NMLS #212430). Earnest LLC and its subsidiaries are not sponsored by or agencies of the United States of America.