Looking for a comprehensive Citizens Bank student loan refinance review, or a review on Citizens Bank student loans? Whether you’re a student or have left school already, read on to learn if Citizens Bank could potentially help with a private student loan or student loan refinancing.

If you’ve looked at Citizens already and have a rate quote, you can even compare their rates with the best lenders out there using Purefy’s quick and easy rate comparison tool (with no credit check required).

Jump to the Citizens Bank Student Loan Refinancing Review

Jump to the Citizens Bank Private Student Loans Review

About Citizens Bank Student Loan Refinancing

If you went to college, you likely walked away with student loans. In fact, according to The Institute of College Access and Success, the average graduate left school in 2017 with $28,650 in student loan debt.

Along with that hefty balance, high interest rates on student loans can cause your balance to balloon over time. You could end up owing far more than you originally borrowed.

If you’re struggling with student loans, refinancing can help you save money and pay off your debt ahead of schedule. Comparing rates from the best lenders is the number one way to get the best deal. Citizens offers student loan refinancing and can be a smart choice if you want to take charge of your loans. Learn more in our Citizens Bank student loan refinancing review.

The 2 Best Companies to Refinance Student Loans

Our Top-Rated Picks for 2024 Offer Low Rates and No Fees

Citizens Bank Student Loan Refinancing Review

When you refinance, you work with a private lender to take out a loan for the amount of your current debt. You can combine federal and private student loans together, so that you have just one loan and one easy monthly payment. With refinancing, you can qualify for a lower interest rate, helping you save thousands over the length of your loan. According to Citizens Bank and Citizens Bank student loan refi reviews, those who refinance through the company save an average of $2,544 per year.

Types of Refinancing Available

With Citizens Bank, you can refinance federal and private student loans, including loans for graduate or professional degrees. Citizens Bank also offers student loan refinancing for parent loans, such as Parent PLUS Loans.

Citizens Bank Student Loan Refinance Rates and Fees

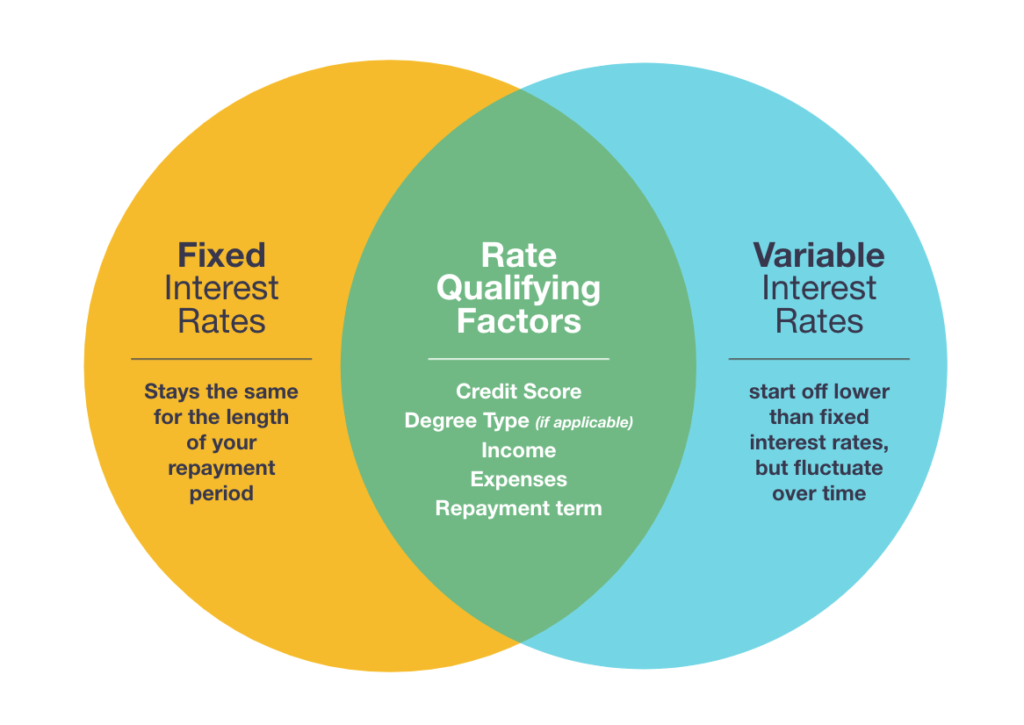

Student loan refinance rates by Citizens Bank include both fixed and variable interest rates. Fixed interest rates stay the same for the length of your repayment period. Variable interest rates typically start off lower than fixed interest rates, but fluctuate over time. The rate you qualify for is based on your credit score, type of degree (if applicable), income, expenses, and the repayment term you choose.

In addition, you can qualify for an interest rate deduction by signing up for automatic payments. If you sign up for autopay, Citizens Bank will knock 0.25% off your interest rate. And, if you have (or sign up for) a Citizens Bank checking or savings account, you can qualify for an additional 0.25% discount.

There are no application fees, origination fees, or prepayment penalties.

Student Loan Refinancing Customer Service

Curious about a Citizens Bank student loan refinance review of their customer service?

Citizens Bank is a longstanding financial institution – dating back to 1828 – with a top-notch reputation in the student loan refinance industry. They’re consistently rated highly for their student loan refinance product thanks to their competitive fixed and variable rate interest rate offers, variety of flexible repayment terms from 5 to 20 years, a helpful cosigner release program, and a 0.25% interest rate reduction for autopay enrollment.

Across many trustworthy student loan reviews sites, Citizens Banks holds a strong 4.5-star rating out of 5 – including NerdWallet and Savingforcollege.com – which factors in their level of customer service and support.

Citizens Bank offers a U.S. based call center with convenient hours of operation – including evenings and weekends – to allow their customers to get questions answered quickly and on their schedule. This dedication to customer service really helps to impact the positive student loan refinancing review of Citizens Bank.

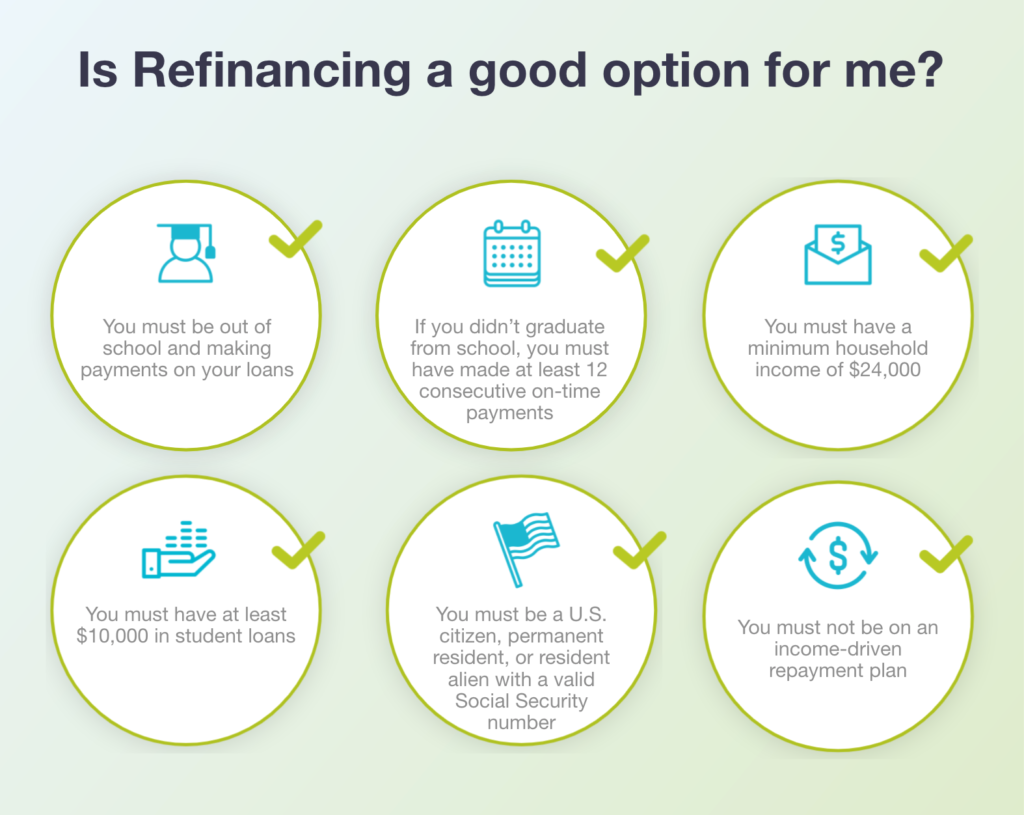

Refinancing Eligibility Criteria

To qualify for a refinancing loan from Citizens Bank, you must meet the following criteria:

While a co-signer is not required, having a co-signer can increase your chances of getting approved for a loan and qualifying for a lower interest rate.

Student Loan Refinancing for International Students

Citizens Bank student loan refinancing is one of the best options for borrowers who are international students or aren’t U.S. citizens.

In order for international students or non-U.S. students to qualify for a student loan refinance, Citizens Bank required that they apply with a creditworthy U.S. citizen of permanent resident.

Although they do require a cosigner for international students, Citizens Bank is one of the few lenders who offers student loan refinancing to those who aren’t U.S. citizens.

What Sets Citizens Bank Refinancing Apart

There are lots of lenders out there, so what makes Citizens Bank student loan refinancing different? There are three main points.

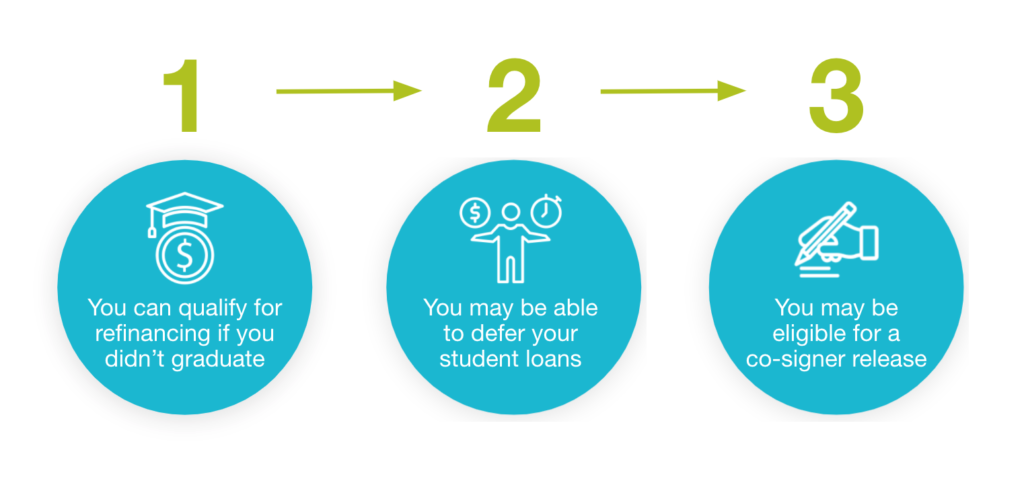

1. You can qualify for refinancing if you didn’t graduate

With most student loan refinancing lenders, you must graduate with a four-year degree to qualify. If you only have an associate’s degree — or if you dropped out of college before completing your degree — you’re not eligible for refinancing. Citizens Bank doesn’t have that requirement. You can qualify for a loan with a two-year degree, or even if you didn’t graduate at all. If you left school without a degree but with significant student loan debt, Citizens Bank can provide much-needed relief.

2. You may be able to defer your student loans

Not all lenders allow you to defer your student loans, but Citizens Bank does. If you decide to go back to school at least half-time, you can enter deferment — where you can postpone making payments — until six months after graduation.

3. You may be eligible for a co-signer release

For one, they offer a co-signer release, which is a big deal. If you have a co-signer, they’re responsible for making payments on the loan if you fall behind, which can hurt their finances and their credit. While a co-signer can help you refinance, after you’ve built up your career and start earning more money, you may want to remove the co-signer from responsibility for the loan.

With Citizens Bank, you can apply for a co-signer release after making 36 consecutive, on-time payments. To qualify, you must meet Citizen Bank’s lending requirements to hold the loan in your own name.

How to Apply for Citizens Bank Student Loan Refinancing

You can use Purefy’s rate comparison tool to get a quote for a refinancing loan from multiple top lenders, in just seconds.

Did you know? Comparing your prequalified refinance rates only takes 2 minutes.

If you’re interested in saving money, use our rate comparison engine to quickly see real-time rate offers from top lenders.

Takes 2 minutes • No impact on credit

After this review of Citizens Bank student loan refinance, do you feel like it’s the best option for your situation?

If you want to compare these rates with Citizens, who is not a Purefy lender, you’ll need to apply with Citizens Bank to see how they stack up. If you do decide to apply with Citizens, you’ll be asked to enter your personal information, such as your name, address, Social Security number, the amount you want to refinance, and your monthly rent or mortgage payment. The application should take you less than 15 minutes to fill out.

You can choose which repayment term works best for you; you can choose terms of 5, 10, 15, or 20 years. In general, the shorter the repayment term, the lower the interest rate.

Once you find a quote and repayment term that you’re satisfied with, you can then complete the full application. You’ll need to provide your employment information and the names of your current lenders.

Typically, you’ll get a response within a few minutes. However, in some cases, Citizens Bank may need additional information. If that’s the case, it will reach out to you for extra documentation, such as pay stubs.

If approved, you’ll receive a loan agreement detailing the terms of the loan. If you want to accept the loan, you just need to sign it. Your refinancing loan will go through in a matter of days.

Refinancing Your Student Loans

If you want to tackle your student loans head on, refinancing can be a smart strategy. By refinancing your debt, you can qualify for a lower interest rate, so more of your monthly payment goes toward the principal rather than interest. Over time, you can save thousands of dollars thanks to the lower rate.

While Citizens Bank offers many benefits, they’re not the only lender out there. It’s important to take Citizens Bank student loan refi reviews into consideration prior to deciding on your favorite lender. Before submitting your application, make sure you compare offers from multiple student loan refinancing lenders to make sure you get the lowest rates.

About Citizens Bank Private Student Loans

It should come as no surprise that college is expensive. According to The College Board, a single year at a private university costs $32,410, on average. Since few people have that kind of money in the bank, chances are that you’ll need to turn to student loans to finance your education.

Private student loans can play an important role in your education. If you need additional funding for school, Citizens can help you complete your degree. Learn how Citizens can help, and how to compare their interest rates with other lenders, in our in-depth Citizens Bank student loans review.

Citizens Bank Student Loans Review

Looking for a complete, unbiased, and transparent Citizens Bank private student loan review? Purefy is here to help.

When you’re accepted into college, you’ll be offered a financial aid package. Your aid typically includes scholarships, grants, and federal student loans. However, there are times when your financial aid package isn’t enough to cover the total cost of attendance. That’s when turning to a private loan lender like Citizens Bank makes sense.

As one of the nation’s oldest and largest financial institutions, Citizens Bank offers a wide range of financial products like student loans. Plus, Citizens Bank student loan rates are often very competitive compared to other companies.

Types of Loans Available

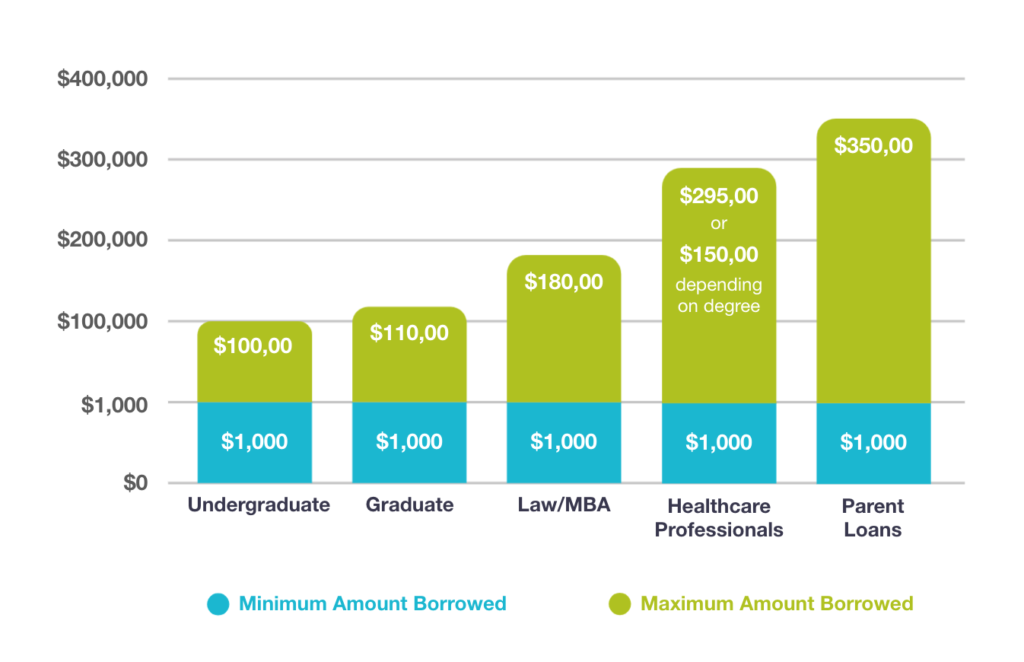

Whether you’re an undergraduate student or you’re a parent paying for your child’s education, Citizens Bank offers student loan options for you. The minimum amount you can borrow is $1,000, and the maximum amount is determined by your degree program:

Regardless of the type of loan you choose, Citizens Bank will disburse the money directly to your selected school. Most student loans allow you to choose a repayment term of 5, 10, or 15 years, while parent loans have repayment terms of either 5 or 10 years.

Citizens Bank Student Loan Interest Rates and Fees

Citizens Bank student loans offers both fixed and variable interest rate loans. Fixed rates stay the same for the length of your repayment, so your minimum monthly payment never changes. With variable interest rate loans, the interest rate tends to start out lower than fixed interest rate loans, but the rate will fluctuate over time.

The rate you receive is dependent on a number of factors, such as your creditworthiness and the repayment term you choose. In general, the longer the repayment term, the higher the interest rate.

You can get a lower interest rate through incentive programs. You can qualify for an additional 0.25 percentage point discount by signing up for automatic payments. And, Citizens Bank offers another 0.25 percentage point discount if you already have a checking, savings, money market account, auto loan, or home loan with the company. Please note that you’ll have to have this account set up before you apply for a student loan, to get the discount. With these two initiatives, you can lower your interest rate by 0.50 percentage points, allowing you to save money.

Citizens Bank student loans have no origination, application, or disbursement fees.

Customer Service for Student Loans

Similar to Citizens Bank student loan refinancing product, their customer service for private student loans is also highly rated and trusted.

Because Citizens Bank has such a rich banking history with roots dating back to the early 1800s, they’ve withstood the test of time thanks to their reputation for excellent financial services.

Citizens Bank provides a convenient, U.S.-based call center with evening and weekend hours in addition to standard weekday hours. Their expert customer support team is always ready to help when their borrowers need it – 7 days a week and after the workday ends.

Student Loans Eligibility Criteria

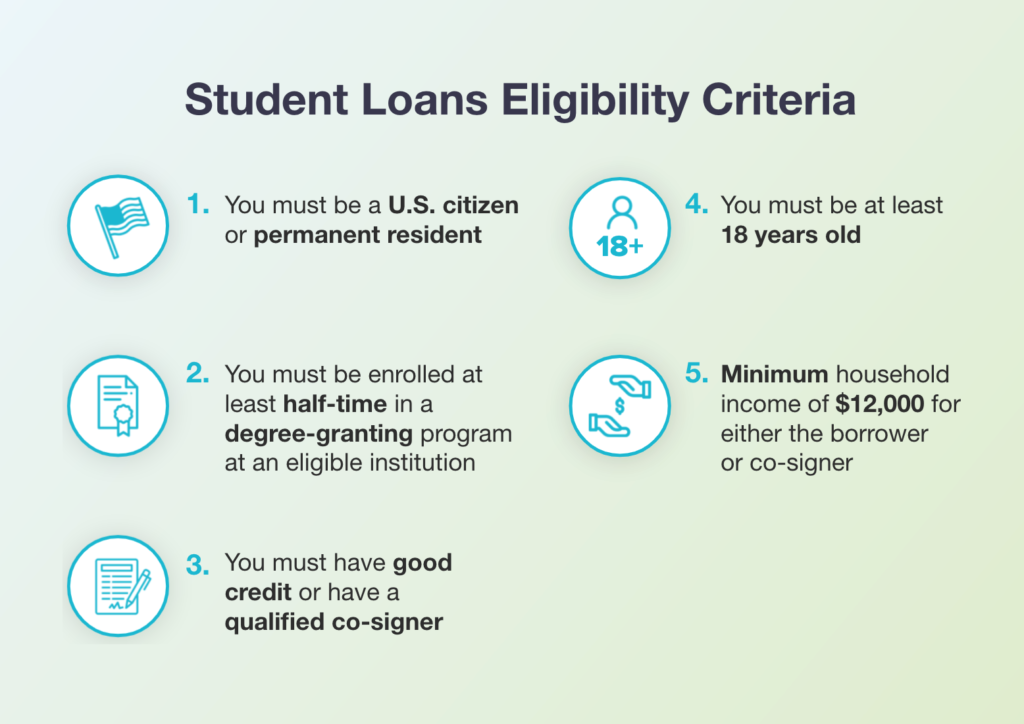

When it comes to private student loans, each lender has their own eligibility criteria. To qualify for a Citizens Bank student loan, you must meet the following requirements:

While a co-signer isn’t required, having one can increase your chances of getting approved for a loan. And, a co-signer can help you qualify for a lower interest rate.

International students can qualify for a loan if they have a co-signer who is a U.S. citizen or permanent resident.

Student Loans for International Students

Citizens Bank student loans reviews often mention that they are the best option for international students and non-U.S. residents.

They’re consistently rated a top option because they offer private student loans to international students as long as they apply with a qualifying cosigner. This cosigner needs to have good credit, income, and be either a U.S. citizen or permanent resident. This is a unique feature of Citizens Bank which many other lenders do not offer.

What Sets Citizens Bank Student Loans Apart

Wondering how a Citizens Bank review for student loans stacks up against the competition? There are dozens of private student loan lenders out there, so it can be difficult to choose one. If you’re trying to decide between lenders, it’s important to keep three points about Citizens Bank in mind.

1. It offers multi-year approval

Citizens Bank is the only lender to offer multi-year approval. With multi-year approval, you submit a loan application just once and you can secure funding for additional years in school until you graduate. Multi-year approval gives you easy access to funding with less of an impact on your credit score.

2. Citizens Bank allows co-signer releases

While a co-signer can help you get a loan and qualify for a lower interest rate, it’s a tremendous responsibility. After you graduate and start working, you might want to release your co-signer from their obligation on the loan. Not all private loan lenders allow co-signer releases; Citizens Bank is one that does. Borrowers can apply for a co-signer release after making 36 consecutive on-time payments.

3. It has loan deferment

Citizens Bank offers in-school deferment, allowing you to postpone making payments until six months after you graduate. That option gives you time to find a job and get on your feet before you have to deal with the responsibility of paying back your loans.

If you enroll in graduate or professional degree programs, you can defer your payments for up to eight years.

How to Apply for a Citizens Bank Student Loan

Using Purefy’s rate comparison tool, you can compare rates from the top student lenders in seconds. We recommend this as a first step any time you are shopping for a student loan, so that you can see what kind of deal you can get from the best lenders out there.

Feel strongly that Citizens is the right choice after reading this Citizens Bank private student loans review? Citizens is not a Purefy lender, so if you do decide to apply with Citizens to see how they compare, you will need to visit their website and fill out their online application, which takes about 15 minutes. Then, you can see how their rates stack up. You’ll need the following information to complete the application:

- Pay stub or other proof of income

- Monthly housing cost (rent or mortgage payment)

- Expected school graduation date

- Loan amount

- Academic period for loan

If approved for a loan, you’ll have to accept the loan and sign a promissory note. Going forward, you can view your loan information online and start managing your loan.

Paying for College

Private student loans can play an important role in your education. As you’ve learned in this Citizen Bank student loan review, choosing the right lender can help you save money and enjoy more flexible repayment terms after graduation. By shopping around and comparing offers from multiple lenders with Purefy’s free online tools, you can ensure you get the right loan for you.