Going to graduate school used to be a guaranteed path to a lucrative career and financial stability. However, the cost of a master’s or doctoral degree has skyrocketed in recent years, making it much more expensive.

While many master’s programs can be completed in just two years, the cost of getting your degree from a top university can be staggering. For example, the total cost of a master’s of business administration degree from The Wharton School at the University of Pennsylvania is a gulp-inducing $222,540.

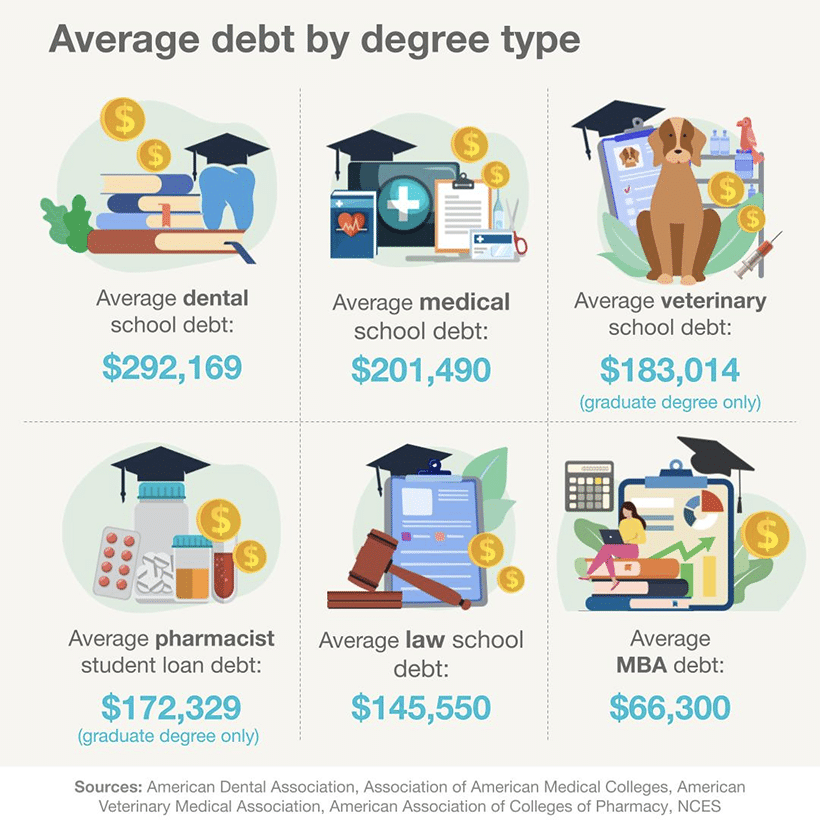

With such a high cost, it’s no surprise that the average graduate student takes on substantially more debt than undergraduate students.

According to The College Board, graduate students borrowed an average of $18,470 in federal loans per year as of 2019. By comparison, undergraduate students borrowed just $4,410 in federal loans per year — and students pursing advanced degrees are borrowing more on top of what they already needed for undergrad. Worse, graduate school loans tend to have the highest interest rates of any student loan. For example, federal Grad PLUS Loans issued before July 1, 2020, had an interest rate of 7.08%.

If you are dealing with more than $100K in student loan debt after getting an advanced degree, here’s how to pay off your grad school loans quickly so you can focus on your other goals.

Should I pay off grad school debt early?

If you have a large amount of student debt from grad school loans, it’s easy to feel overwhelmed. It can be tempting to just ignore your loans or simply make the lowest possible payment for the duration of your loan term. But if you take the full repayment term to pay back your debt, you could end up paying thousands in interest charges.

Feeling overwhelmed by your grad school loans?

We can help! Our rate comparison tool makes it fast and easy to find a lower rate that could lead to you saving thousands or helping you get out of debt faster.

Takes 2 minutes • No impact on credit

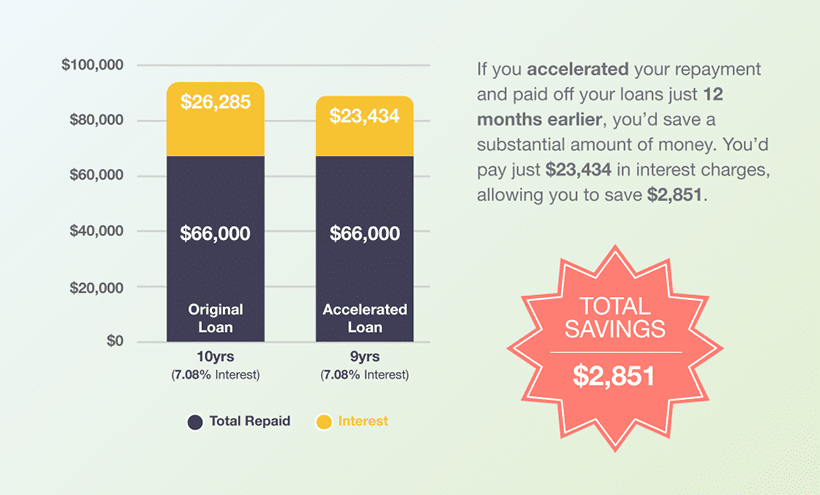

To see how much time can affect your debt, consider an example. The average loan balance for borrowers that complete master’s degrees is $66,000. If you had that amount in Grad PLUS Loans at 7.08% interest and you repaid them over a standard 10-year repayment term, you would pay $26,285 in interest on top of the $66,000 you originally borrowed.

If you accelerated your repayment and paid off your loans just 12 months earlier, you’d save a substantial amount of money. You’d pay just $23,434 in interest charges, allowing you to save $2,851.

How to pay off grad school loans faster

If you’re wondering how to pay off large student loan balances more quickly, here are five strategies you can use to get rid of your debt faster.

1. Increase your monthly minimum payments

To save money on interest, try to pay more than the minimum required each month. When you pay more than the minimum, more of your payment will go toward the principal, bringing down your balance and reducing interest charges.

For example, your minimum monthly payment on a $66,000 loan with a 7.08% interest rate and a 10-year repayment term would be $769 per month. If you increase your monthly payment by just $60 per month — putting $829 per month toward your debt — you’d pay off your loans in just nine years instead of 10.

2. Use windfalls to make lump sum payments

Whenever you receive an unexpected windfall, meaning money you didn’t budget for, put it directly toward your student loan balance. Whether you get a tax refund or a bonus from work, using your windfalls to make lump sum payments can make a dramatic difference.

Some employers offer signing bonuses to graduates of select master’s degree programs. According to U.S. News, the average signing bonus for graduates from top ten business schools was approximately $30,000.

If you had the same loans as mentioned above and you received that bonus and applied it to your loan balance, you’d pay off your loans 65 months early.

Even better, you’d save a whopping $20,031 in interest charges.

3. Ask your employer for help

An increasing number of employers are offering student loan repayment assistance benefits to recruit top talent. In fact, the Society of Human Resource Management reported that employer-provided benefits have doubled since 2018, with 8% of employers offering this perk.

With most programs, employers will match a portion of your loan payments up to a percentage of your salary. Over time, your employer’s assistance can help you pay off your debt sooner and save money.

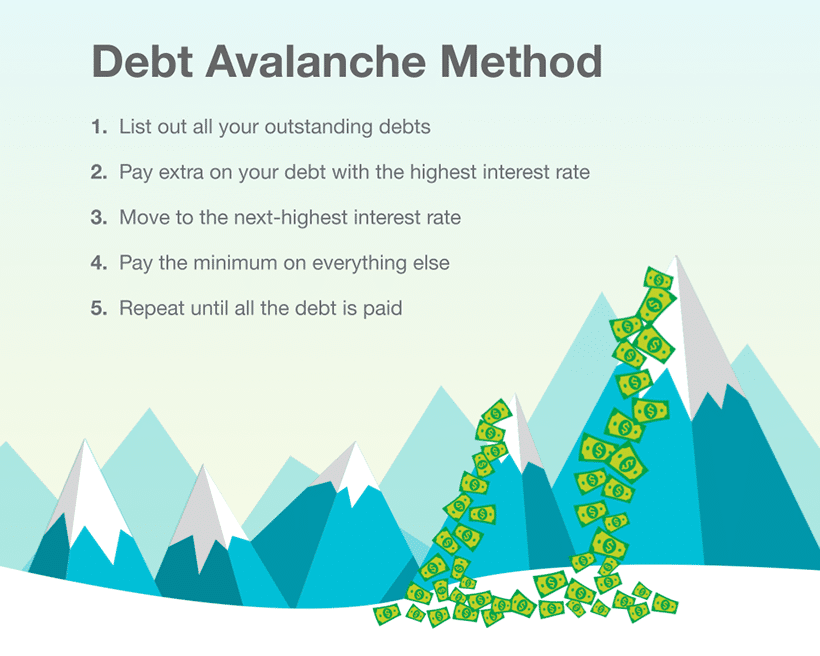

4. Use the debt avalanche method

If you have multiple student loans, the most efficient debt repayment strategy is the debt avalanche method. With this approach, you continue making the minimum payments on all of your loans — while putting any extra money you have toward the loan with the highest interest rate.

Once that loan is paid off, you roll that payment — and the extra money you were putting toward it each month — into the payment on the loan with the next highest interest rate.

This allows you to wave goodbye to the higher rate loans more quickly, saving you the most in interest charges.

5. Refinance grad school loans to get a lower interest rate

To pay off your debt as quickly as possible, you can refinance grad school loans. When you refinance, you can qualify for a lower rate so less interest accrues on the loan, allowing you to save money. Student loan refinancing is different from student loan consolidation because the rates you receive are based on credit score, income, and other factors.

The 2 Best Companies to Refinance Student Loans

Our Top-Rated Picks for 2024 Offer Low Rates and No Fees

For example, if you refinanced your $66,000 in Grad PLUS loans and qualified for an eight-year loan at 4% interest, you’d pay just $11,231 in interest charges.

By refinancing your loans, you’d save over $15,000 and be out of debt two years sooner.

| Original Loans | Refinanced Loan | |

| Balance | $66,000 | $66,000 |

| Loan Term | 10 Years | 8 Years |

| Interest Rate | 7.08% | 4% |

| Minimum Monthly Payment | $769 | $804 |

| Total Interest Paid | $26,285 | $11,231 |

| Total Repaid | $92,285 | $77,231 |

To qualify for the lowest possible rates, you’ll likely need to opt for a shorter loan term. If your credit score is less than stellar, you may benefit from adding a cosigner to your loan application. A cosigner can increase your chances of getting a loan and qualifying for a competitive interest rate.

How to qualify for the best refinance rates

If you’re struggling with a large student loan balance, figuring out how to pay off grad school loans quickly is key for your financial future. By increasing your payments, using windfalls, and refinancing your grad school loans, you can pay off your loans early and save thousands of dollars on interest.

If you decide to refinance grad school loans, use Purefy’s Compare Rates tool to get rate quotes from top refinancing lenders all at once — saving you time and the most money possible.

Talk to a student loan expert

Purefy’s Student Loan Advisors are ready to guide you through the student loan process.

Talk now (202) 524-1115

Shannon