In this deep dive review of College Ave Student Loans and Refinancing, we’ll look closely at benefits, features, and repayment options to help you determine if College Ave is the right lender for you.

And at any time, you can check your estimated interest rates from College Ave and compare them with other lenders in our Compare Rates tool — with no credit check required.

With its proprietary technology platform and easy online application, College Ave Student Loans has become one of the top lenders for both private student loans and student loan refinance.

In this review we will look at eligibility, cosigner requirements, and some of the unique benefits that make College Ave stand out. Keep reading to see if this could be the right lender for you.

Read the College Ave Private Student Loans Review

Read the College Ave Student Loan Refinancing Review

College Ave Private Student Loans

There are a lot of reasons why you may turn to private student loans. Perhaps your federal aid package doesn’t cover the total cost of attendance. Or, you decide to attend a summer session. Or, your expenses unexpectedly change. Whatever the reason, private student loans can play an important role in financing your education.

If you’re looking for funding, College Ave student loans can help you achieve your goals. Our College Ave Student Loans review will go over their flexible repayment terms and competitive interest rates, and help you decide if College Ave is a lender you should consider.

Full Review: College Ave Student Loans

When thinking about how to pay for college, it’s a good idea to exhaust federal student loan options first, as well as scholarships and grants. However, those options may not cover the full cost of school, which is where College Ave comes in.

College Ave Student Loans is a relatively new company; it was launched in 2014. Designed to help you pay for school easily and inexpensively, College Ave student loans can be useful financial tools.

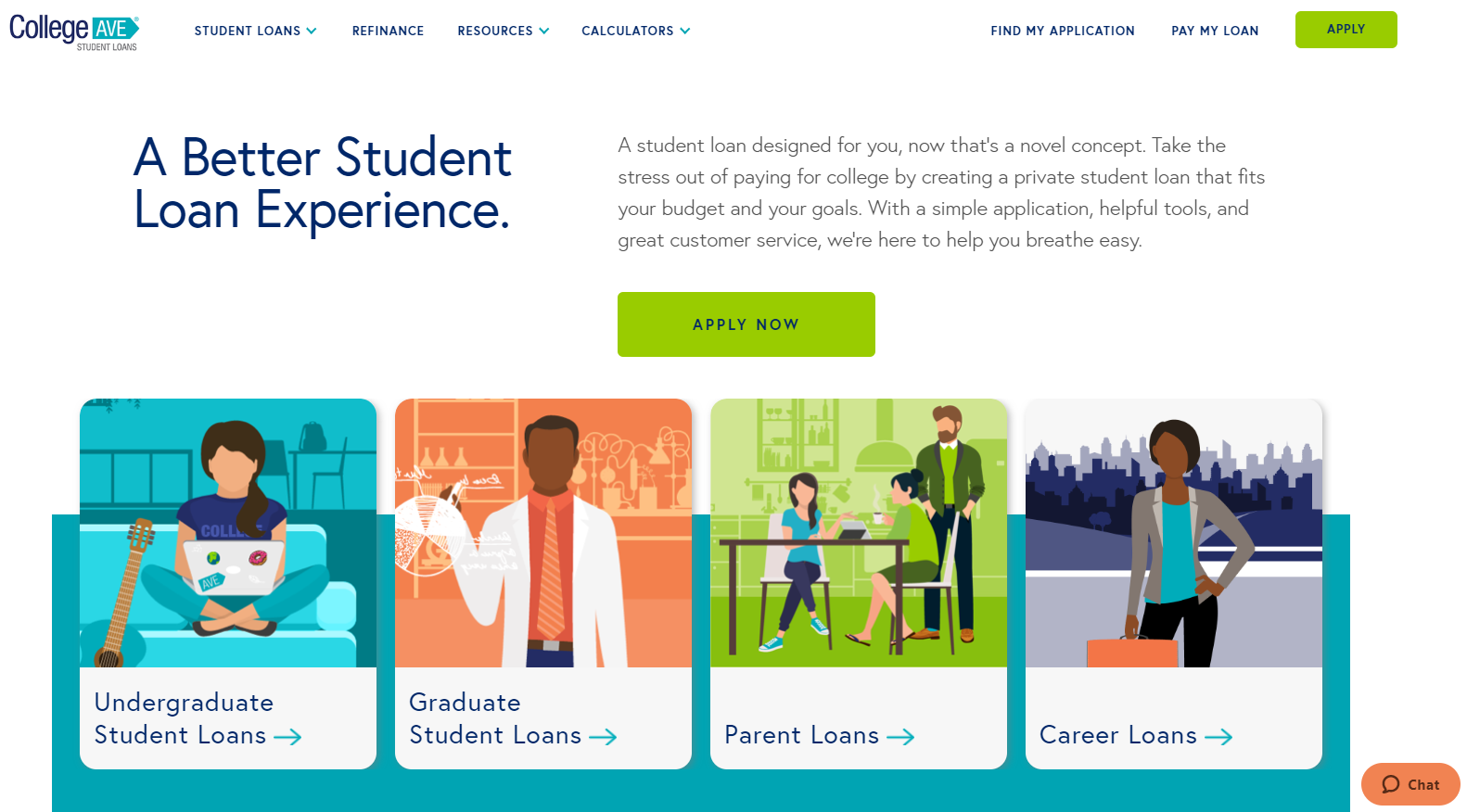

Types of student loans available

College Ave allows you to borrow up to the total cost of attendance. That means you can get money for expenses beyond just tuition, such as room and board, books, school fees, and even a laptop.

College Ave offers loans for different stages of your college career:

- Undergraduate loans: Undergraduate loans are for students pursuing their associates or bachelor’s degrees.

- Graduate loans: Graduate school loans are for students enrolled in a masters, doctoral, or professional degree program.

- Parent loans: Parent loans are for those who want to help pay for their child’s education expenses.

Interest rates and fees

Like many private student loan lenders, College Ave offers both variable and fixed interest rate loans:

- Variable rates start off lower than fixed-rate loans but can increase over time if market rates go up.

- Fixed interest rate loans have the same rate for the duration of your repayment period.

Using Purefy’s Compare Rates tool, you can check to see what interest rates and terms are available to you. This tool will also let you compare College Ave’s rates and terms to other lenders’ loan options.

College Ave student loans have no origination fees or prepayment penalties. They also offer student loan interest rate discounts if you enroll in autopay.

Compare Private Student Loan Rates with No Credit Check

Purefy’s tools let you compare savings from the best lenders.

Eligibility criteria

To qualify for a College Ave student loan, you must be a student at an eligible college or university and have a valid Social Security number. The minimum you can borrow is $1,000, and you can borrow up to the total cost of attendance as determined by your school’s program.

If you cannot qualify for a loan on your own because you haven’t built up a good credit history yet, you can always add a co-signer to your application. A co-signer — typically a parent or relative with a stable income and good credit — can increase your chances of getting a loan and qualifying for a low-interest rate.

Benefits of College Ave student loans

Deciding between private student loan companies can be stressful. If you’re struggling to choose a lender, keep these three things about College Ave in mind.

1. It has flexible repayment options

College Ave offers flexible repayment options, making it easier to afford your payments. Repayment terms can be five, eight, 10, or 15 years in length, and there are different payment plans to choose from:

- Full principal and interest payment: With this option, you start paying against the accrued interest and principal right away. This approach has the lowest overall cost.

- Interest-only payment: While you’re in school, you only pay the interest charges each month.

- Flat payment: To reduce your accrued interest, you pay a flat $25 per month while in school.

- Deferred payment: While in school, you don’t have to make payments. However, you’ll pay more in interest over the length of your loan.

2. You don’t need to be enrolled half-time

Most student loan lenders require borrowers to be enrolled at an eligible institution at least half-time to qualify for a loan. College Ave is different. To be eligible for a loan, you just need to enroll at a qualifying school, even if it’s just for a couple of classes. That means College Ave is a great option for working students who don’t qualify for loans from other lenders.

3. Parents can get cash for expenses

With most student loans, the lender disburses the loan directly to your selected school. The school uses the money to pay off your bill, including tuition and room and board. If there’s any money left over, the school releases the extra cash to you. Then, you can use that money to pay for any additional expenses. However, the process can take weeks or even months.

With College Ave parent loans, you can get up to $2,500 upfront to pay for necessary expenses. That can come in handy if you need to buy supplies or put down a security deposit on an apartment off-campus.

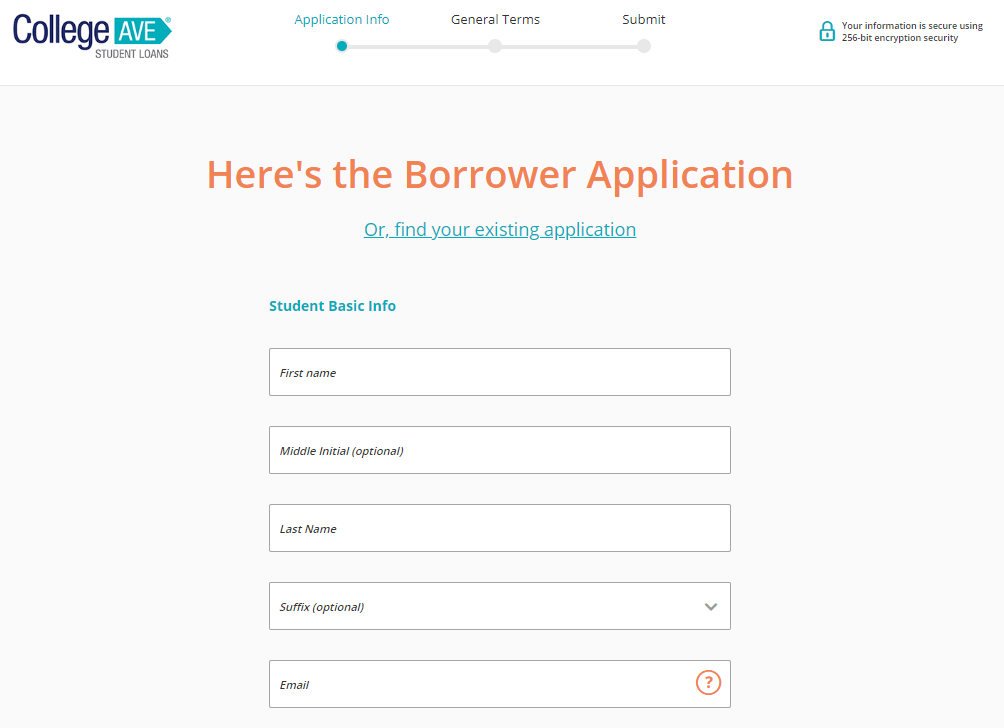

How to apply for a College Ave student loan

The application process for a College Ave student loan is quick and easy. If you select College Ave as a lender in our Compare Rates tool, you’ll be taken straight into their application. From there, the site will prompt you to enter the necessary information. You should be prepared to enter the following:

- Your Social Security number

- Your estimated annual income

- Your selected school’s name

- How much you’d like to borrow

- Your estimated financial assistance

According to the company, you can find out if you’re approved for a loan in as little as three minutes.

Paying for college with College Ave

If you’re looking for a reputable private student loan lender, College Ave should be on your list. Offering low-interest rates and different repayment options, College Ave offers you flexibility that will be especially valuable after graduation.

However, it’s a good idea to compare offers from multiple lenders before making a decision. Use Purefy’s Compare Rates tool to receive offers from several different student loan lenders at once. That way, you’ll know for sure you are getting a great deal.

College Ave Student Loan Refinancing

Student loan debt has reached unprecedented levels. Currently, Americans owe nearly 1.6 trillion in student loan debt — more than double the total just a decade ago. And the average student loan debt per person? Just under $30,000 with little sign of slowing down.

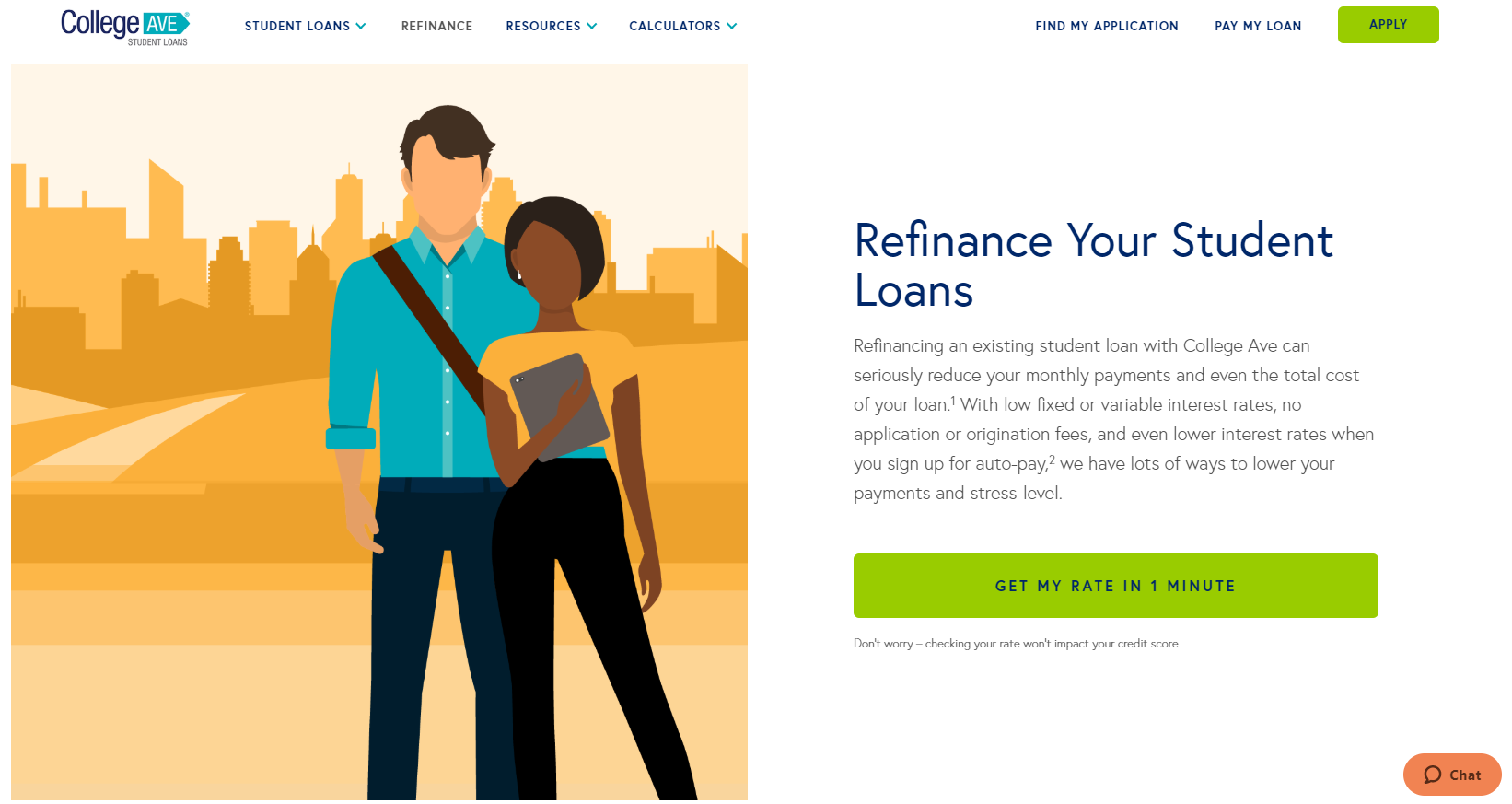

If you’re struggling with student loans, you’re certainly not alone. One solution to consider is student loan refinancing through a lender like College Ave. You can reduce your interest rate or qualify for a lower monthly payment, making your loans more manageable. Continue reading this College Ave student loan refinancing review for more information about your options.

Full Review: Refinancing student loans with College Ave

When you refinance your loans with College Ave, you take out a new loan for the amount of your current debt, including both federal and private loans. Going forward, you have just one loan and one easy payment. The new loan will have a different:

- Interest rate

- Monthly payment

- Repayment term

Refinancing can reduce your interest rate so that you save money over the length of your loan. Or, you can extend your repayment term and dramatically reduce your monthly payment, giving you more room in your budget.

Interest rates and fees

College Ave offers student loan refinancing for all federal and private student loans, including federal Direct, Parent PLUS, and Grad PLUS loans. College Ave student loan refinancing does not charge any origination fees or prepayment penalties.

You can check what rates you would qualify for using Purefy’s Compare Rates tool with no credit check required After answering a few simple questions, you can easily compare rate estimates from College Ave and other top lenders to find the best deal — in just 15 seconds.

College Ave also offers a 0.25% discount if you sign up for automatic payments.

Compare Student Loan Refinance Rates with No Credit Check

Purefy’s tools let you compare savings from the best lenders.

Eligibility criteria

The minimum amount you can refinance is $5,000. If you have a medical, dental, pharmacy, or veterinary doctorate degree, the maximum you can refinance is $300,000. If you have a bachelor’s or other graduate degree, the maximum amount you can refinance is $150,000.

Residents of Maine are currently ineligible for refinancing loans through College Ave.

To qualify for a loan, you must meet the following requirements:

- You must be a U.S. citizen or permanent resident

- You must be at least 18 years old

- You must have graduated from a Title IV-eligible undergraduate or graduate program

College Ave doesn’t publicly list its credit score and income requirements. In general, you’ll need good credit to qualify for a loan. Otherwise, you may be able to get approved for a loan if you have a co-signer apply with you.

Benefits of College Ave refinancing

When you’re comparing refinancing lenders, it’s important to know that no two lenders are the same. They all have unique features, so it’s important to do your homework. Here are three highlights of College Ave’s program:

1. Fixed or variable rate loans are available

With College Ave, you can choose between a fixed or variable interest rate for your new loan:

- Fixed-rate loans have the same interest rate for the length of your repayment, so you never need to worry about rates increasing in the future.

- With a variable rate loan, your interest rate starts off lower than it would be with a fixed-rate loan. However, it will fluctuate over time, meaning your interest rate could go up.

If you want to aggressively pay off your debt ahead of schedule, opting for a variable rate loan makes sense. You can take advantage of a lower rate and pay off your loans before you see significant increases.

If you think you’ll need several years to repay your loans, a fixed-rate loan will give you more security and peace of mind.

2. There are flexible loan terms as long as 20 years

College Ave offers loan terms as short as 5 years or as long as 20 years. Borrowers can choose any number of years between those limits to repay their student loan. This allows for more flexibility than most refinance lenders, who typically only offer 4 or 5 options. With a longer repayment term, you’ll pay more in interest fees over time. However, you might find that drawback well worth it, because you’ll get a much smaller and more manageable monthly payment. When you’re just starting out and not making much money, a longer repayment term can give you a lot more breathing room in your monthly budget.

3. You could qualify for an interest rate discount

If you sign up for automatic payments, you could qualify for a 0.25% interest rate reduction on your loans. For example, if you qualified for a 6.00% interest rate and signed up for automatic payments, your interest rate would drop to 5.75%. That difference may not sound like much. However, over time, that reduction can help you save hundreds of dollars.

For example, let’s say you had $30,000 in student loans at 6.00% interest and a 15-year repayment term. Over the length of your loan, you’d repay $45,568.

But if you signed up for automatic payments and your interest rate dropped to 5.75%, you’d repay just $44,842. By simply enrolling in autopay, you’d save $726.

How to apply for a College Ave student loan refinance

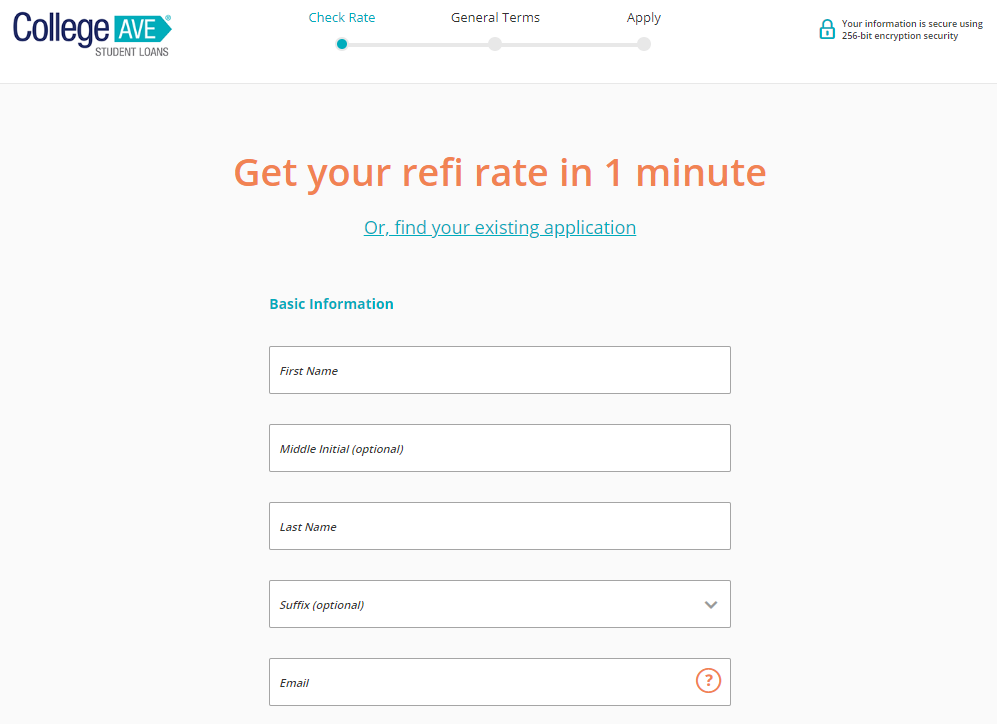

Before refinancing, you should always start by comparing rates from multiple lenders using Purefy’s free Compare Rates tool. If you select College Ave after looking at how they stack up against other lenders, you’ll be taken directly to their online application.

According to College Ave, the application takes just three minutes to complete, and you’ll receive a decision right away.

To complete the application, you’ll have to enter:

- Your name

- Phone number

- Address

- Email address

- Date of birth

- Social Security number

- Income

- School information

Once you submit that information, College Ave will list a summary of possible rates and fees available on the loan. If everything looks good, you can continue with the loan. After you submit the required information, College Ave will give you an instant decision, so you’ll know if you’re approved immediately.

Refinancing your student loans

College Ave’s refinancing options include low-interest rates and favorable repayment terms, making it a good choice if you’re shopping around for a lender. However, you shouldn’t look at just one company. Instead, compare offers from multiple student loan refinancing lenders to make sure you get the lowest rates.